USDC, the stablecoin by Circle, is gaining significant momentum in markets outside the United States, stirring excitement in the cryptocurrency world. Since the fourth quarter of 2023, USDC has seen noticeable growth, with its market value exceeding $28 billion and reaching a remarkable level.

Coinbase Releases USDC Report

Coinbase released a report indicating that USDC is revitalizing, parallel to its expansion in markets outside the US, despite general market conditions. Since December 1, 2023, USDC’s market value has increased by over 14%, rising by more than $3.5 billion. This impressive growth has pushed USDC’s total market value above $28 billion.

Particularly, USDC’s volatile story is related to the exposure of its relationship with Silicon Valley Bank (SVB), which went bankrupt in March. This caused USDC to lose its peg to the dollar, and its value dropped to as low as 87 cents. However, the subsequent normalization of reserves and new market entries increased activities around USDC.

USDC becoming a larger presence in markets outside the US seems to signal a new era. Specifically, nearly a fivefold increase in its share of spot and derivative transactions could be just the beginning of this growth.

Factors Behind USDC’s Growth

Coinbase’s international exchange and market maker incentive program have accelerated the global acceptance of USDC. Coinbase’s market maker program has served in spot and perpetual offerings for numerous trading pairs to provide liquidity and depth. Additionally, the relisting of USDC on Binance, the largest centralized cryptocurrency exchange by volume, has accelerated USDC’s growth.

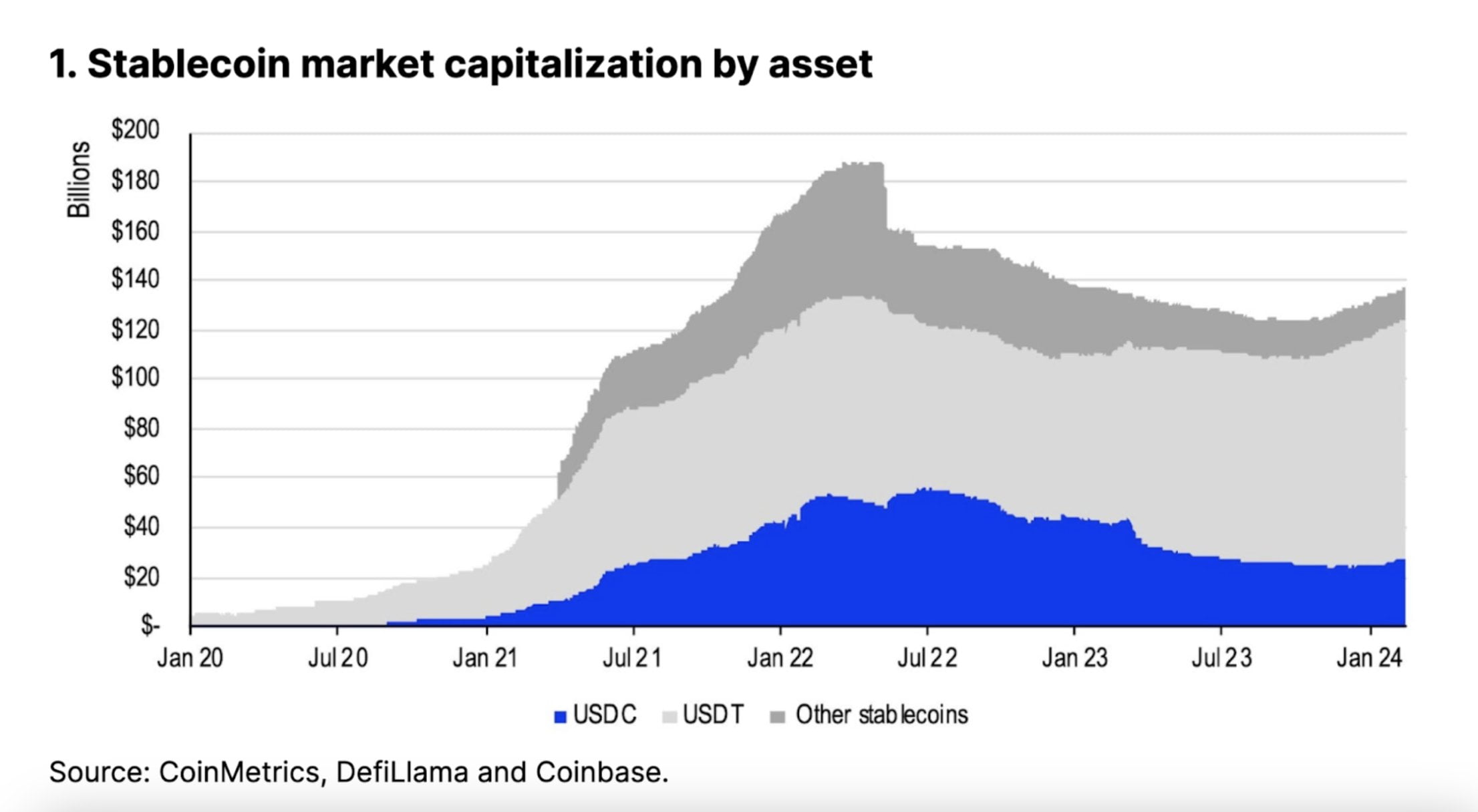

Circle is working to increase USDC adoption by forming partnerships with financial institutions in Japan and Singapore. With its recent rise, USDC has surpassed USDT, the largest stablecoin by market value, in terms of growth. However, USDT still maintains the lead in market dominance and market share.

In my opinion, the rapid growth and international acceptance of USDC can be considered a significant turning point in the cryptocurrency world. This indicates an increase in confidence in crypto assets and the expanding role of cryptocurrencies in the global financial system. Lastly, I would like to emphasize that news about legal regulations for stablecoins, especially from the US, will be extremely important.

Türkçe

Türkçe Español

Español