A senior crypto currency analyst at investment giant Fidelity has suggested that Bitcoin (BTC) is ready to take market share from gold, which has traditionally been the primary investment choice for investors. The senior crypto analyst shared his views by comparing Bitcoin and gold with his followers.

Gold Comparison in Bitcoin’s Valuation

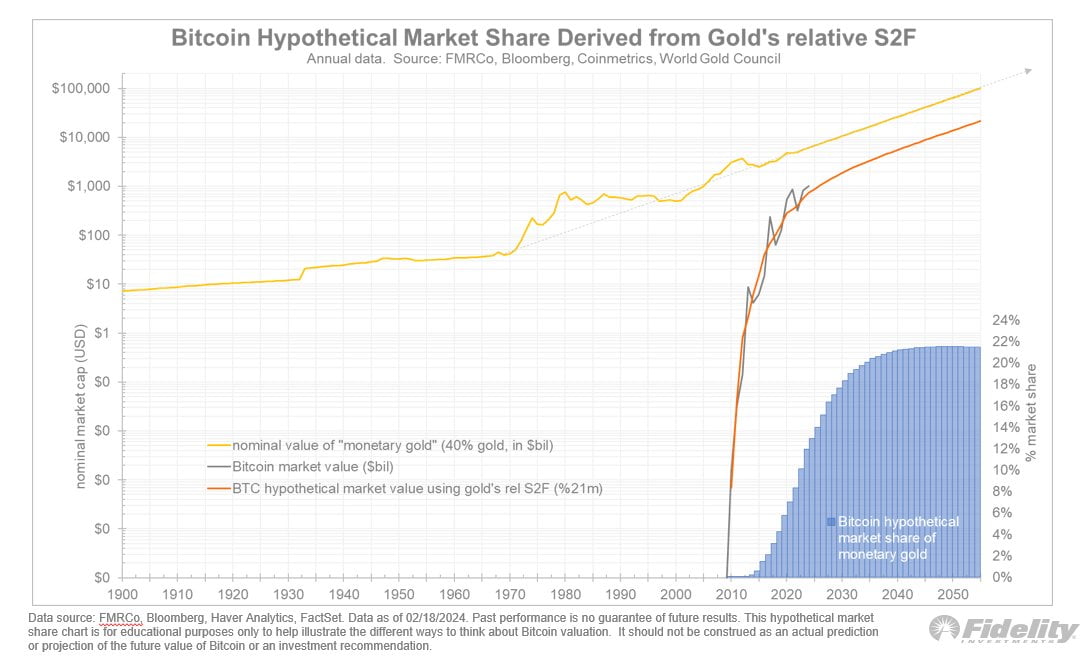

Fidelity’s Director of Global Macro, Jurrien Timmer, shared a chart on social media that addressed the value of “monetary gold.” The term refers to gold that is explicitly held as a monetary token by central banks and private investors, or gold that is not used for industrial purposes. The expert stated the following in his remarks:

This is not an exact science, but based on data published by the World Gold Council, I estimate that the share of monetary gold is about 40% of the total above-ground gold. Based on the calculations outlined in my previous topics, I estimate that Bitcoin will eventually capture about a quarter of the monetary gold market. With 40%, the value of monetary gold is currently about 6 trillion dollars, while Bitcoin is valued at 1 trillion dollars.

Bitcoin’s Price Target

A quarter of 6 trillion dollars is a market value of 1.5 trillion dollars, which could translate to a price of approximately 76,000 dollars per Bitcoin. However, crypto analyst Jurrien Timmer assumes that when BTC reaches the market share of gold, the value of the precious metal will be “much higher.” This could indicate that the estimated market value for Bitcoin would be above 1.5 trillion dollars.

On the other hand, Bitcoin and gold investments have been a topic of discussion among crypto currency experts many times. While some analysts report that Bitcoin will leave gold far behind as an investment tool in the coming years, others focus on the opposite scenario. At the time of writing, according to data from the 21milyon.com website, Bitcoin has seen an increase of over 9.30% in the last 24 hours, trading at the level of 56,306 dollars.

Türkçe

Türkçe Español

Español