Bitcoin and other cryptocurrencies continue their upward trend, while XRP has been in the spotlight due to the Securities and Exchange Commission’s (SEC) lawsuit. Today’s events have been recorded as significant developments affecting the price trajectory of XRP. The SEC’s request to extend the briefing deadline in its case against Ripple led to a climb in XRP’s price. So, what does this development mean?

What’s New in the XRP Case?

This development in the course of the lawsuit sheds light on the recent debates in the legal battle between the SEC and Ripple. The SEC’s postponement of briefing deadlines is considered a significant step towards setting a new schedule for the case. This process is of great importance for Ripple, as meeting regulatory demands and managing the legal process will have a direct impact on the company’s future.

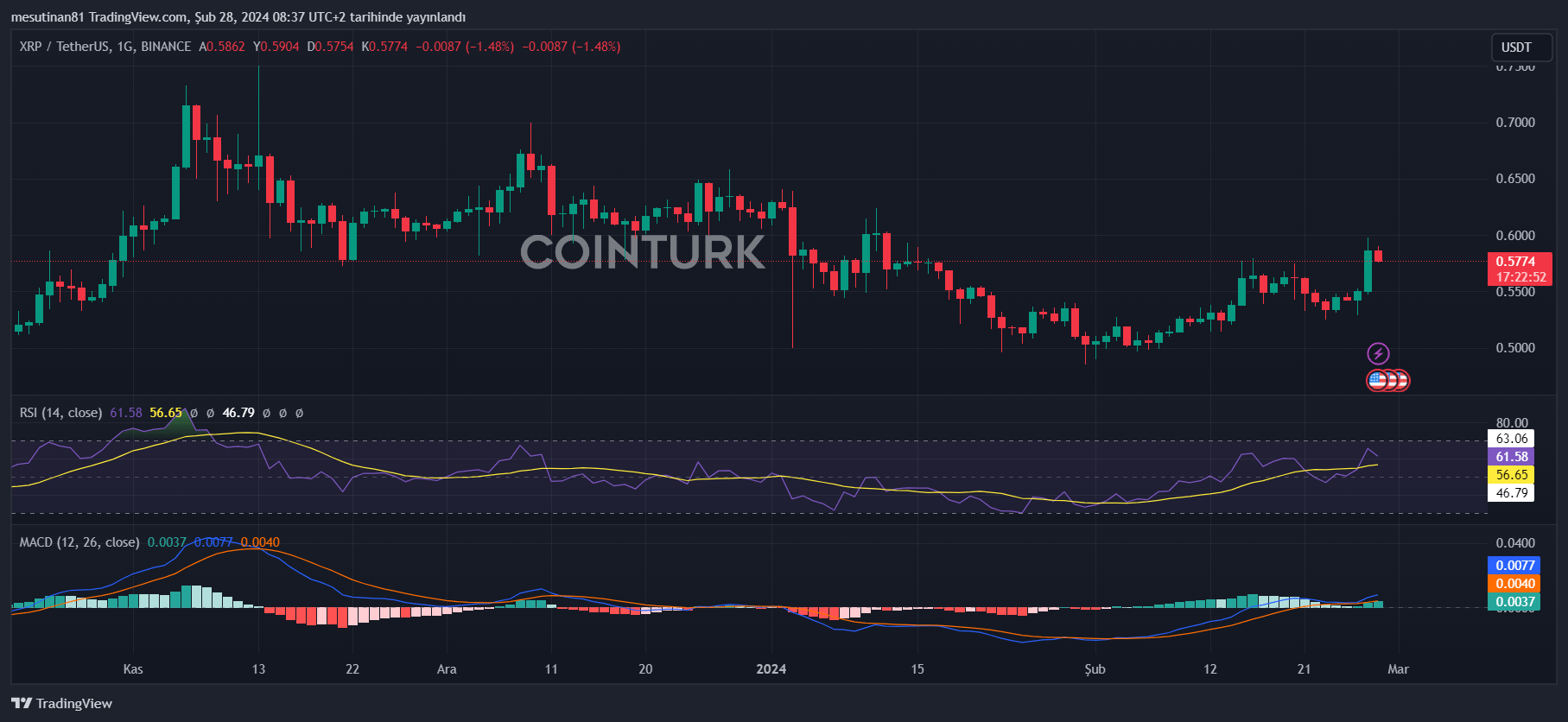

In particular, the impact of the SEC’s extension of briefing deadlines on XRP’s price cannot be ignored. Today’s climb in XRP’s price has led investors to reassess their positions in light of these developments. XRP’s approach to the $0.60 target is seen as a reflection of market activity.

Technical analysis provides clues about the future trajectory of XRP. Notably, the $0.60 level is an important resistance point for the altcoin, and surpassing this level could lead to new highs. However, the significance of the 78.6% Fibonacci retracement level should not be overlooked, as surpassing this level could increase XRP’s potential to rise even further.

What Do the Metrics Say About XRP?

Metrics also indicate that XRP is on an upward trend. The Moving Average Convergence Divergence (MACD) and Awesome Oscillator (AO) support the price gains and indicate a strong bullish trend.

However, if the daily candlestick closes below certain levels, the bullish scenario could be invalidated, and XRP could retract to lower levels.

In the world of cryptocurrency, the combination of developments related to XRP’s SEC case and technical analysis could provide a significant roadmap for investors. However, considering the volatile nature of the market and the uncertainties for XRP, it is advisable for investors to proceed with caution. Additionally, I always mention in my writings that XRP’s position is very different from other cryptocurrencies. This is because Ripple, the company behind XRP, currently holds 40.7% of the supply.

Türkçe

Türkçe Español

Español