A development in the investment world has drawn attention towards the cryptocurrency Bitcoin, related to the actions of a company. According to Benchmark analyst Mark Palmer, MicroStrategy shares (MSTR) are currently worth buying. Why? Because this software firm is preparing to profit from institutional demand and critical events like the Bitcoin halving by purchasing Bitcoin.

MicroStrategy in the Spotlight with Its Massive Bitcoin Assets

MicroStrategy has increased its Bitcoin assets to over $11 billion. According to Benchmark, the company’s share price could rise to $990. Palmer bases this prediction on the assumption that Bitcoin will reach $125,000 by the end of 2025.

However, MicroStrategy’s potential for growth is influenced not only by the cryptocurrency Bitcoin but also by the increasing demand for new spot Bitcoin exchange-traded funds (ETFs) in the US. Excluding Grayscale’s GBTC, ten US Bitcoin ETFs have seen significant net inflows, attracting more than $6 billion in total.

Another reason for the expected upward trend in MicroStrategy shares is the upcoming Bitcoin halving on April 20. This event, which will result in a reduction of miners’ rewards, is expected to increase demand for Bitcoin and contribute to a long-term rise, according to experts.

MicroStrategy’s Bitcoin Strategy

MicroStrategy is using a leveraged business strategy to increase its focus on Bitcoin. This strategy is viewed positively by analysts who believe the firm will benefit from the continuous rise in Bitcoin prices.

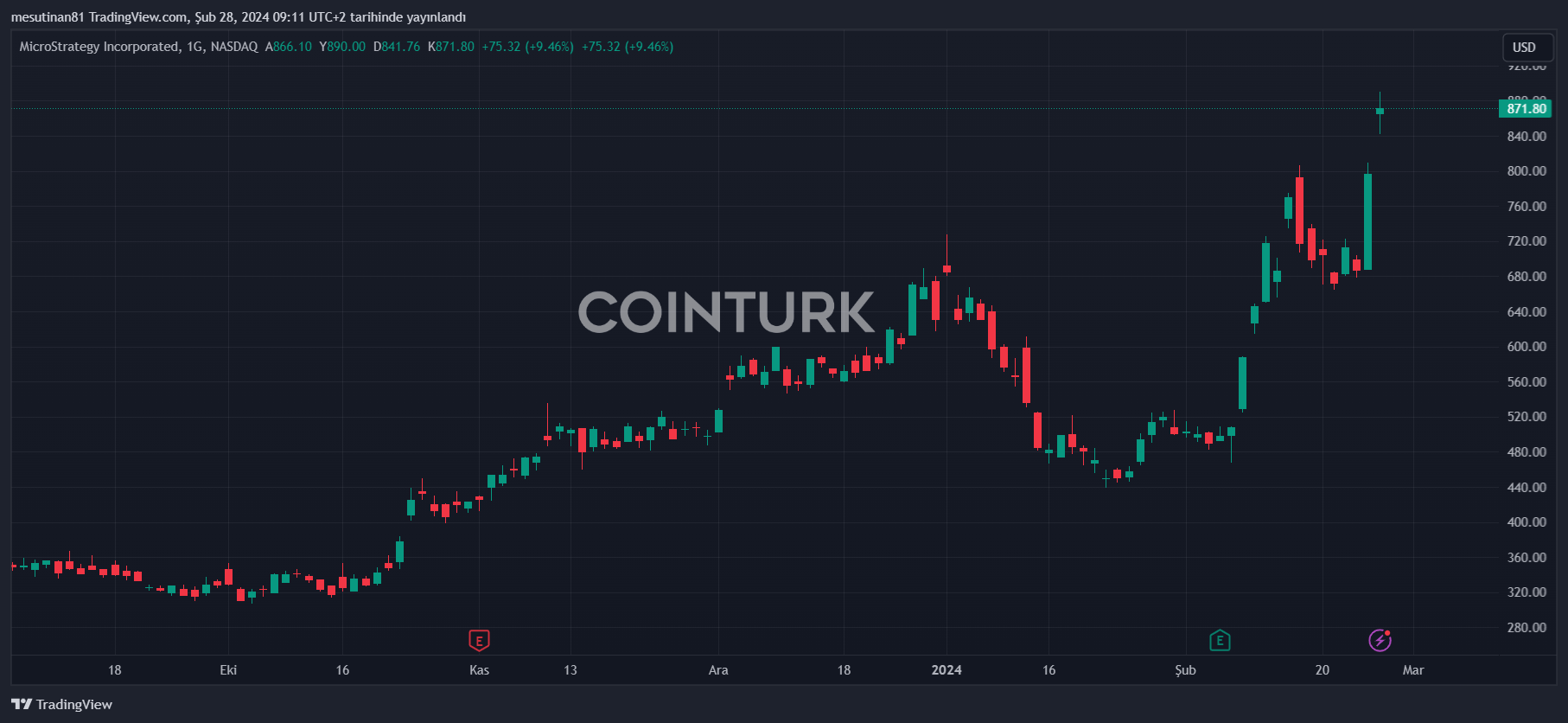

The company most recently purchased an additional 3,000 Bitcoins on February 26, bringing its total holdings to 193,000 BTC. This means that MicroStrategy’s total value is just over $11 billion. MSTR’s share price is currently trading at $871, up 9.4%, and has recorded an increase of up to 230% over the last 12 months.

The flagship cryptocurrency Bitcoin‘s price has gained 9.2% in the past three days, trading at $57,083. Largely due to the increasing institutional demand for the cryptocurrency, the value of Bitcoin could continue to rise.

Benchmark’s analyses of MicroStrategy’s investment opportunities in Bitcoin and stocks, along with market trends, could serve as a guide for investors. If the Bitcoin price breaks through the $58,000 resistance and heads towards $60,000, the movement of MSTR shares will be of interest.

Türkçe

Türkçe Español

Español