Bitcoin (BTC) and Ethereum (ETH) markets have recently seen a drop in the difference between their continuous funding rates, indicating a notable increase in investors’ risk appetite and suggesting that altcoins may potentially perform better in the near future. This development shows that investors are increasingly willing to take leveraged long positions or capitalize on uptrends in the Ethereum perpetual futures market compared to Bitcoin, reflecting an increased appetite for smaller and riskier altcoins, including memecoins.

Investors Begin Shifting Their Focus to Altcoins

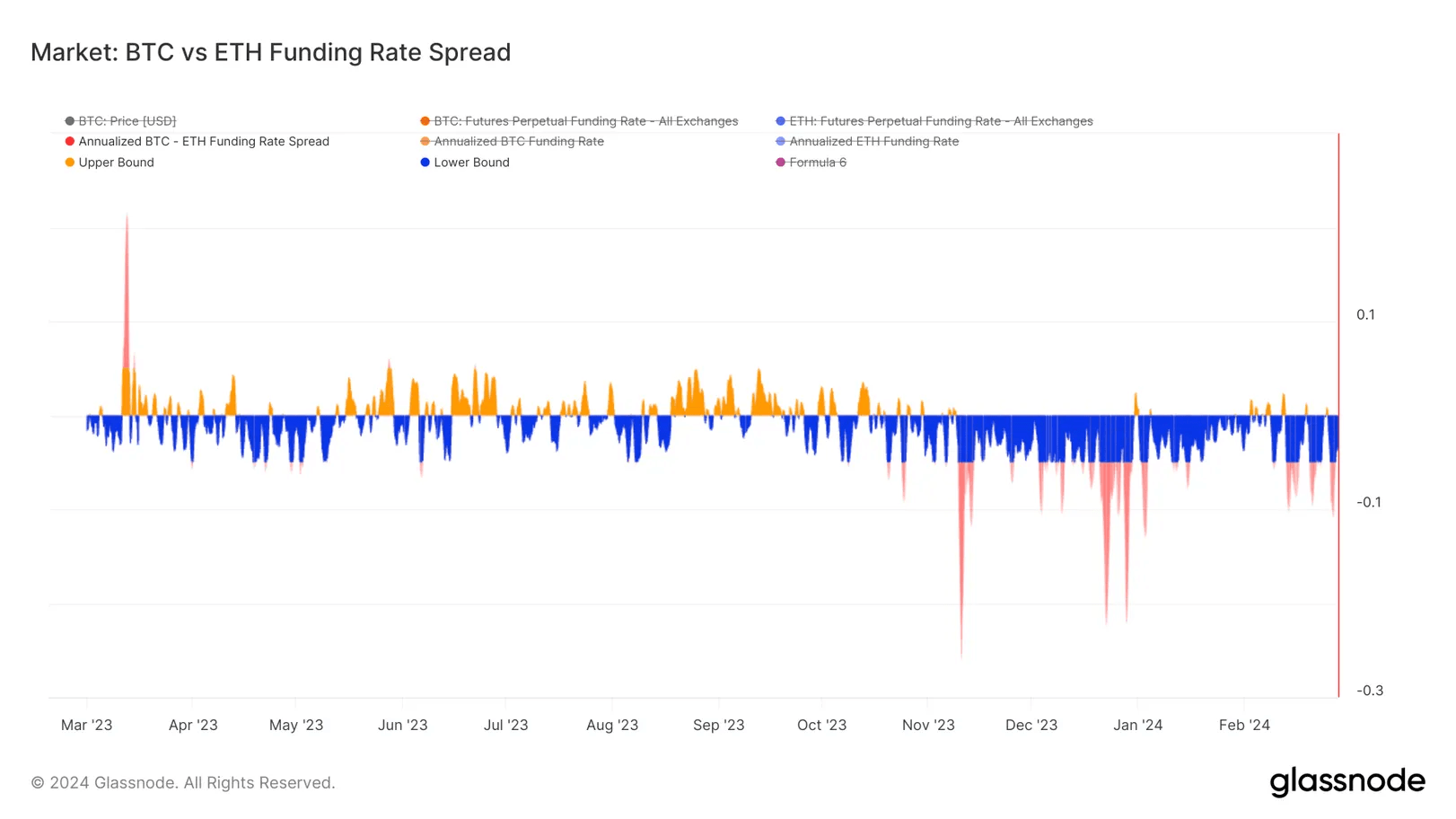

According to data tracked by crypto data platform Glassnode, the gap between Bitcoin and Ethereum funding rates recently dropped to an annual level of -9%, signaling a significant shift in market sentiment. This change marks a serious deviation from the relatively neutral period observed before October 2023, where the gap fluctuated between positive and negative states. Since the rally in October 2023, Ethereum’s funding rates have consistently exceeded those of Bitcoin, triggering speculations that investors’ interest in altcoins is increasing.

Bitcoin, being the world’s largest and most liquid cryptocurrency by market value, typically serves as an indicator of overall market sentiment. In contrast, Ethereum is considered a high-beta asset and a leader among altcoins. Therefore, the difference in funding rates between Bitcoin and Ethereum serves as a reflection of broader risk sentiment, similar to how currency pairs like AUD/JPY function in traditional financial markets.

Perpetual contracts, or futures contracts without an expiry date, include a funding rate mechanism to ensure that prices closely follow spot prices. A positive funding rate indicates a bullish leverage trend, with long position holders willing to pay short position holders to keep their positions open. A negative funding rate indicates the opposite.

Altcoins’ Total Market Value Rapidly Increases

A closer look at the decline in Bitcoin and Ethereum funding rates reveals that the downtrend coincides with an increase in the total market value of ETH and other altcoins. This situation is a significant indicator that investors are shifting their focus to cryptocurrencies other than BTC.

Despite Bitcoin’s market dominance (BTC.D) remaining relatively stable between 51% and 54% since the beginning of January, the total value of the cryptocurrency market has risen from approximately 1.7 trillion dollars to 2.2 trillion dollars during this period.

Türkçe

Türkçe Español

Español