We have experienced many events from the most challenging days of 2022 to today, and now we have moved from extreme selling days to extreme buying days. Cryptocurrency markets have always moved in such cycles. Investors with sufficient experience have made money, but those who acted emotionally managed to lose in every period. So, what happens now?

Crypto Bull Market

At the end of 2022, in a deepening bear market, the Bitcoin price bottomed out at $15,500 and rose by 155% in 2023. During this period, we experienced days of accumulation and gradual rise. Those targeting levels around $12,000 were disappointed, and Bitcoin is now trading above $59,000 again. So, what do the current indicators tell us about the future?

Bullish Signals in Crypto

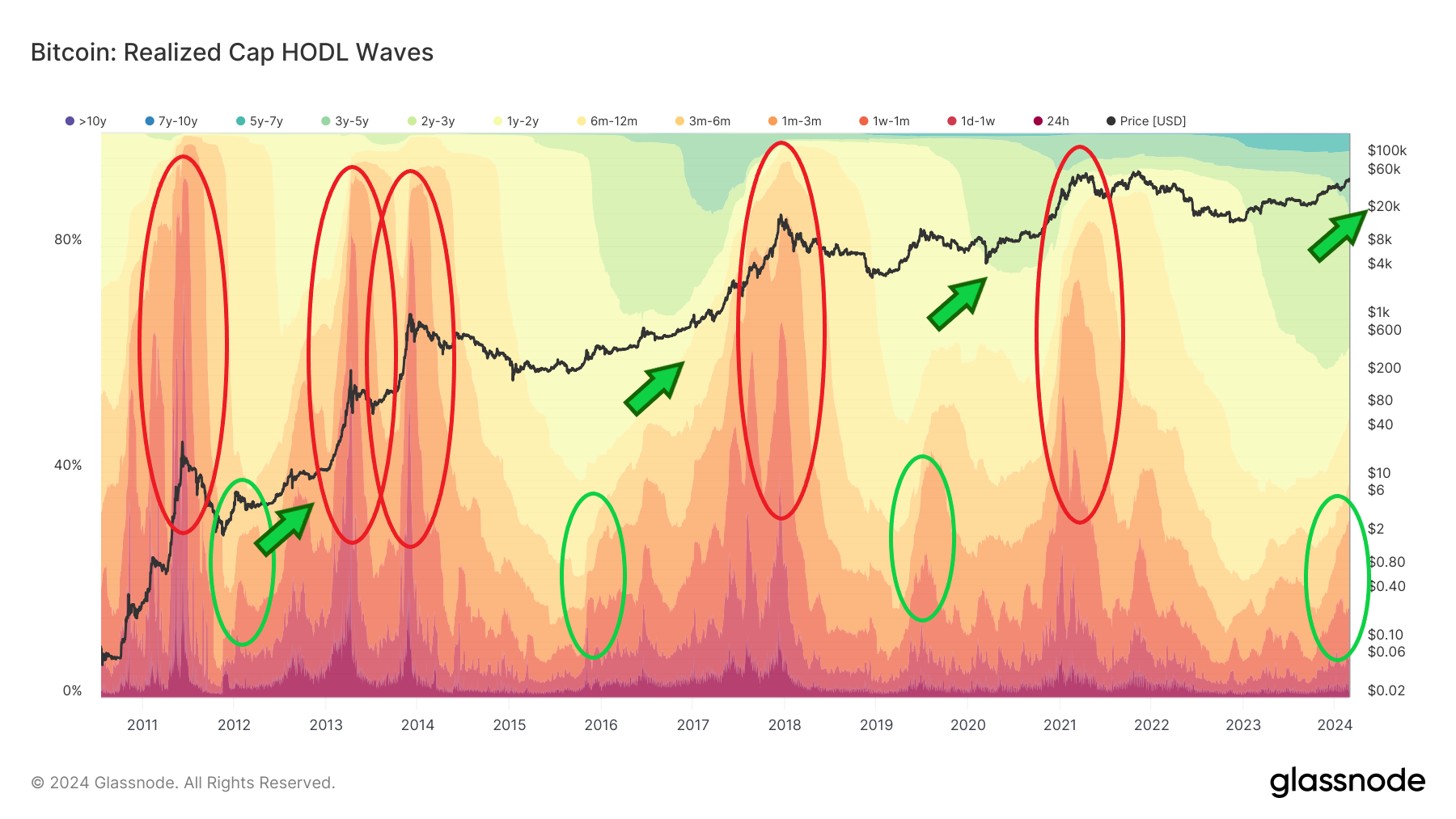

The first major signal indicating the start of a solid bull market is the Realized Cap HODL waves. This indicator, which limits HODL waves by the realized price, draws a chart with the percentages of Bitcoin moved recently. In other words, Realized Cap HODL waves also track the age of Bitcoin held by investors.

So how does it work? Generally, short-term HODL waves (red and orange, less than 6 months) contract during a bear market. In a bull market, long-term waves, namely greens and blues, decrease as they are sold. At the peak of the cycle, this leads to a situation where most coins are held in short-term HODL waves (red areas) for short periods. Such a situation quickly leads to a peak burst and comes before a long-term bear market.

When the declines end, the red and orange (short-term) hold waves remain flat for a long time. The result? According to the current view, this criterion tells us that Bitcoin has already started a strong bull season and is on its way to an All-Time High (ATH).

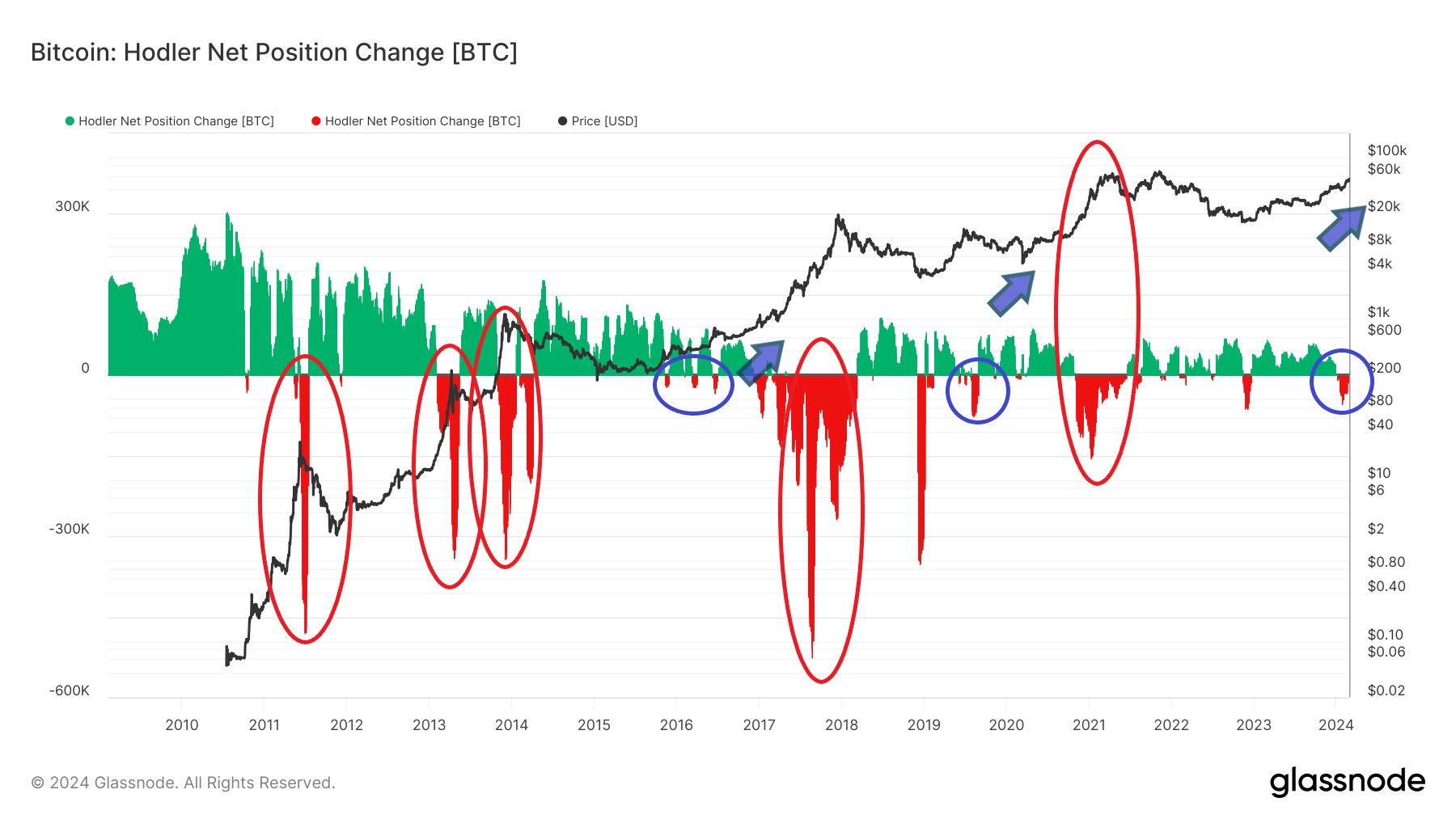

Long-Term Holder Sales Begin

Long-Term Holders (LTH) provide us the opportunity to track investors holding BTC for the long term. Position changes are shown monthly in red (selling) and green (buying). Historically, the largest position reductions are associated with market peaks (red areas).

If you’re wondering about the current situation, we can say that we are in the mature days of the bull market as long-term investors have begun selling. Those expecting a major interim price correction may be disappointed. At the current stage, the maximum price correction Bitcoin could see while advancing towards its historical peak is 20-30%. At least that’s what historical data suggests.