Famous investor and entrepreneur Robert Kiyosaki recently made a share about the cryptocurrency Bitcoin after it rose above the $63,000 level. The increase of over 11% in the last 24 hours, reaching the $64,000 level for a short time, has excited Kiyosaki.

Kiyosaki’s Praises for Bitcoin

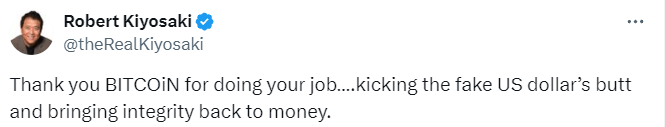

Kiyosaki praised the cryptocurrency Bitcoin for its strong performance against the US dollar and emphasized in his tweet that Bitcoin should be considered an alternative to the fake US dollar, following its rise from $57,140 to $64,000. However, after this significant rise, there was a pullback, and Bitcoin fell to the $62,450 level.

Kiyosaki’s post starts with a thank you to Bitcoin. He states that BTC is doing its job well and emphasizes that it brings honesty to money.

Kiyosaki’s confidence in Bitcoin has strengthened in an environment of increasing financial instability and geopolitical risks. He particularly draws attention to the plans of central banks worldwide to launch their own digital currencies. Therefore, it is noteworthy that Kiyosaki’s increased demand for Bitcoin coincides with his turn to alternative investment instruments like gold and silver.

An Investor Evaluating Bitcoin’s Declines

Kiyosaki’s statement that he plans to buy more BTC if Bitcoin loses value provides an important clue on how he evaluates opportunities in the financial markets. Also, Kiyosaki’s criticism of the US Federal Reserve and his belief that it negatively affects the US economy is a point worth noting.

One of the main factors behind Bitcoin’s recent rise is the growing interest in spot exchange-traded funds, or Bitcoin ETFs. With this increasing interest, optimism in cryptocurrencies is also growing, and this is reflected in the prices. Particularly, spot Bitcoin ETFs approved by the SEC on January 11 have increased interest in Bitcoin and encouraged major companies to invest in this area.

Kiyosaki’s interest in Bitcoin and investment strategies are certainly an important reference point for investors in a period where cryptocurrencies and alternative investment instruments are increasingly taken into account. However, we have reached a stage where traditional markets coexist with cryptocurrencies.

I must state that I do not agree with the idea that cryptocurrencies will end the era of the dollar or similar fiat currencies. However, we see that cryptocurrencies provide significant protection against inflation in terms of their value.