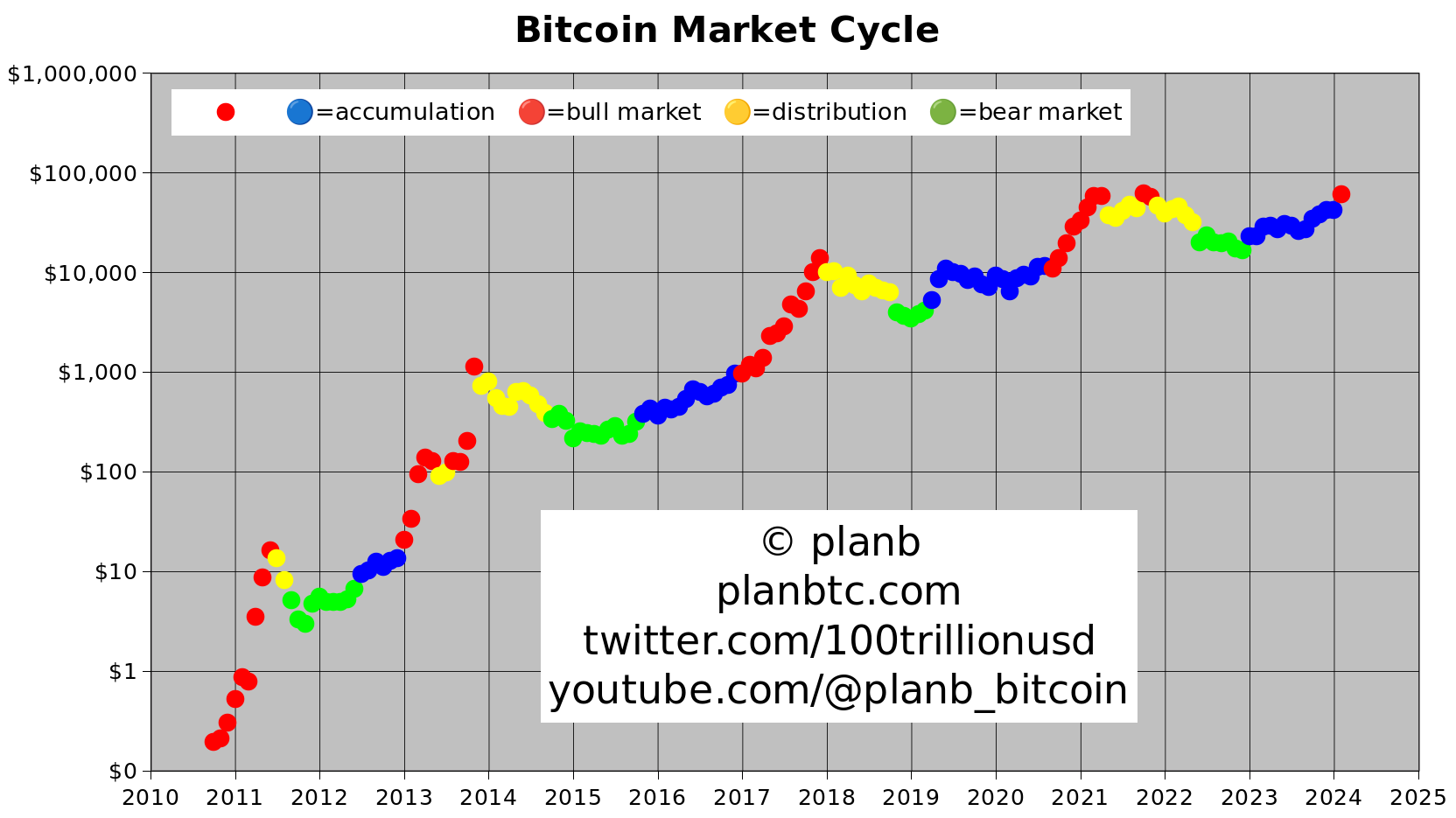

Bitcoin price is above $62,000, and if the weekly close is near this region, there will be no significant barrier left on the path to a new all-time high (ATH). According to PlanB’s Stock-to-Flow (S2F) chart, the bull market has officially begun. Historical data once again tell us that the bad days are behind, and days of “excitement” are ahead, causing sleepless nights.

PlanB Bitcoin Bull

PlanB, the top crypto analyst at the end of 2021, is climbing back up the ranks of popular analysts. According to the S2F chart shared by the crypto expert, Bitcoin has formed its first red dot, marking the official start of a 10-month bull market. In the coming months, we might witness exciting rallies for altcoins.

PlanB said in his latest assessment;

“The accumulation phase has ended: there are no easy buying opportunities in a steadily and slowly rising market anymore.

The bull market has started. If history is any indication of the future, we will see an exciting period of ~10 months, enjoy the extreme price rallies along with multiple -30% drops.”

QCP Analysts Comment on Crypto

Bitcoin is now on the path to ATH, and cryptocurrency experts are excitedly welcoming the excessive demand from the ETF channel. I have been saying for months that the approval of ETFs would not create a normal FOMO, sell the news cycle, but would trigger the start of a strong bull season. With the price increase in spot markets, we saw FOMO in the ETF channel for the first time, and the daily volume exceeded $7 billion.

As demand from the ETF channel continues to rise, a significant portion of the new investor influx will come from traditional markets, unlike previous cycles. In the next phase, we should see different institutions like MicroStrategy starting to accumulate as well.

QCP analysts said;

“Just two days ago in our Vol-Cast, we asked whether BTC would reach all-time highs before the end of March. With BTC reaching $64,100 (ETH’s highest level at $3,522), we are not far off now.

In addition to strong ETF inflows (a record of +$673 million on Wednesday!), this rise was driven by speculative individual buying frenzy. Individual-focused exchanges like Binance led the price movement with BTC perpetuals trading at a $70-80 premium to the spot price and funding rates up to 84%!

Deribit funding rates were relatively moderate for once, suggesting that institutional names might have stayed in the background during this impulsive rise. In fact, we saw players with call options actively profiting.

The leveraged buying frenzy pushed the entire futures curve upward. Selling the spot-forward spread became an obviously profitable investment for anyone with spare dollars to use.

April futures are trading at an annualized rate of +19%, and even December at +13.5%. At these levels, we saw intense interest from our clients to lock in these risk-free returns.”

Türkçe

Türkçe Español

Español