Opening new long positions in perpetual futures markets has become expensive, and investors’ unrealized profit margins are nearing extremely high levels. Some on-chain data indicates that after Bitcoin‘s rise to the $64,000 price level, it could gain excessive momentum, suggesting a significant correction could occur soon.

What’s Happening on the Bitcoin Front?

According to the weekly report by blockchain data analysis platform CryptoQuant, the increasing unrealized profit margin of investors and the high cost of opening new long positions in perpetual futures markets indicate a pause or correction in Bitcoin’s price.

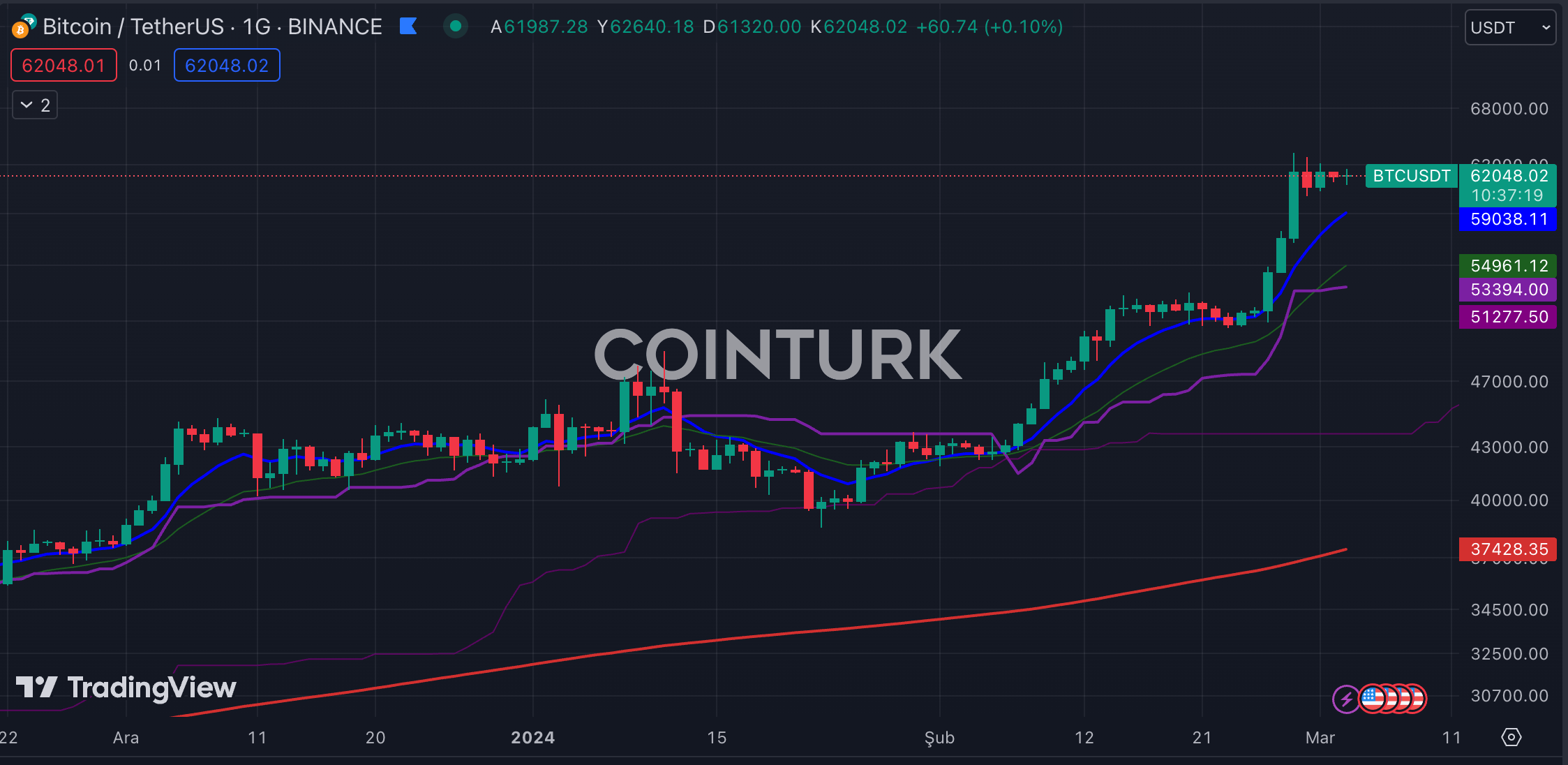

Since the beginning of this week, bulls have taken control of the market, and the price of Bitcoin has increased by more than 25%, bringing the cryptocurrency to levels not seen since November 2021. Bitcoin managed to recover from below $52,000 and surpassed the $60,000 mark. After pulling back from $64,000, Bitcoin was trading at $62,239 at the time this article was written. CryptoQuant analysts state that the price increase is due to high Bitcoin demand from US investors, which is clearly seen with the Coinbase premium index reaching its highest level since mid-February at 0.13%.

The high demand for Bitcoin is coming from larger institutions, with their holdings rising to 3.975 million Bitcoin, a level last seen in July 2022. The current holdings of investors who have accumulated between 1,000 and 10,000 Bitcoin represent significant growth.

Noteworthy Details About Bitcoin

While demand for Bitcoin increases, the asset is trading at a level vulnerable to correction. Bitcoin’s price has surpassed the short-term target of $56,000, predetermined by network activity assessment. The price represents the red Metcalfe Price Valuation Band, which served as a resistance level in April and November 2021 and April 2022. Analysts indicate that a correction could occur around this price level.

Moreover, as opening new long positions in perpetual futures markets has become expensive, investors’ unrealized profit margin is at 32%, which could lead to a potential correction in Bitcoin’s price. Meanwhile, the Miner Profit/Loss Sustainability data shows that Bitcoin’s price is not yet overpriced because miners are still paid low fees, although this rate is lower than at the beginning of January when Bitcoin was valued at $38,000.