Bitcoin continues its upward trend, with the anonymous analyst known as Titan of Crypto sharing predictions for the largest cryptocurrency’s potential cycle peak based on historical Fibonacci extension levels. Drawing from previous Bitcoin cycles, the analyst offered two reasonable predictions for Bitcoin’s cycle top using the well-performing Fibonacci extension levels.

Pointing to the $170,000 Level

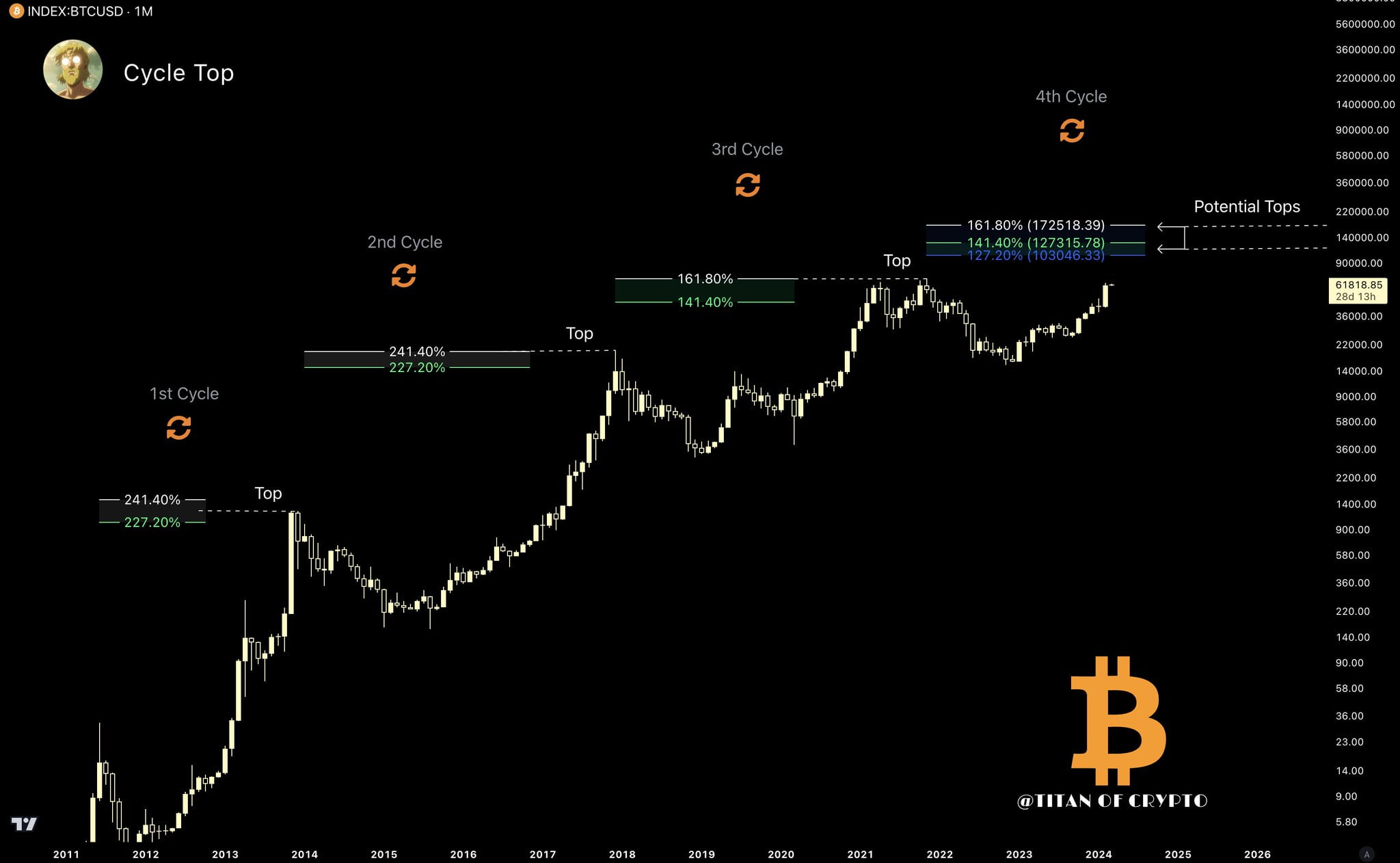

Titan of Crypto suggests that Bitcoin’s first and second cycles peaked within or above the 227.20% to 241.40% Fibonacci extension levels. Similarly, during the third cycle, the largest cryptocurrency peaked within the 141.40% to 161.80% Fibonacci extension levels.

Considering the trend of diminishing returns over time as markets mature, the analyst presented two conservative cycle top targets. Accordingly, the most reasonable estimate points to a range between $103,000 and $127,500, while the second target level is indicated at $172,500.

While deeming these price targets as acceptable, Titan of Crypto also highlighted Bitcoin’s current upward trend, adding that the largest cryptocurrency could potentially exceed these targets. The analyst pointed to Bitcoin’s price trajectory towards the blue line of the Power-Law Corridor, a model that uses logarithmic scales to plot the price over time graph of Bitcoin. According to the analyst, surpassing this line could lead to significant price movements.

The Rising Trend of Bitcoin and the $69,000 Barrier

At the time of this writing, Bitcoin has seen a 5.5% increase in the last 24 hours, trading at approximately $67,000. Data shows that the largest cryptocurrency has experienced about a 30% rise over the last 7 days. Bitcoin’s recent price surge is partly supported by the green light for spot Bitcoin ETFs in the US.

On the other hand, some analysts advise caution as the price approaches the $69,000 level, considered a significant resistance zone during the current rising cycle. They suggest that the price could sharply retract from this level.

Türkçe

Türkçe Español

Español