Bitcoin price had fallen to as low as $63,500 at the time of writing this article. The price has melted down $5500 from the ATH level. Naturally, this situation affects altcoins the most because they had not even had their share of the rise yet. So, what is the reason for the decline? How much deeper can it go?

Why Is Bitcoin Falling?

After reaching the ATH level, the price turned downward as profit-taking began. Almost all investors saw levels where they could make a profit and took advantage of this opportunity. This led to the price melting. On the other hand, there are falling prices with increasing volume in the ETF channel, meaning profit-taking has started here too. The volume in the IBIT fund has already exceeded 2 billion dollars, and a new record could come today.

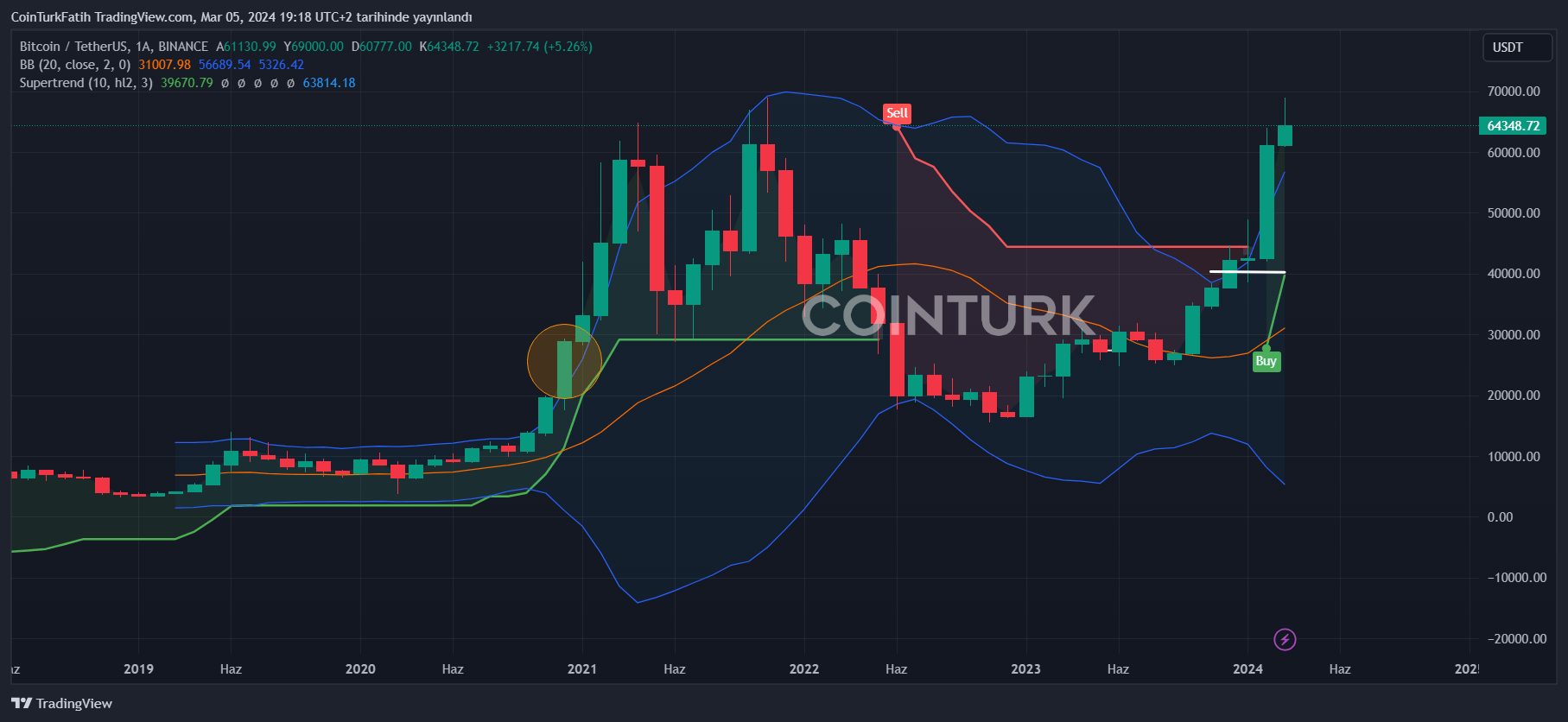

BTC currently needs to close above the $65,000 resistance level for peaks above $70,000. However, markets might see some retracement with the nervousness brought by tomorrow’s employment data, Friday’s wage increases, and unemployment figures. FOMO pushed the price to the ATH region, and now the time to take profits has started, even if it is short-term.

Historical data suggests that BTC makes its cycle peak within 10 months after a halving. So, we may still have months to go before we see rapid rises and focus on the actual peak.

Türkçe

Türkçe Español

Español