Despite a notable rise in 2021 and a sharp decline after the FTX incidents in 2022, Solana‘s situation remains unsettled. As of early 2024, SOL‘s price had fallen from $130 to $70, but it quickly recovered, surpassing $125 again. However, recent issues with the network have been identified on the Binance side. Binance has made a statement regarding the matter.

Binance and Solana Statement

The statement from Binance has raised questions about Solana, which was undeniably a star performer in the past. The project, which has previously drawn criticism for network outages, seems to be facing new issues. Binance’s statement is as follows:

Dear Binancians,

Withdrawals on the Solana (SOL) network have been intermittently suspended since March 4, 2024, due to increased transaction volume on the network. Binance has identified areas for optimization and is working to provide a stable and long-term solution. The estimated implementation date for the solution is March 9, 2024, at 18:00 (UTC).

We apologize for any inconvenience caused.

The team has informed investors that transactions on the network have been intermittently suspended since March 4th and this could continue until March 9th. Considering this is due to high demand, it could be seen as a positive development for Solana (SOL).

Current Solana Price Situation

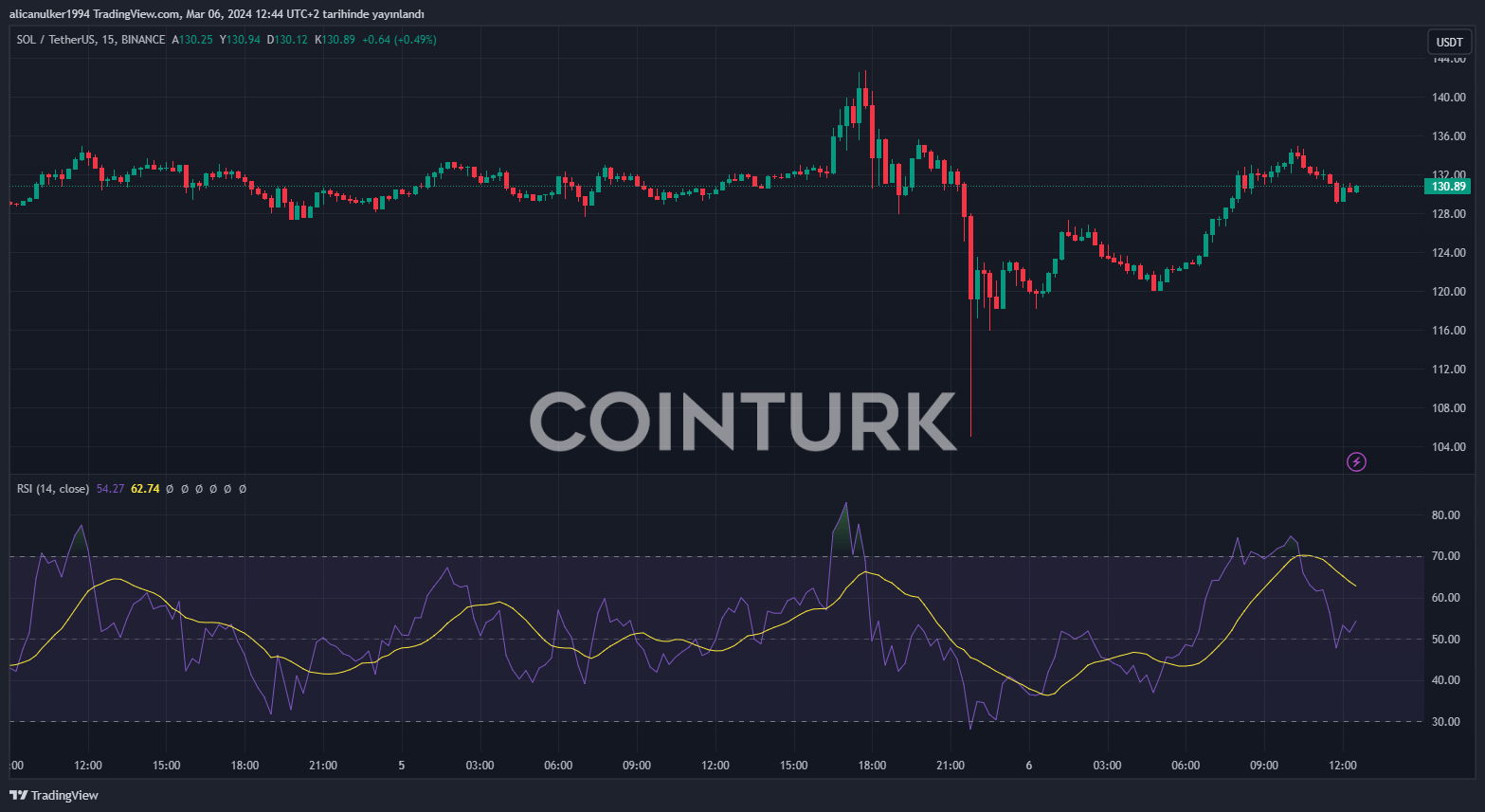

Amidst these developments, attention has turned back to the price of Solana (SOL) following Binance’s announcement. While Bitcoin trades at $66,647, SOL continues to stay above the $130 mark with a 0.52% decrease.

The market cap of Solana (SOL) is at $57 billion, a 0.45% decrease, which still places it significantly above the fourth rank in terms of market cap. There has been a 101% increase in Solana’s last 24-hour volume, reaching $9.5 billion.

Considering this trading volume, it’s understandable why Binance might have taken such a decision. Although SOL is 50% below its all-time high of $260, the fact that it has risen from last year’s low of $9 to this point could provide hints about where the project could go with the support of its investors.

Türkçe

Türkçe Español

Español