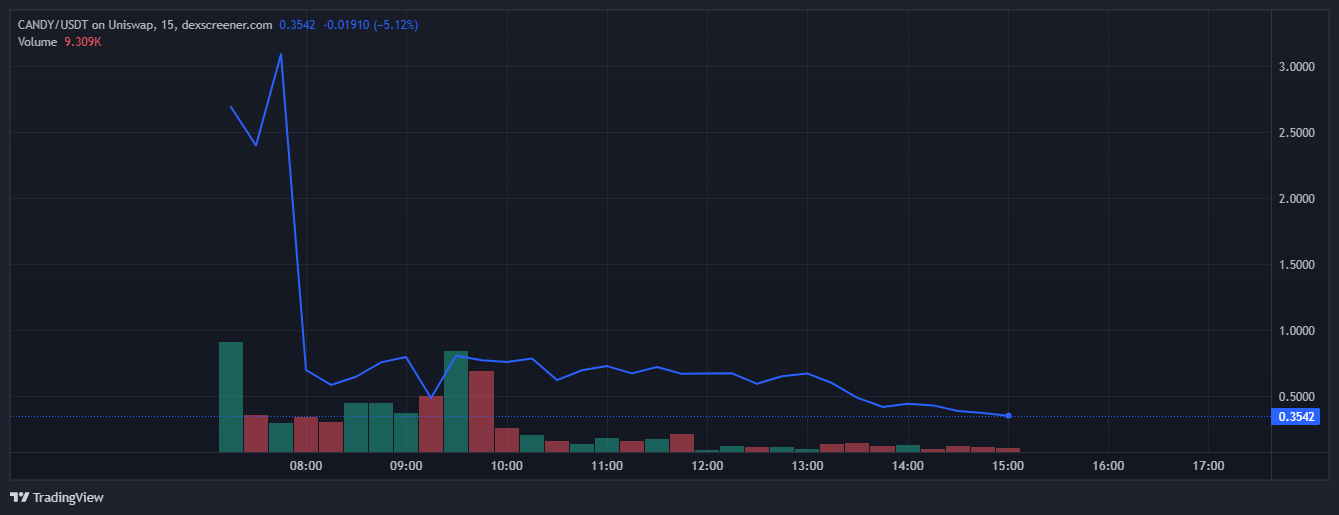

The liquidity protocol Lena Network’s Candy token suffered a loss of over 87% in value following a $2.9 million loss in 753 Ethereum just as the protocol was made available to users. According to Dexscreener data, the Candy token fell from its daily high of $3.08 to $0.38, an 87% decrease.

What Happened at Lena Network?

According to Etherscan, the Candy token began to fall after blockchain data showed that on March 6, the Lena Network distributor address transferred 753.11 Ethereum to an address associated with the OKX exchange. This transfer occurred just hours before Lena Network announced on a March 6 post that it had officially renounced ownership of the token contract. The protocol team had not yet responded to the incident at the time of publication.

According to an announcement related to the protocol, Lena Network raised over 850 Ethereum worth a total of $3.2 million for the Candy initial farm offering, which ended on March 3. The Candy token was launched on March 6, before experiencing a sharp decline, but these developments continue to raise concerns about the token.

Fraud Incidents in the Crypto Market

Rug-pull and hacking incidents are an increasing concern in the crypto space. According to a research report published by blockchain security firm Immunefi on February 29, over $200 million in crypto assets have been lost to hacks and rug-pull scams in 32 separate incidents to date in 2024.

The loss of over $200 million since the beginning of the year represents a 15.4% increase compared to January and February 2023, when $173 million in crypto assets were stolen. In February alone, over $67 million in crypto was stolen in 12 specific hack and scam incidents, which is about a 50% decrease compared to January, when $133 million worth of cryptocurrency was stolen.

According to a report by Immunefi dated December 28, 2023, a total of $1.8 billion was lost to crypto hacks and scams in 2023, with 17% attributed to the North Korea-based Lazarus Group. These incidents in the crypto market are causing many investors to experience fear and concern about the cryptocurrency market.

Türkçe

Türkçe Español

Español