Bitcoin experienced a shock sell-off in the last 24 hours, dropping to $59,000, but thankfully it did not stay there long and recovered after profit-taking sales. It is now hovering around the $67,000 mark. Closing prices above $65,000 are crucial for fostering hope for further rises in altcoins. So what’s next for Litecoin (LTC)?

Litecoin (LTC)

In bull markets, short-term traders often focus on volume rankings. Altcoins that attract volume experience impressive rises during bull runs, and closely monitoring volume changes in the coming months can be profitable, especially for altcoins with low market value. LTC’s volume increased from $391 million on February 20th to $1.3 billion on March 5th.

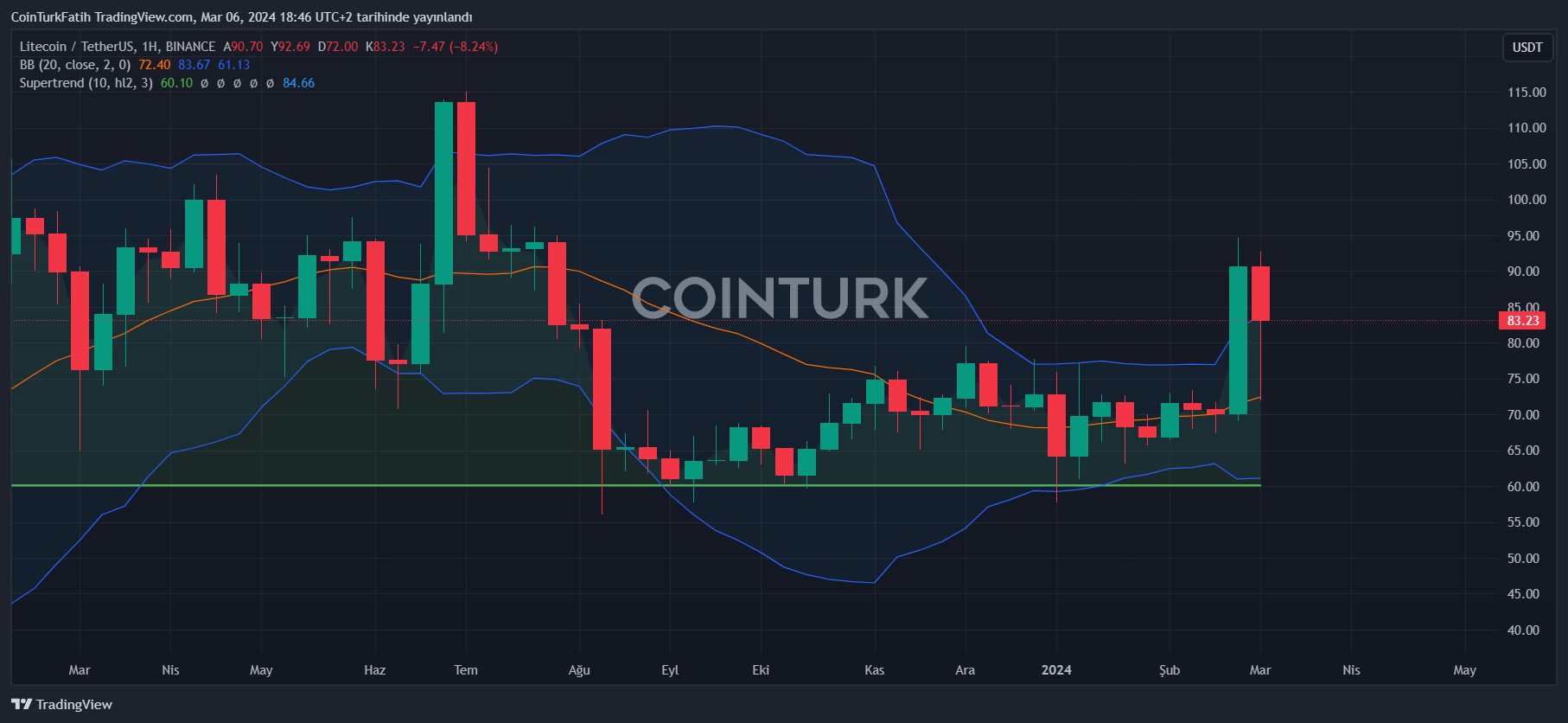

The astonishing 232.48% growth in volume clearly reflects investor interest and underscores the potential for price movement. After this fluctuation pushed the price above $94, we saw a rapid decline along with other altcoins. The LTC price has since dropped to $72, still lingering at levels significantly lower compared to BTC gains.

LTC Price Forecast

Let’s briefly look at the on-chain aspect for the current outlook. The number of transactions on the network hasn’t surpassed 300,000 since peaking at 353,240 on January 25th, with a 7-day average around 225,700. While the LTC price climbed from $68.30 on February 23rd to $94 on March 2nd, the transaction count remained constant. We observed this in June 2023 as well. However, the following month saw a price increase of 40%. If this repeats, LTC Coin could see movement within 30 days.

The number of Active and New Addresses interacting with Litecoin has also remained stable. Previously, an increase here had led to a price drop, so the current stability is positive. In the last 30 days, the number of whales holding assets between $1 million and $10 million in LTC increased by 15%. The rise in the number of larger whales is also noteworthy.

Even though transaction and address counts remain steady, whales are accumulating more LTC. This suggests that while there may not be significant activity on the network, the overall market sentiment is optimistic enough to spur experienced investors into action.

If the price can turn $94 into support, the rally could gain momentum. For now, holding above the $70 support level is a positive sign. Surpassing the $114 target in a potential rise could pave the way to a $156 goal.

Türkçe

Türkçe Español

Español