Bitcoin, leading the cryptocurrency market, exhibited dramatic volatility following liquidations, resulting in a steep price correction. Sudden volatilities have sparked debates among investors and analysts about whether Bitcoin has reached the market’s peak. Recent activities, particularly comments made by significant financial analysts and the extensive liquidation of positions witnessed on major trading platforms, have led to important discussions.

What’s Happening on the Bitcoin Front?

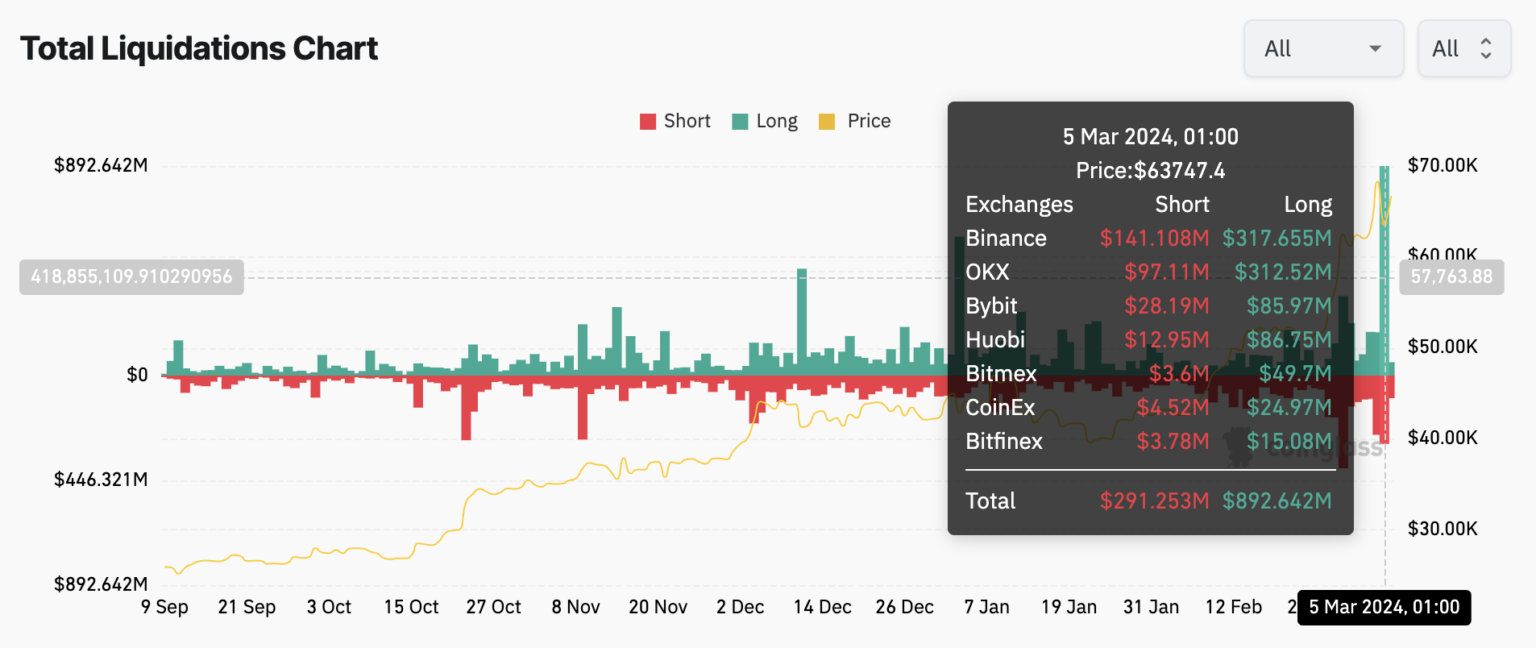

Bitcoin has caught the attention of both investors and analysts. The highly volatile cryptocurrency recently dropped from its all-time high of $69,300 to $59,200 within five hours. This sharp decline, attributed to the liquidation of long positions in the futures market, resulted in over $1 billion worth of positions being liquidated, affecting approximately 296,908 investors.

Blockchain data analysis platform CoinGlass reports that this figure consisted of approximately $892 million for long positions and about $291 million for short positions. This significant market movement has sparked debates about Bitcoin’s stability and future expectations. Crypto analyst Miles Deutscher described the process as the biggest crypto liquidation event in over six months.

Optimism Continues in the Market Despite Volatility

Despite the dramatic drop, the market’s resilience was fully demonstrated by the aggressive buying of the dip and establishing $60,000 as a solid support level. QCP Capital notes an increased interest in Bitcoin and Ethereum for the September-December period, viewing this drop as a favorable moment for investors. This suggests a bullish sentiment among investors despite recent volatility. QCP Capital analysts stated:

“Despite the decrease in leverage ratio, futures are still trading at a surprisingly good premium, making cash and carry trades much more attractive. Customers are rushing to sell the spot-futures spread at these peak levels. We don’t expect this to last very long,”

John Bollinger, the creator of Bollinger Bands, offers a measured perspective, suggesting that taking profits at new highs is typical, but the magnitude of the sell-offs raises questions. Bollinger acknowledges that a one-day pullback doesn’t necessarily indicate a market peak, but a failed rally attempt could have significant implications.

In the face of these market dynamics, investors like Raoul Pal view liquidation days as golden investment opportunities. This sentiment underscores a broader market philosophy of leveraging volatility for strategic gains:

“Days like today, with liquidation, are a great day to put some money to work.”

Türkçe

Türkçe Español

Español