Experienced cryptocurrency analyst Dylan LeClair recently provided a comprehensive market assessment by analyzing the current state of the Bitcoin (BTC) market. The analyst shed light on the dynamics emerging between long-term investors and newcomers to the market, particularly among spot Bitcoin exchange-traded funds (ETFs).

Long-Term Investors Selling, ETFs Accumulating

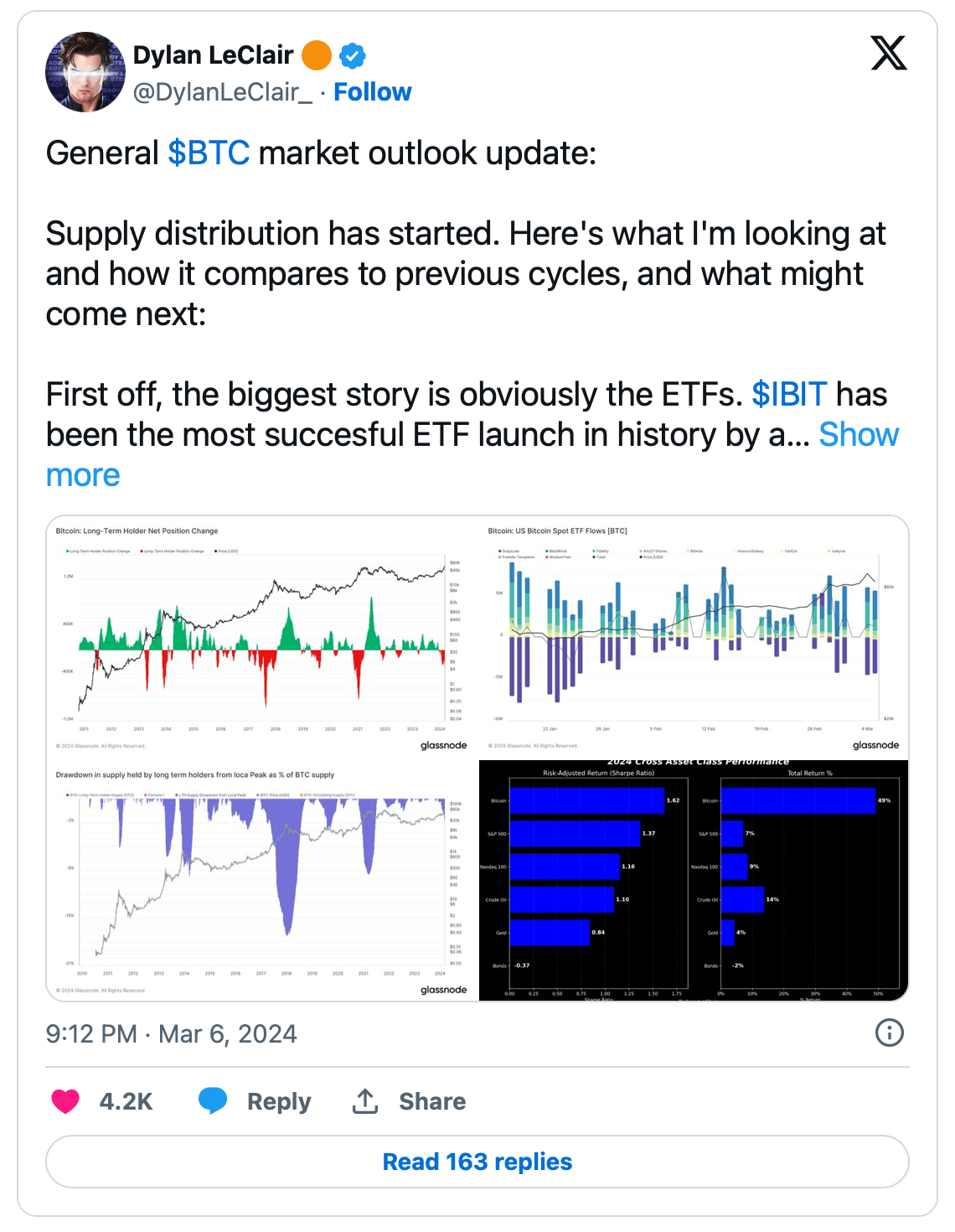

According to LeClair’s analysis, a significant shift in supply distribution has begun, with long-term Bitcoin investors starting to sell their BTC as ETFs gain popularity in the market. Despite this development, LeClair notes that the demand for ETFs remains very strong, with these funds continuously accumulating more BTC and alleviating concerns about potential sales.

According to LeClair, the demand for ETFs has exceeded initial expectations, and even as the Bitcoin market rises, nine new ETFs in the US continue to break records with ongoing entries and daily trading volumes. Notably, the world’s largest asset management company BlackRock‘s IBIT fund witnessed a record entry of $788 million on March 5th, when Bitcoin reached its all-time high price. Institutions like BlackRock and Fidelity have since the launch of their ETFs purchased a significant portion of the total Bitcoin supply, amounting to 284,000 BTC.

The analyst emphasized that while long-term investors have started distributing Bitcoin, this is still in the early stages and is balanced by increasing demand from ETFs and institutional investors. He identified various catalysts for further adoption and price increase of Bitcoin, such as the continuation of ETF entries, institutional adoption, and potential sovereign accumulation by countries seeking an alternative to US dollar hegemony.

LeClair predicts that as Bitcoin reaches new price peaks, the distribution by long-term investors will likely increase. However, he expects this supply to be absorbed by rising institutional demand, leading to a sustained upward trend in the market. He described the current market environment as one where long-term investors have begun distributing their assets, but this action is met with overwhelming capital inflows from institutional investors, setting the stage for a dynamic and potentially volatile period ahead.

In terms of Bitcoin’s price outlook, LeClair’s analysis aligns with the latest market movements, where Bitcoin pulled back to $60,000 after refreshing its record at the beginning of the week and then recovered, trading around the $66,000 level.

Famous Billionaire Bulls Join the Rally

Despite the sharp pullback on March 5th, billionaire entrepreneur Mark Cuban expressed a strong bullish outlook for Bitcoin, citing its scarcity and increasing demand as factors likely to drive up its price.

Cuban’s forecast underscores Bitcoin’s growing acceptance as a store of value and highlights the long-term growth potential amidst evolving market dynamics.

Türkçe

Türkçe Español

Español