Bitcoin (BTC) price has been testing different levels while recently reaching all-time highs (ATH). Concurrently, with the new price increase, miners also witnessed the highest level of daily revenue ever.

Bitcoin Miner Revenues

An analysis of Bitcoin miner revenue from Glassnode revealed a significant increase on March 5th. The daily mining fee rose to $75.9 million, marking the highest daily revenue since April 2021. At the time of writing, the daily mining fee had fallen to approximately $62 million. Despite this decline, the fee continues to be among the highest observed since December 2021. Moreover, the increase in fees can be linked to the rise in daily transactions. An analysis of the volume chart from Santiment showed that on February 6th, BTC volume exceeded $102 billion.

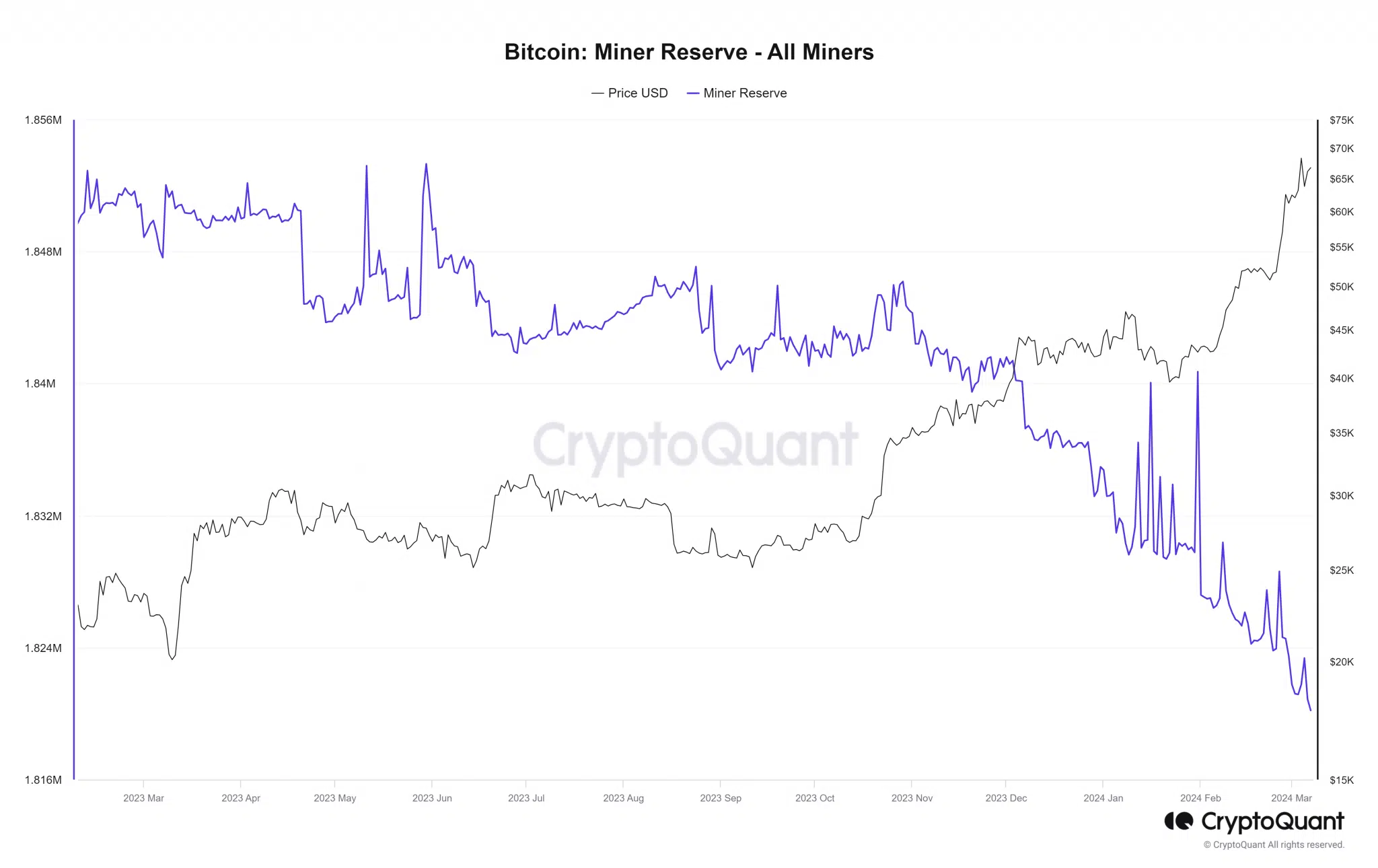

This was the first instance in over a year that BTC witnessed such high volume. At the time of writing, the volume was over $55 billion. An analysis of miner reserves from CryptoQuant indicated that as fees increased, reserves experienced a decline. At the time of writing, the reserve was over 1.820 million. At the beginning of the month, the reserve was approximately 1.821 million, and at the start of February, it was around 1.827 million.

Bitcoin Price Analysis

The recent decline could indicate that miners are selling their tokens as BTC prices rise. While this has not yet affected the BTC price, more significant declines could lead to a price drop. A detailed analysis of Bitcoin’s price trend on the daily timeframe could suggest a pullback after surpassing $68,000 on March 4th.

This could mean that Bitcoin reached this level for the first time in over a year. At the time of writing, Bitcoin was trading around $66,700, following a nearly 1% increase in value. This sustained the previous trading session’s 3.6% rise. Additionally, as indicated by data from the relative strength index (RSI), Bitcoin remained in the overbought zone.