Bitcoin (BTC) options market activity, especially the surge in out-of-the-money (OTM) call options, shows a rise in sentiment reminiscent of the excitement seen in 2021, according to Deribit’s market data. The leading crypto options exchange Deribit has reported significant interest in the Bitcoin call option at the $200,000 level, which is currently trading at about three times the current market rate of Bitcoin.

Investors Anticipate Bitcoin Surpassing $200,000

The recent rise in Bitcoin’s price has paralleled a record surge in interest in the largest crypto options market, fueling excitement among investors and traders. According to Deribit Metrics, the $200,000 Bitcoin call option saw significant interest on Friday, with nominal open interest exceeding $20 million.

Investors are essentially betting that Bitcoin’s price will surpass this level by the end of the year by purchasing call options at the $200,000 strike price expiring on December 31, 2024. Call options give buyers the right to purchase the underlying asset at a predetermined price on or before a specific date, reflecting the bullish outlook in the market.

Price Rises with Major Shift in Supply-Demand Dynamics

The popularity of the $200,000 call option reflects sentiments seen during the previous rally when Bitcoin rose above $60,000 in 2021. The interest in such deep OTM call options is based on the prevailing consensus that the upcoming Bitcoin block reward halving will decrease supply, potentially tipping the supply-demand dynamics in favor of the bulls and possibly driving prices to six-figure territory.

The supply-demand balance has significantly changed with Wall Street’s adoption of US-based spot Bitcoin exchange-traded funds (ETFs), contributing to a demand-favorable ratio of 1:10. As a result, the price recently reached new record levels above $69,000, showing a 59.7% increase since the beginning of the year and indicating rising optimism in the market.

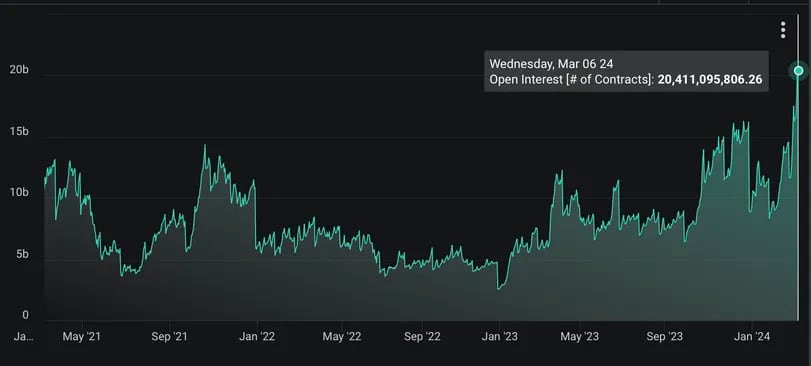

The rally has not only revitalized the spot market but also increased activity in the options market. The total open interest in Bitcoin options on Deribit also rose to $20.4 billion, surpassing the previous peak recorded in October 2021. Similarly, the total open interest in Ethereum (ETH) options reached an all-time high of $11.66 billion.

Türkçe

Türkçe Español

Español