BlackRock iShares Bitcoin ETF (IBIT) is purchasing thousands of Bitcoins every day. Following a purchase of Bitcoin (BTC) worth $778 million on March 5, it became apparent that investors took advantage of the drop in price during this period. Meanwhile, renowned figure Michael Saylor also commented on the situation.

Smart Money’s Direction

MicroStrategy CEO and fervent supporter of cryptocurrencies, Michael Saylor, shared his views on Bitcoin’s future direction and his concerns about BlackRock’s entry into the cryptocurrency market during an interview with Natalie Brunnell.

While Saylor dismissed concerns about BlackRock’s influence, he stated:

Smart money is buying Bitcoin because it is a crypto commodity network. It is a decentralized asset with no issuer.

Saylor once again emphasized that Bitcoin is a decentralized asset.

Will Bitcoin Surpass Gold?

Saylor also criticized investments in other assets like gold, real estate, and bonds, classifying them as inferior assets.

Your enemies are not people buying Bitcoin. Your enemies are those buying inferior assets like gold, real estate, stocks, or bonds.

Despite the substantial support and investments in BTC ETFs by BlackRock, Saylor believes that the voices of users are getting louder and attracting new participants, thus strengthening the network.

Saylor expressed the following:

I believe that with each new participant, the network becomes more decentralized, and the more participants we have, the less likely someone can disrupt the network.

Additionally, Saylor highlighted the significant success of the BTC ETFs that started trading in mid-January and expressed optimism about institutional adoption and regulatory clarity:

I expected the ETF launch to be successful, but the level of success at this point is quite impressive. I can see these ETFs surpassing gold ETFs in not too long a time. Bitcoin ETFs are the most successful ETF launch in the past 30 years and seem to have outperformed all other ETFs in the first 30 days.

Saylor and His Bitcoin Journey

While concerns about BlackRock’s impact on the market are growing, Saylor remains optimistic about BTC’s strong stance. He also points out that its decentralized structure and adoption will protect Bitcoin.

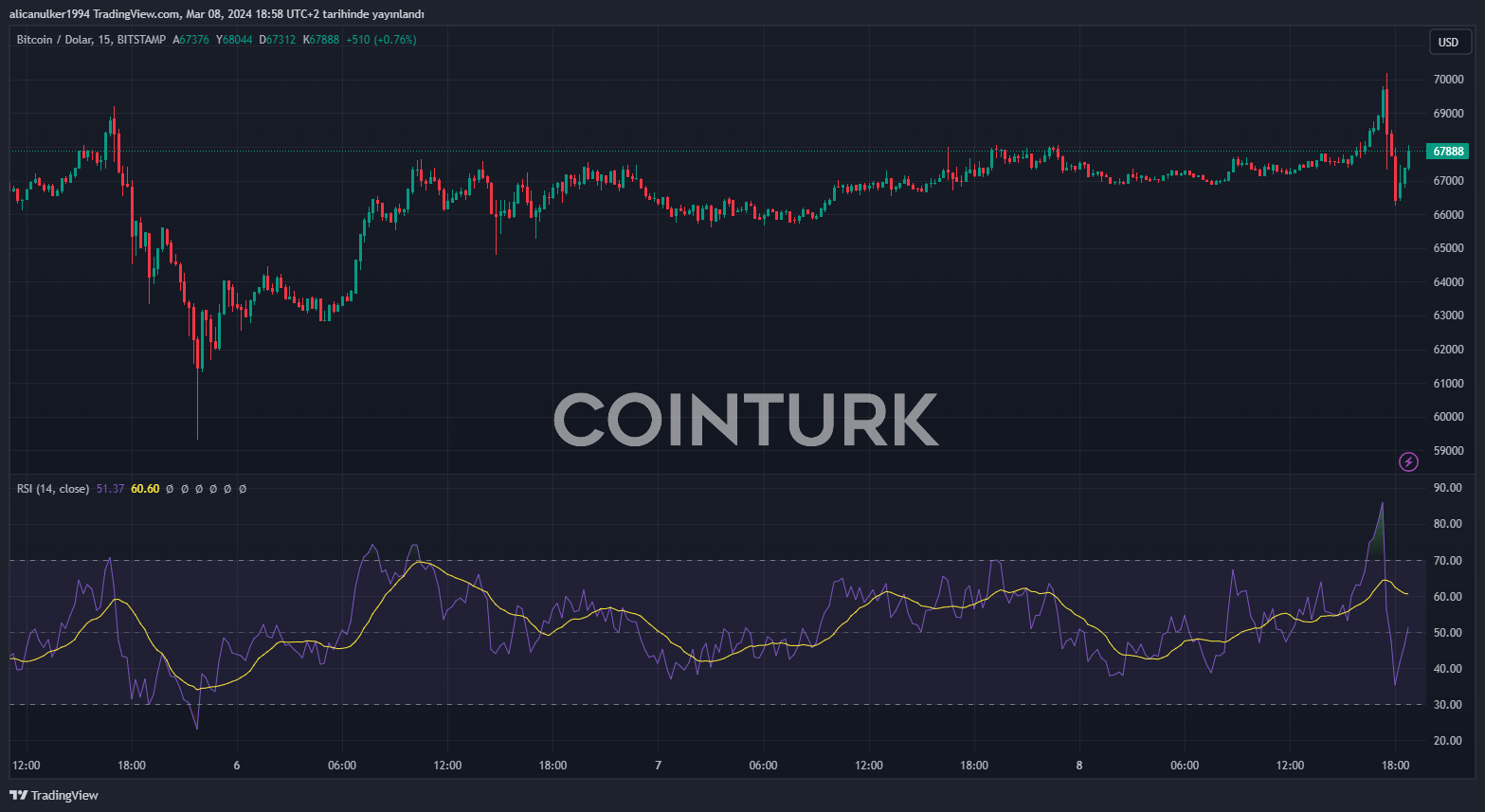

Amidst all these developments, the Bitcoin price surpassed $70,000 in futures trading while reaching up to $69,990 in the spot market, achieving new highs. The price of Ethereum, on the other hand, experienced a pullback after momentarily exceeding $4,000 in the futures market.

Türkçe

Türkçe Español

Español