Bitcoin (BTC) has seen a significant development as BlackRock’s spot Bitcoin ETF, IBIT, now holds more BTC than MicroStrategy after 40 trading days. This milestone highlights the growing importance of spot Bitcoin ETFs in the investment world.

BlackRock’s ETF Becomes the Largest Bitcoin Investor, Not MicroStrategy Anymore

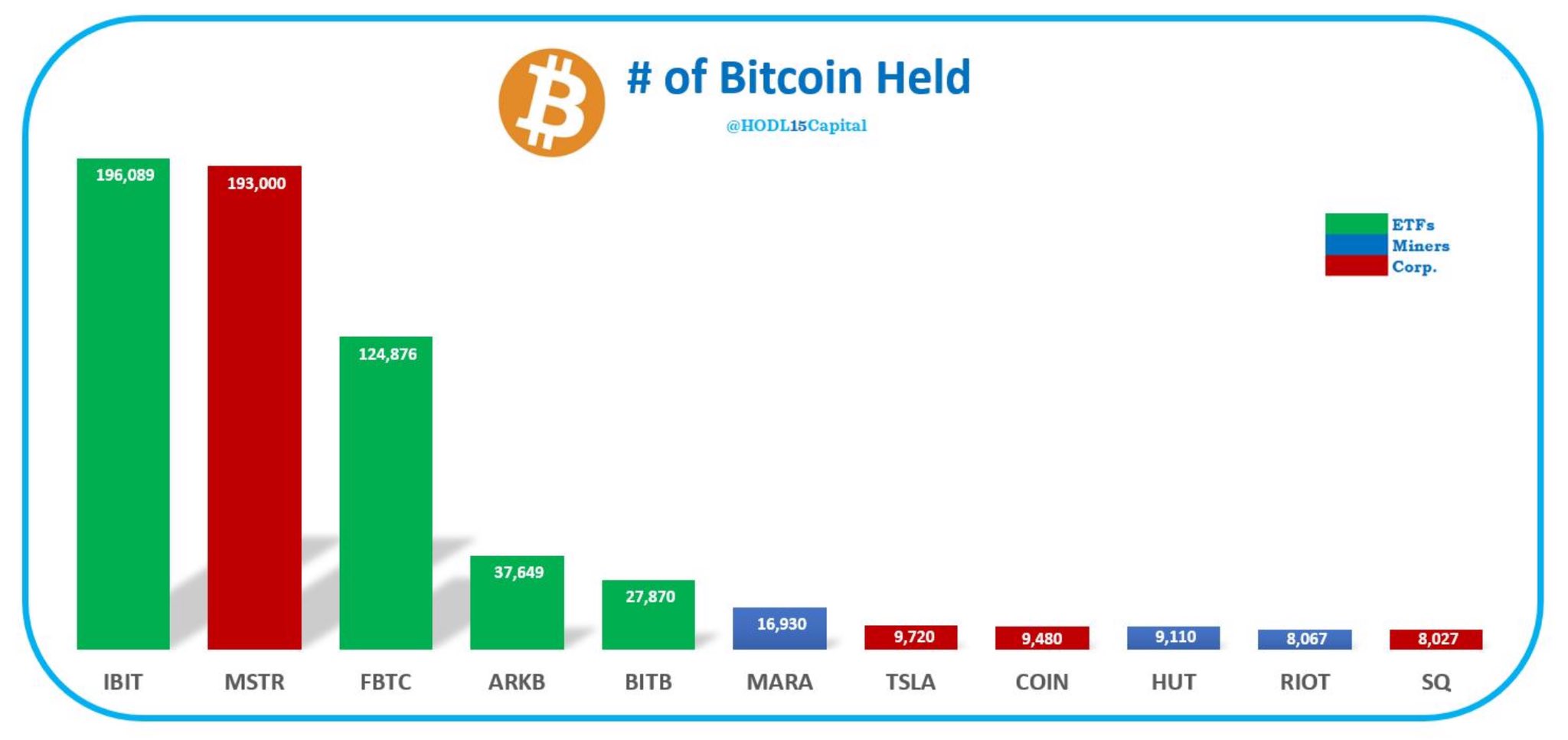

HODL15Capital‘s data indicates that in just 40 trading days, BlackRock’s spot Bitcoin ETF, IBIT, has accumulated 196,089 BTC, surpassing MicroStrategy’s 193,000 BTC holdings. This shift indicates that the largest corporate Bitcoin investor is now a BlackRock ETF instead of MicroStrategy.

Moreover, data from Lookonchain shows that the total reserves of spot Bitcoin ETF issuers have now exceeded 800,000 BTC. This milestone is a result of strong inflows into spot Bitcoin ETFs since their inception.

The increase in BTC assets in spot Bitcoin ETFs followed the approval by the U.S. Securities and Exchange Commission (SEC) of nine spot Bitcoin ETFs, including BlackRock’s, on January 10th. Since their launch, these ETFs have attracted significant interest from both individual and institutional investors, achieving high trading volumes and supporting both the Bitcoin and altcoin markets.

The Impact of Spot Bitcoin ETFs

The SEC’s approval of spot Bitcoin ETFs marks a significant moment for the crypto market, providing investors with a regulated way to invest in Bitcoin. This regulatory green light has fueled optimism among market participants and contributed to the growing adoption of cryptocurrencies within traditional finance.

The rapid accumulation of BTC by ETFs reflects the increasing institutional interest in cryptocurrencies as a viable asset class. The involvement of established financial institutions like BlackRock has played a crucial role in democratizing access to the largest cryptocurrency for investors of all sizes.

As spot ETFs continue to attract attention, their role in shaping the dynamics of the crypto market is expected to grow. The increasing BTC reserves held by these ETFs indicate a shift in investor preferences towards regulated investment vehicles and signal a potential major supply shock for the largest cryptocurrency.

Türkçe

Türkçe Español

Español