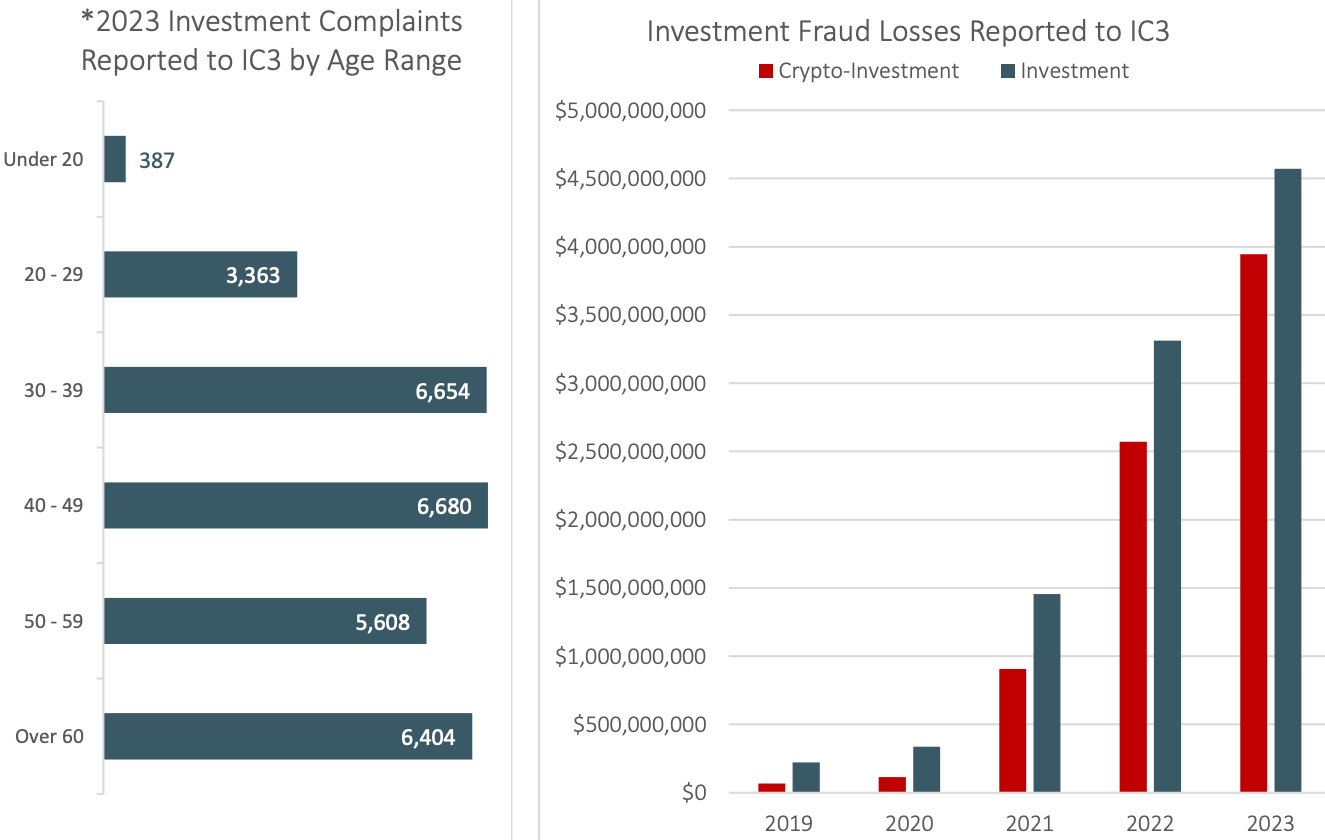

The Federal Bureau of Investigation (FBI) has reported that investment fraud involving cryptocurrencies constitutes the largest portion of investment losses in 2023, highlighting it as a significant concern in the US. According to data, investment losses involving cryptocurrencies increased by 53% in 2023 compared to the previous year.

Emphasis on Romance Scams

A recent FBI report indicates that investment losses involving cryptocurrencies jumped from $2.57 billion in 2022 to approximately $3.94 billion in 2023, marking a significant 53% increase. This staggering figure represents about 86% of all investment fraud losses in the country, showing an increase in cryptocurrency-related scams targeting unsuspecting victims.

The FBI emphasized that an increasing number of individuals are falling victim to crypto fraud, lured by promises of significant returns on their investments. These scams are often designed to deceive victims with attractive return expectations, but the fraudsters disappear with the collected funds.

Among the most common types of crypto fraud that disturb individuals is romance scamming, where criminals use fake online identities to gain the trust and affection of victims before convincing them to send cryptocurrency, ultimately disappearing without a trace.

In December 2023, Blockchain analytics firm Chainalysis reported that romance scams alone caused a suspected loss of at least $374 million in cryptocurrencies throughout the year. According to data, over 324,000 users fell victim to such scams in 2023, and other methods like phishing scams were used to empty approximately $295 million worth of crypto wallets.

Extending Beyond US Borders

The concerning trend of citizens falling victim to crypto fraud extends beyond US borders, as other countries worldwide grapple with similar issues. In April 2023, The Australian Competition and Consumer Commission (ACCC) reported that Australians lost $221.3 million Australian dollars ($146.9 million) to investment scams involving cryptocurrencies as a payment method in 2022. This figure indicates a significant 162.4% increase from 2021, highlighting the global scope and severity of the issue.

As the adoption of cryptocurrencies continues to rise and they become more mainstream, the necessity for individuals to exercise caution while engaging in investment activities becomes apparent.

Türkçe

Türkçe Español

Español