Crypto investors are gearing up for a busy week with an expected rise in volatility. As this article is being prepared, Bitcoin is consolidating around the $69,000 mark, while altcoins are on the brink of starting more significant rallies. However, the developments in the next 7 days could affect prices for better or worse.

Significant Developments in Cryptocurrencies

We wrote about the critical nature of last Friday exactly one week ago, on Sunday, March 3. We witnessed together how US macroeconomic data pushed Bitcoin to $70,000. We have been writing about the week’s developments every Sunday for a long time, and COINTURK readers thus get the opportunity to prepare for what’s coming.

Especially as we move into the hottest days of the bull market, the importance of news tracking has increased significantly. This also represents an opportunity for investors looking for short-term trading opportunities. Let’s now look at what will happen in the next 7 days.

Monday, March 11

- The Fed will stop lending through the Bank Term Funding Program (BTFP)

Tuesday, March 12

- 15:30 US Monthly Core Inflation (Expectation: 0.3%, Previous: 0.4%)

- 15:30 US Inflation (Expectation: 3.1%, Previous: 3.1%)

- Starknet V0.13.1

Wednesday, March 13

- Ethereum Dencun Upgrade (16:55)

- APT Unlocking ($327 Million)

Thursday, March 14

- 15:30 US PPI (Expectation: 1.1%, Previous: 0.9%)

- 15:30 US Core Retail Sales (Expectation: 0.4%, Previous: -0.6%)

Friday, March 15

- ETHGlobal London March 15-17

- Cyber Unlocking ($10.4 Million)

- First Meeting with FTX Digital’s Creditors

Saturday, March 16

- Cardano USDM US Launch

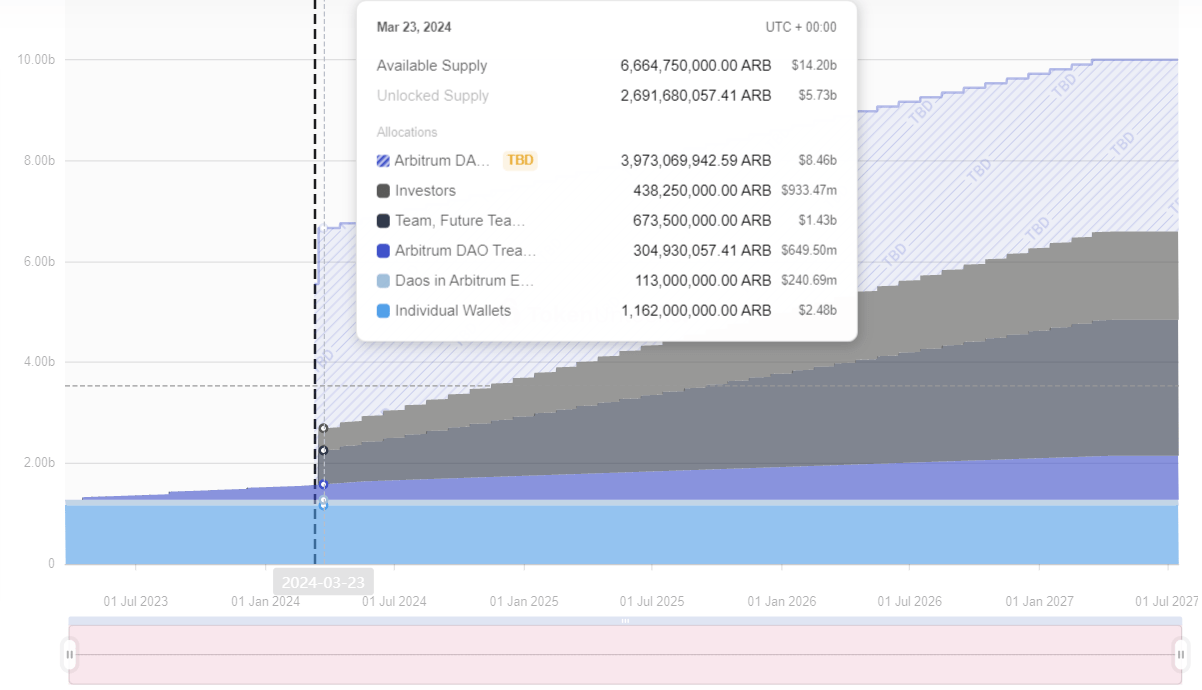

- Arbitrum Unlocking ($2.1 Billion)

What to Watch For?

Firstly, the BTFP will stop pumping liquidity into banks tomorrow, and Powell had mentioned days ago that some commercial banks (medium and small-scale local) could go bankrupt. We might see some bank failures when BTFP ends. On the other hand, we are entering inflation week, and if inflation comes in high, we could see rapid sales in crypto following the Fed’s disregard for January data.

The Dencun upgrade is one of the most important events of the week, and Ethereum‘s layer2 solutions could push the Ether price higher on this date. On Saturday, Arbitrum will unlock $2.1 billion, which roughly corresponds to 76% of the circulating supply. Such a large unlocking could have devastating consequences if the overall market sentiment also turns negative.

Türkçe

Türkçe Español

Español