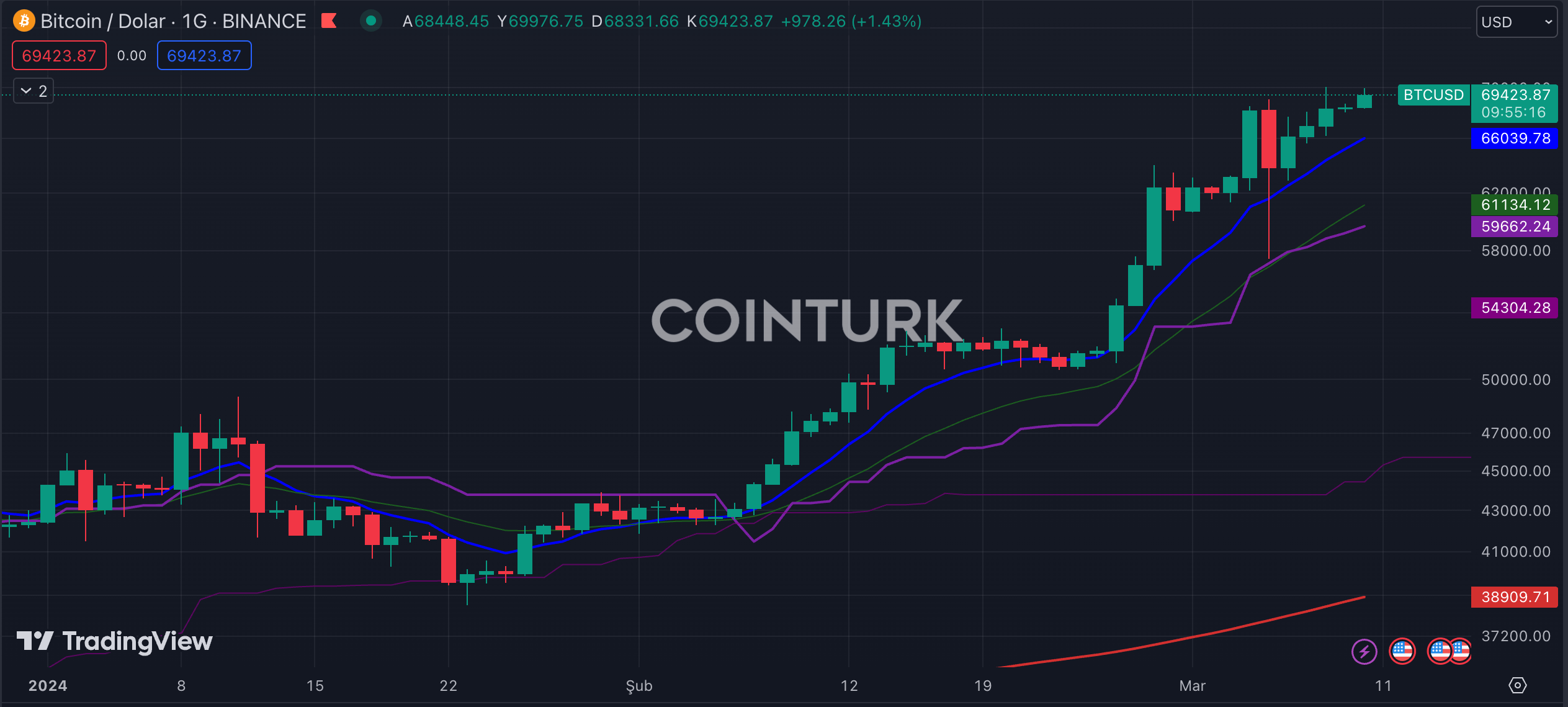

Bitcoin price this week exceeded the all-time high of $69,000. However, this cycle appears different from the rise experienced in 2021. Just three weeks ago, on February 12th, Bitcoin‘s price overcame the $50,000 resistance. Sean Farrell, Head of Crypto Strategy at Fundstrat Global Advisors, excited investors by stating that there is definitely some room for this rally to continue in the near term.

Bitcoin and US Data

The cryptocurrency market rally reached just over $70,000 on Friday, March 5th, before pulling back to its current position. At the time of writing, Bitcoin was trading at $69,320. As Bitcoin reached its all-time high, the US dollar federal fund rate for borrowing had not even begun to fall.

When Bitcoin’s price last soared this high, the dollar supply was abundant, and the Fed was keeping interest rates low. This time, however, it did so without low rates. James Butterfill, Research Director at crypto asset management firm CoinShares, recently stated in an interview with ABC News:

“The price increase coincides with a period of stubbornly high interest rates, indicating that the surge in demand is due to excess cash looking for a place to go with very few borrowers.”

When this situation changes, likely in 2024, Bitcoin could become a major demand source for the crypto currency as a deflationary haven from the Federal Reserve, while technology stocks benefit from the same investment surge due to the abundance of cash and cheap borrowing from the low interest rate regime.

Predictions for Bitcoin Continue

Bitcoin marked a promising milestone by closing its first monthly candle of $20,000 in February, hinting at the potential sharpness of upcoming price volatilities. In this regard, an analyst from blockchain data analysis platform Glassnode stated:

“February 2024 witnessed the largest monthly USD increase in history with a Bitcoin candle of $19,840. This added $390 billion to Bitcoin’s market value, a notable increase of 47%.”

According to a report published at the end of February by crypto data analysis firm Kaiko Research, the percentage of weekly volume in the crypto market continues to decline over the weekends:

“However, this trend has been ongoing for a long time; the share of Bitcoin traded over weekends has significantly decreased over the past six years, dropping from 24% in 2018 to just 17% in 2023.”

This likely indicates that institutions operating during business hours from Monday to Friday are increasingly accepting and using cryptocurrencies:

“In 2024 so far, only 13% of all Bitcoin transactions from January 1st to February 20th took place over the weekend. When we break this down by region, weekend transactions decreased at both offshore and US exchanges.”

The drop from 17% to 13% demonstrates the significant impact of spot Bitcoin exchange-traded funds on the market.

Türkçe

Türkçe Español

Español