Bitcoin (BTC) continues its ascent by breaking the $72,000 barrier and setting a new record, while famed analyst and CMCC Crest executive partner Willy Woo offers an optimistic forecast for the largest cryptocurrency. The analyst suggested that Bitcoin could reach a surprising peak of $337,000. Woo shared details of his bullish prediction for Bitcoin, supported by a series of factors contributing to its upward momentum.

BMI Index Indicates a Fully Developed Bull Market

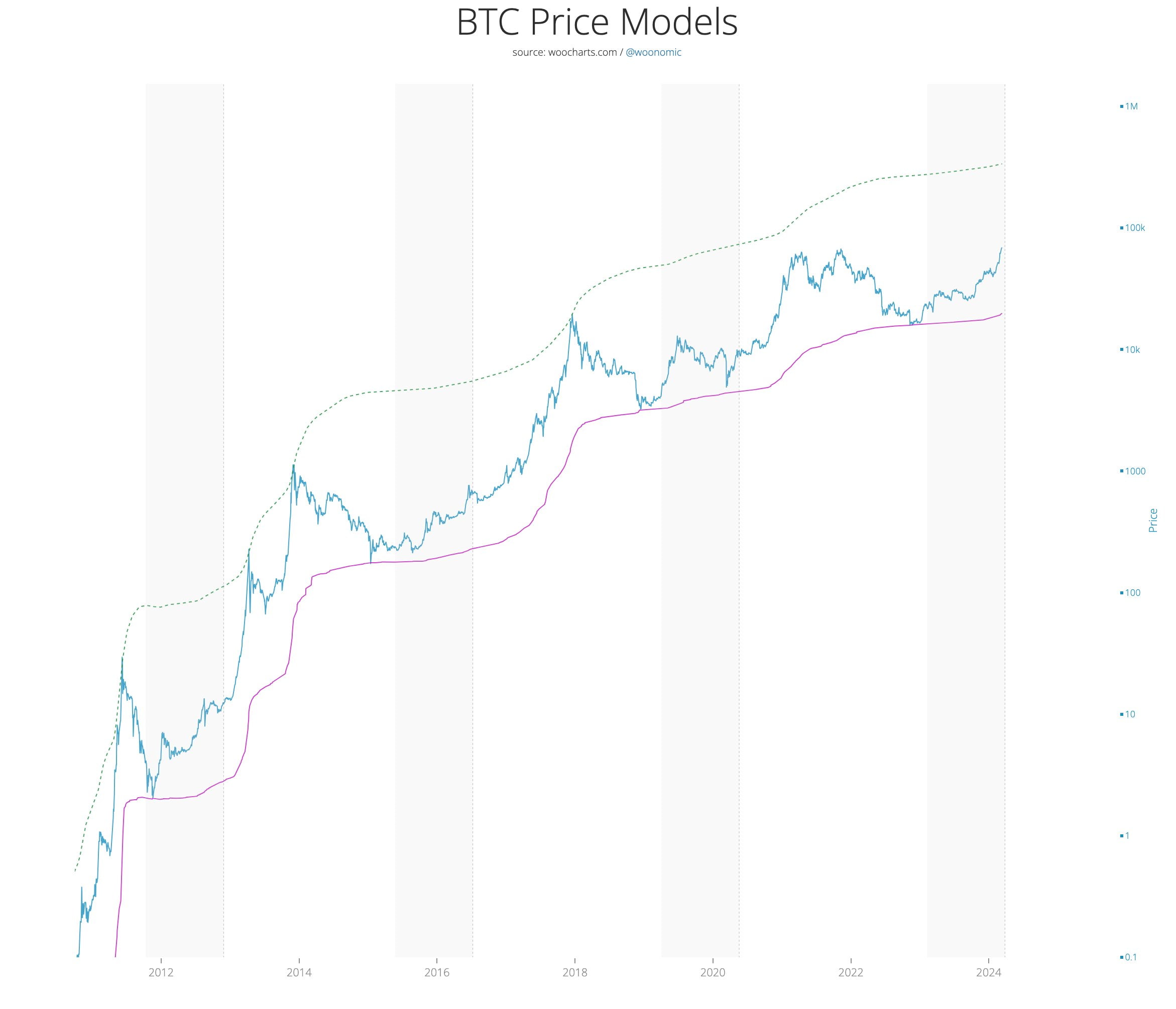

Willy Woo‘s Bitcoin forecast shared on the X platform points to a potential upper bound model that could see the largest cryptocurrency reaching unprecedented high levels. The analyst linked this bullish sentiment to significant capital inflow into the network and the emergence of a full-fledged bull market based on solid fundamentals.

Woo highlighted that the Bitcoin Macro Index (BMI), a combination of 17 macro signals, indicates a fully developed bull market and that a daily inflow of $1.8 billion to the network signifies strong investor confidence.

Despite the positive momentum, Woo cautioned investors to be careful during the rally, pointing out potential profit-taking opportunities measured by the Spent Output Profit Ratio (SOPR), which could indicate an upcoming consolidation period.

The recent price increase in Bitcoin has injected renewed optimism into the market with expectations that the upcoming fourth block reward halving, historically associated with significant price rallies, will trigger a surge. Institutional interest, evidenced by strong entries into spot Bitcoin ETFs in the US, demonstrates confidence in Bitcoin’s long-term potential. Additionally, the announcement by the London Stock Exchange (LSE) that it will accept Bitcoin and Ethereum ETN requests further boosted investor confidence.

Current Bitcoin Status

According to recent data, Bitcoin has seen a 4.53% increase in the last 24 hours, trading at $72,530. The data shows a significant 90.40% increase in daily trading volume, reaching $65 billion.

Moreover, in the last 24 hours, Bitcoin’s Open Interest (OI) has risen by 4.10%, reaching 491.65 thousand BTC or $35.36 billion. The OI on the CME exchange has increased by 2.41% to $10.63 billion, while the OI on the Binance exchange has risen by 5.08% to $8.07 billion.

Türkçe

Türkçe Español

Español