Bitcoin (BTC) saw its new peak today, and the appetite for risk in altcoins continues to be strong. In the coming days, this positivity is likely to trigger larger movements. There are also different signals increasing optimism specifically for SOL Coin. So, what is the latest situation on the Solana front?

Solana (SOL) Analysis

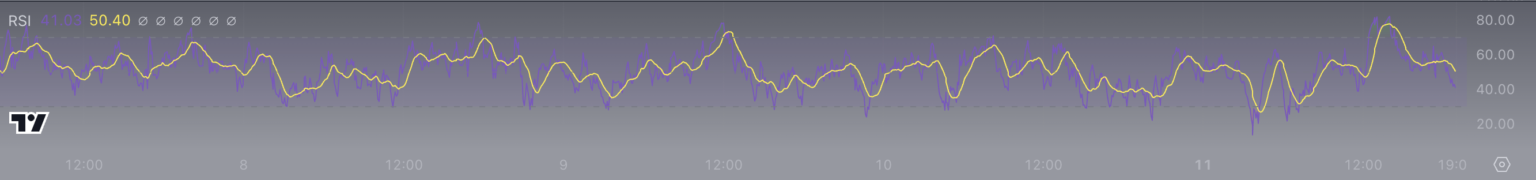

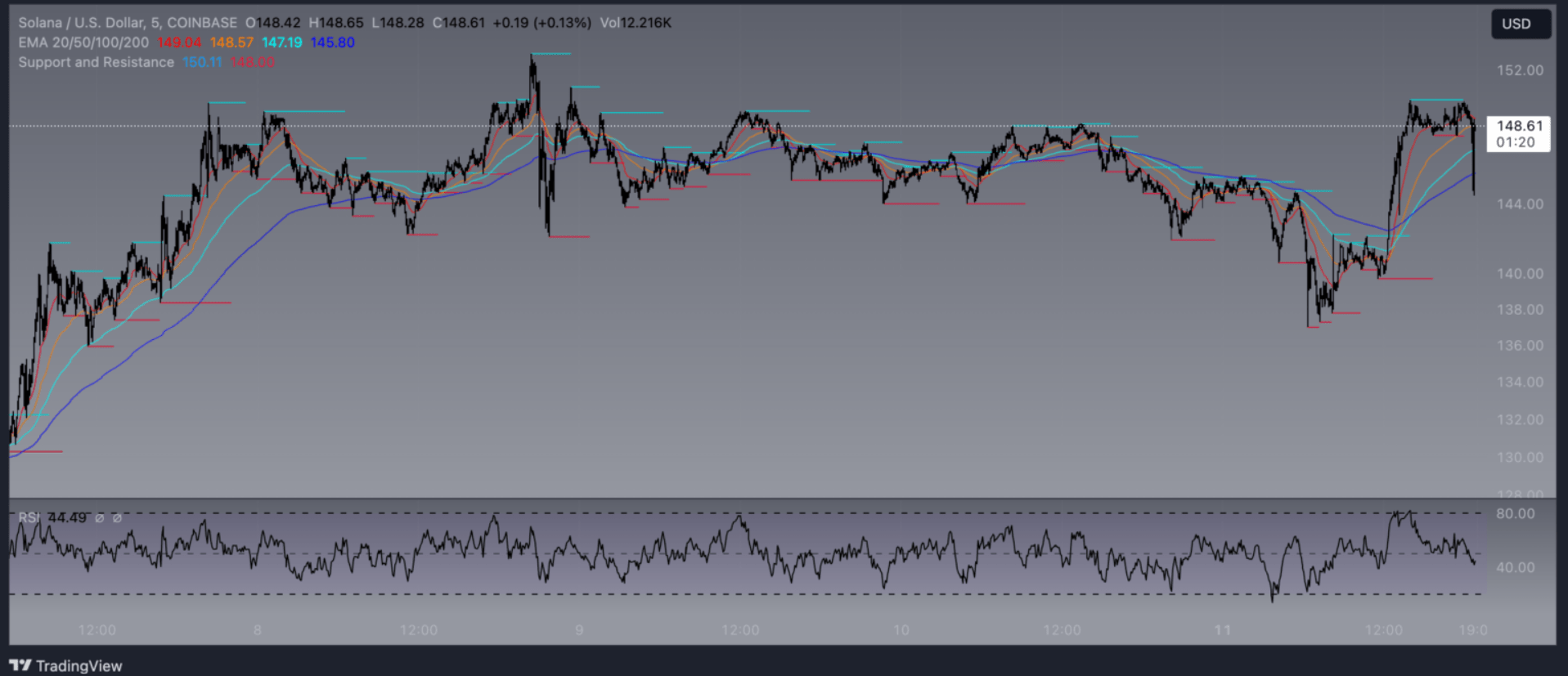

Before BTC‘s rapid rise, SOL Coin had doubled its price and is now indicating selling pressure with its neutral RSI. On the other hand, RSI not being in the overbought zone allows room for a possible accelerated rally. The current view suggests we are on the eve of a significant movement that could start in either direction.

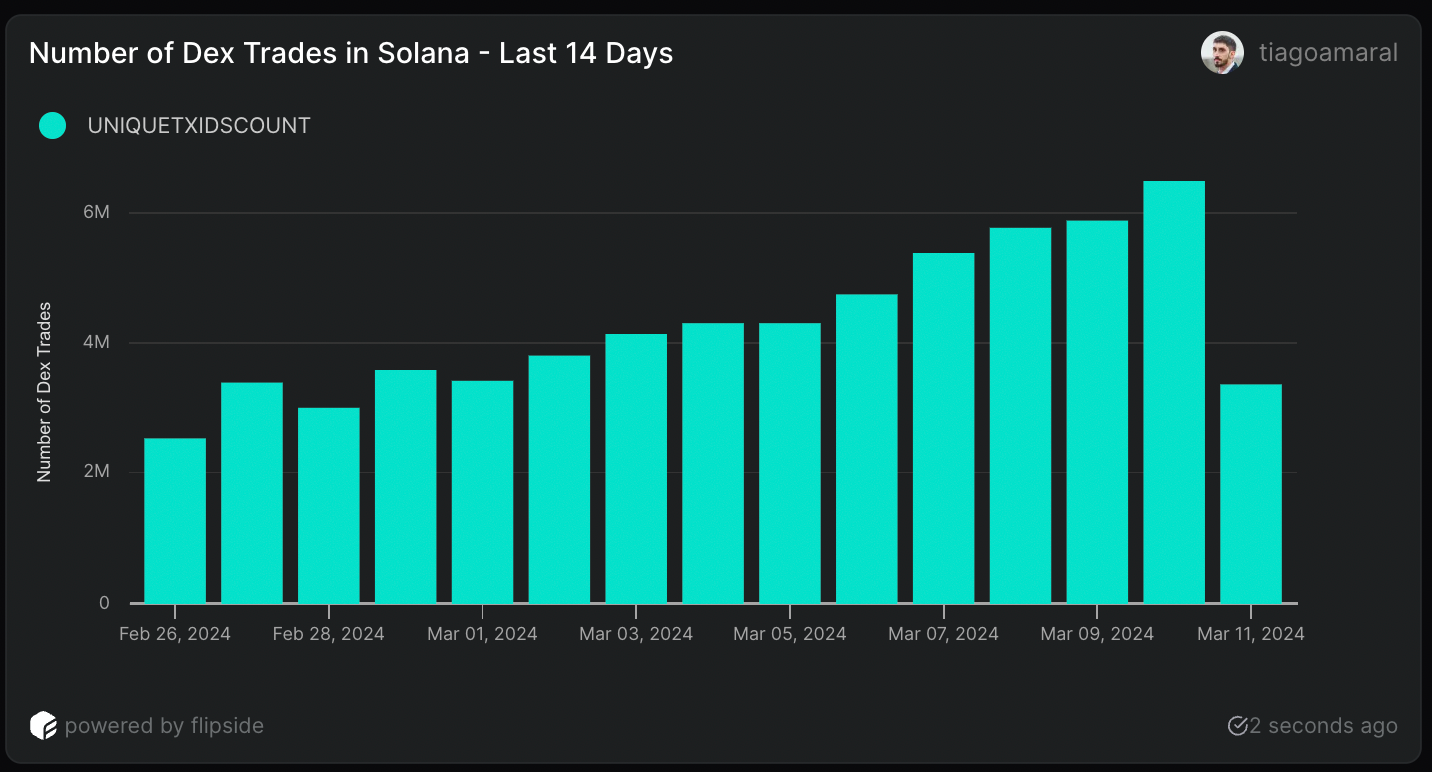

Activity on the network has significantly increased. Yesterday’s DEX transaction count exceeded 6.5 million, marking an all-time high. Since February 26, the total number of transactions on decentralized exchanges in the Solana ecosystem has remained above 2 million.

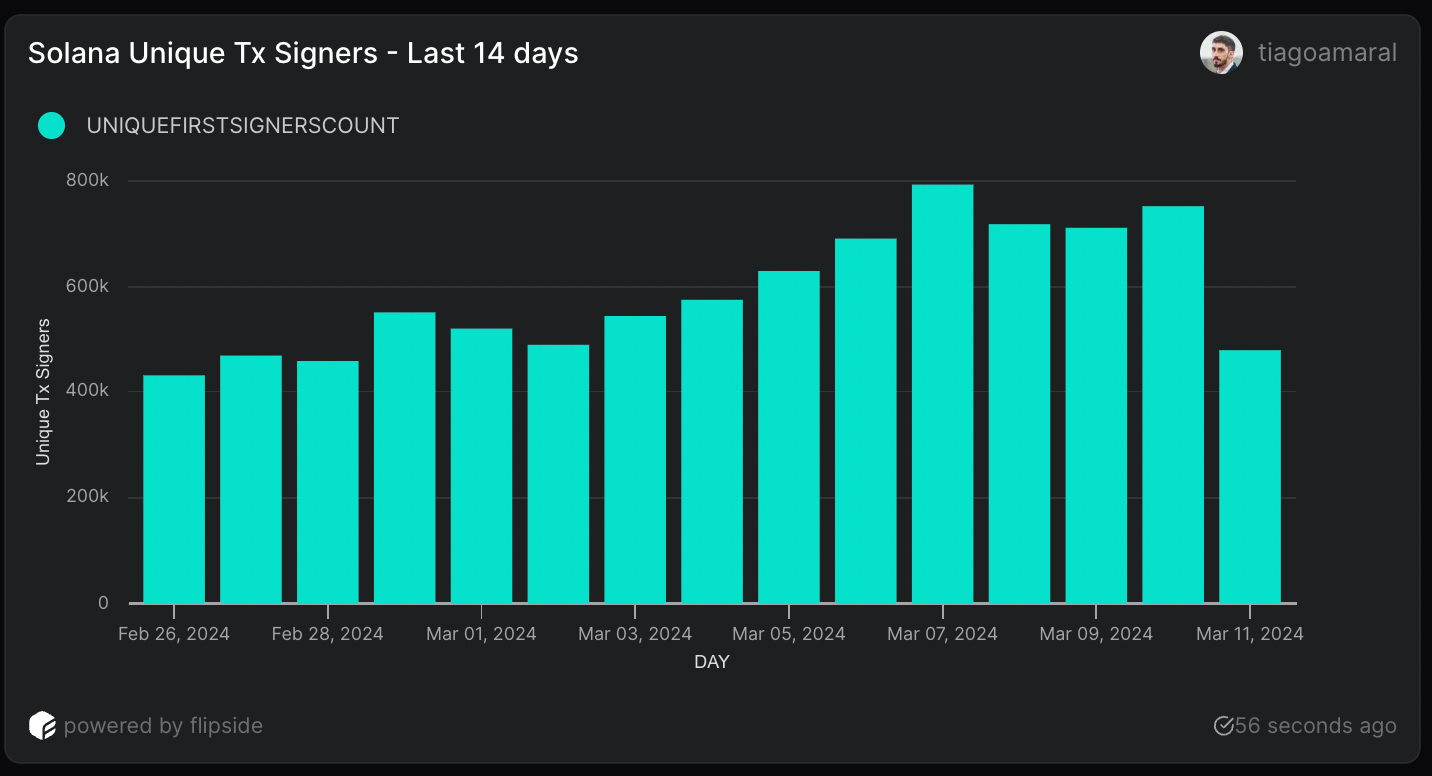

The strength of the Solana ecosystem is becoming more significant as the number of daily active users recently surpassed 800,000. If this pace continues, it is likely that the number of unique users on the Solana network will reach the 1 million threshold within 15 days.

SOL Coin Price Prediction

BTC is eyeing a target of $76,000 while the price of SOL Coin continues to hover around $150. The resistance level at $148-150 is historically significant and remains a major line of defense for sellers today. At the time of writing, the price of SOL Coin was $147.38.

If the price of SOL Coin can close above $150, we may see it targeting the major psychological barrier on the way to its ATH, which is $200. On the other hand, a deviation below $144 could lead SOL Coin to retreat to the $140, $138 areas. EMA indicators suggest the uptrend may continue.

In the short term, the fundamental thing all cryptocurrencies will follow is this week’s upcoming final inflation data and BTC’s momentum. At some point, BTC may quickly start its pre-halving correction, which has the potential to trigger an exodus in altcoins.

Türkçe

Türkçe Español

Español