XRP’s price has increased by approximately 11.50% in the last 24 hours, reaching $0.68. XRP had been trading at its highest level since November 2023, at $0.74. We are examining the key factors contributing to the XRP price rally on March 12th. Today’s price increase in XRP emerged following significant capital transfers from cryptocurrency exchanges.

Why Is XRP Rising?

Data analytics platform Whale Alert shared on March 8th that an anonymous investor withdrew 300 million XRP, valued at over $187.13 million, from Binance. Subsequent similar transactions worth $19 million occurred, indicating that XRP’s wealthiest investors prefer to hold onto their tokens rather than exchange them for other assets on exchanges.

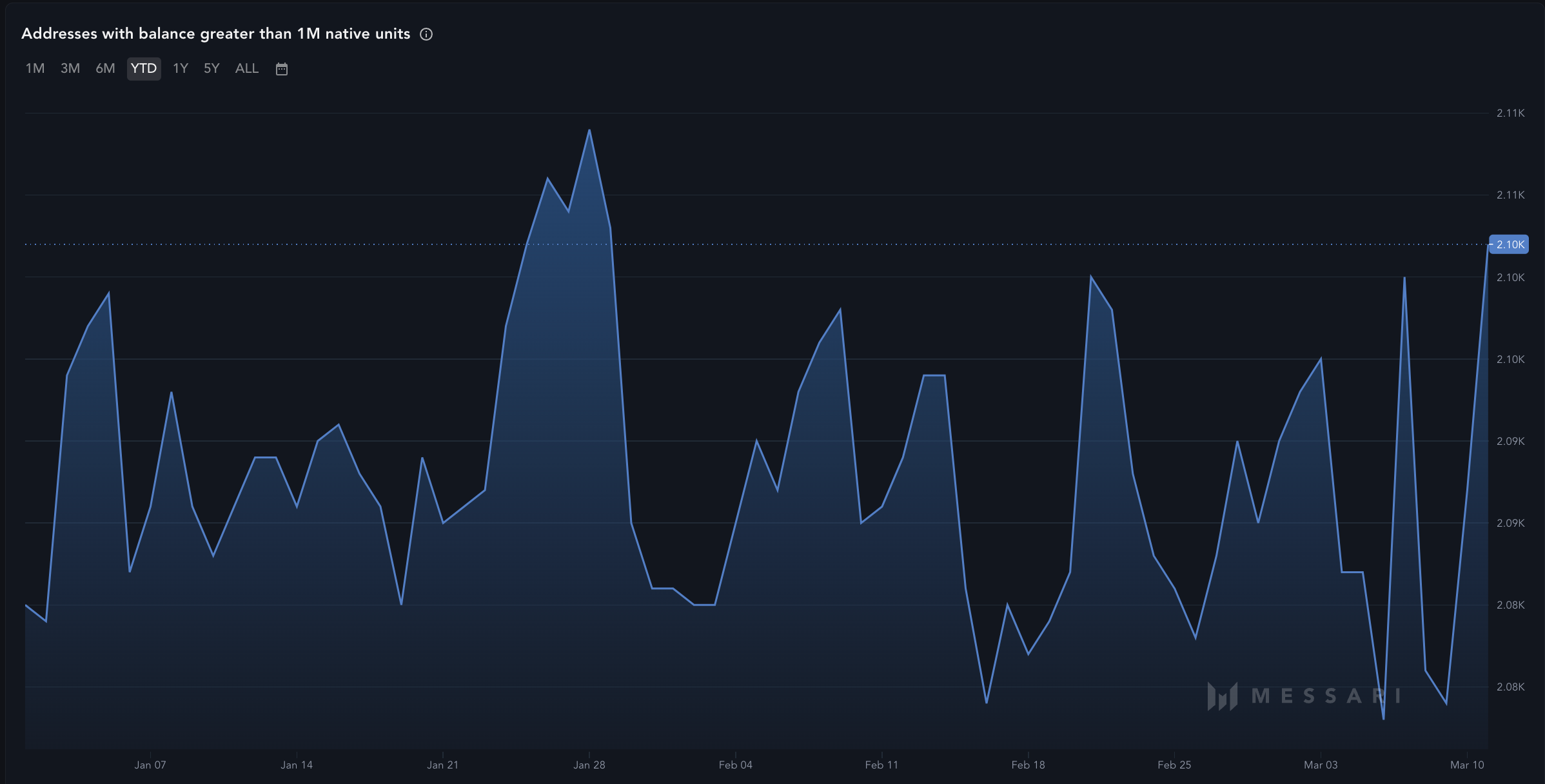

This trend is also visible in the whale data from blockchain analytics platform Messari. During the ongoing price rally, the number of addresses holding more than 1 million XRP has increased. This data indicates that large crypto investors are behind the current XRP price surges, which typically bodes well for further increases.

XRP Chart Analysis

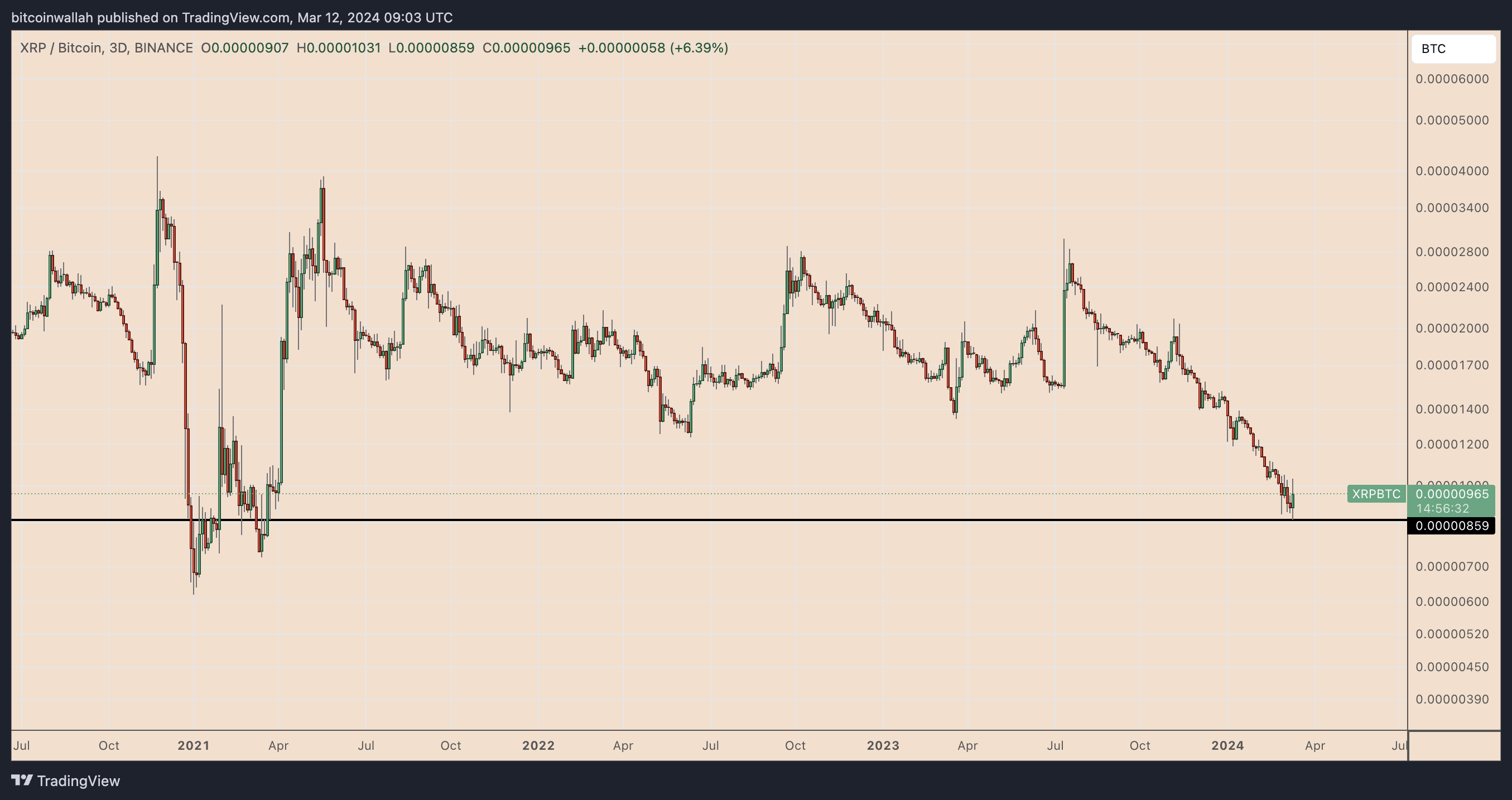

XRP’s price increase is also evident in a sharp recovery against Bitcoin. Notably, the XRP/BTC pair showed an increase of over 12% one day after dropping to its lowest level since March 2021, at 0.00000859 BTC. This recovery indicates that some risk-taking investors are shifting from Bitcoin to altcoins for potentially higher short-term profits.

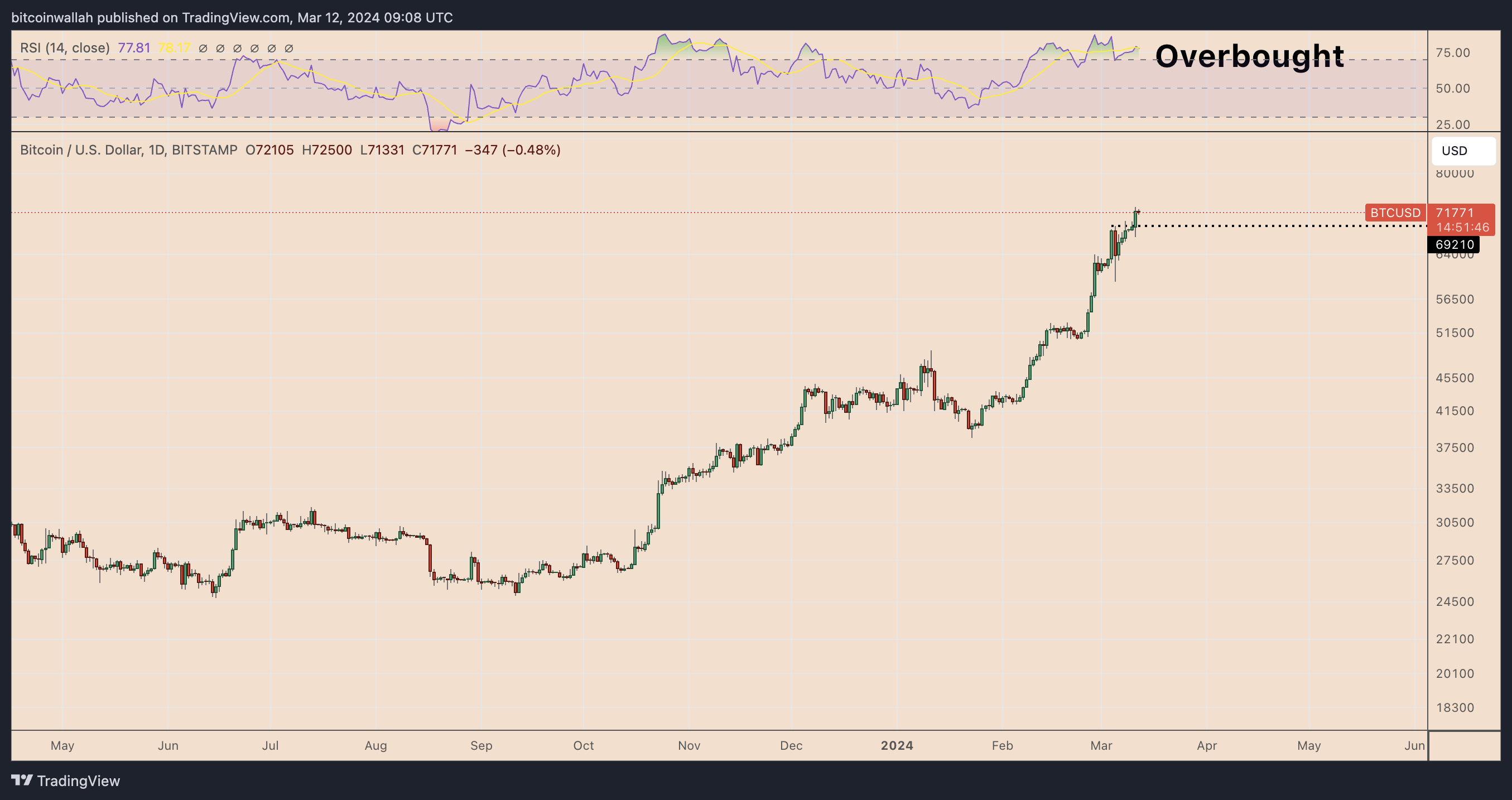

Investors are also rotating capital to reduce risks in overbought assets. Despite Bitcoin’s 72.5% rise so far in 2024, it continues to be in the overbought level on the daily time frame chart.

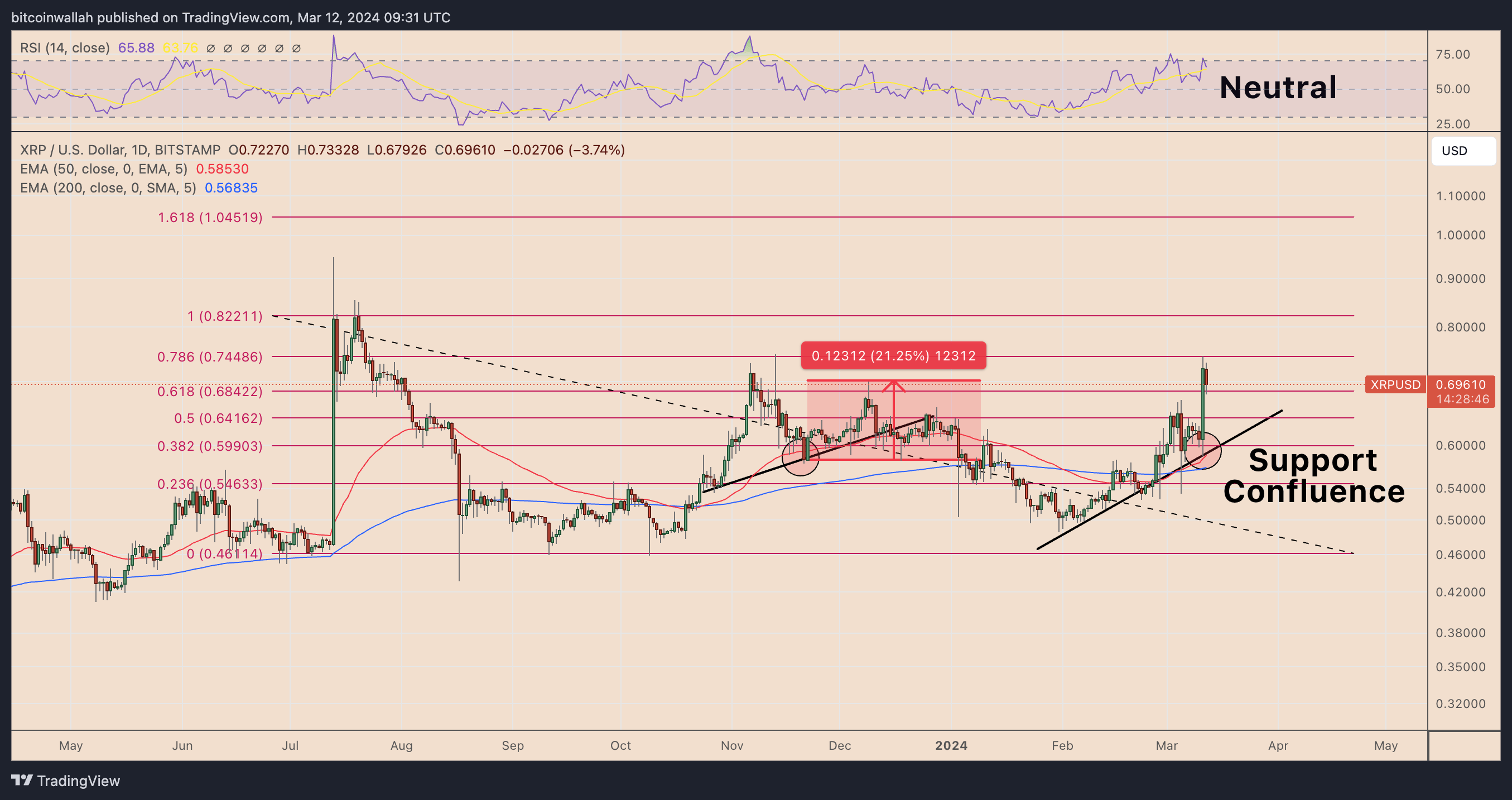

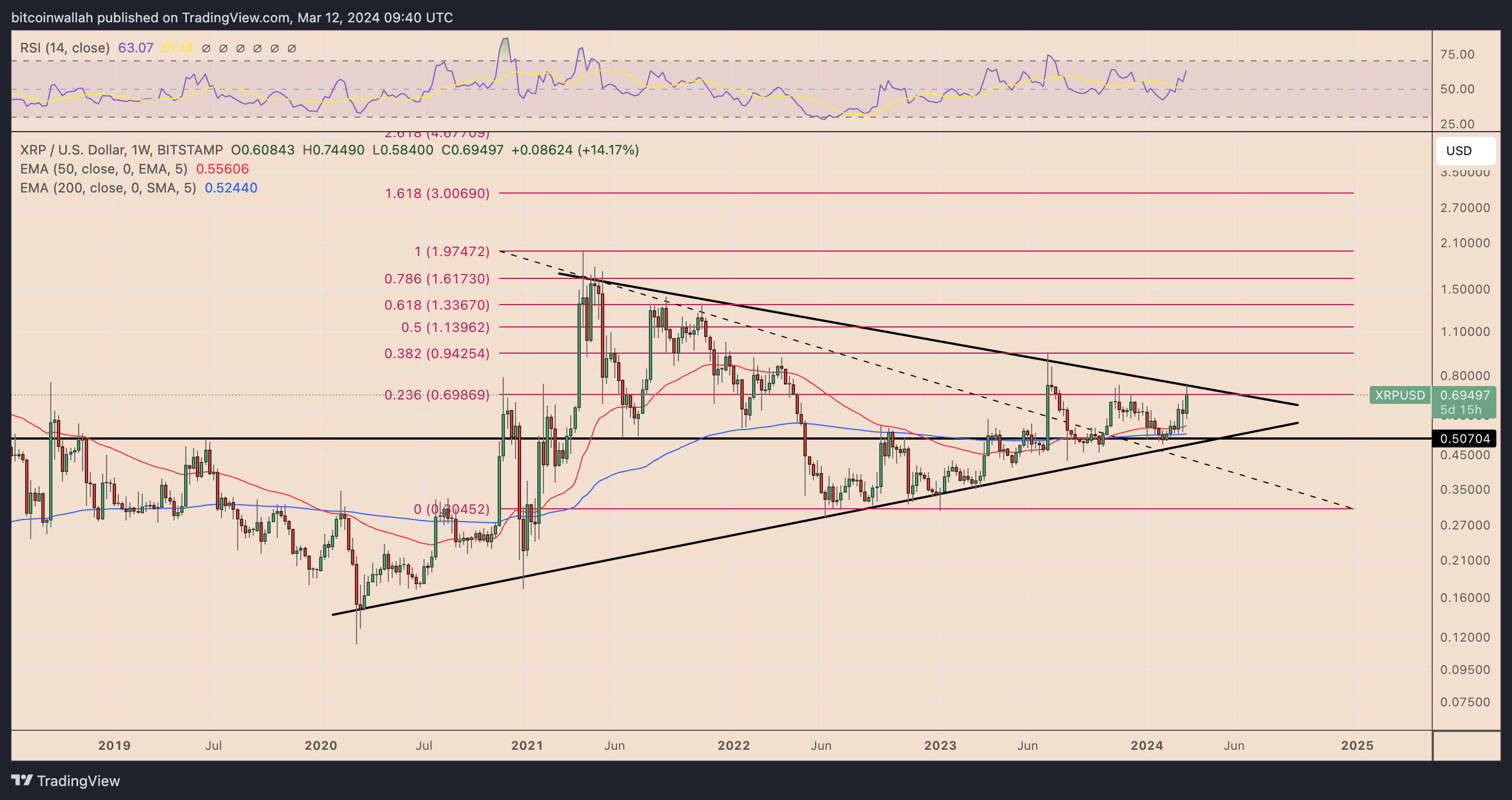

In contrast, XRP’s daily Relative Strength Index (RSI) remains in the neutral range of 30 to 70, indicating balanced sentiment among investors. This suggests that XRP technically has more room to rise against the rally leader Bitcoin.

From a technical analysis perspective, XRP’s price increase is emerging from a support confluence area. This confluence includes XRP’s rising trend line, the 50-day exponential moving average (blue wave) at $0.58, and the 0.382 Fibonacci retracement line near $0.59. These support levels resemble a fractal prior to a 21.25% price rally in November 2023.

Therefore, the XRP price is looking for a close above the multi-year descending trend line resistance to continue its ascent towards the popular target of $1. Conversely, a routine pullback from resistance could lead to a 20% decline towards the rising trend line support near $0.50.

Türkçe

Türkçe Español

Español