Two Binance executives are reportedly being held by Nigerian officials who blame the exchange for causing devaluation in the country’s currency, the naira. A Bloomberg ETF analyst revisited the likelihood of Ethereum ETF approval by May, citing the SEC’s silence towards potential issuers. Meanwhile, Bitcoin miner Bitfarms exercised an option to purchase an additional 51,908 ASIC miners about five weeks after the next halving event. Here are three significant developments that have marked the last 24 hours.

Tension Between Binance and Nigeria

Despite announcing its exit from Nigeria last week, two senior executives from Binance are still reportedly being detained in the country’s capital, Abuja. According to a March 12 report by Wired, Tigran Gambaryan, a former U.S. federal agent focusing on cryptocurrencies, and another Binance executive, Nadeem Anjarwalla, have been held in Abuja without passports for two weeks.

A Binance representative emphasized that both executives are professional employees and the exchange is confident that a swift resolution will be found for this issue. Initial reports of Gambaryan and Anjarwalla’s arrests emerged at the end of February, with the Financial Times reporting on the detentions on February 28 without revealing identities.

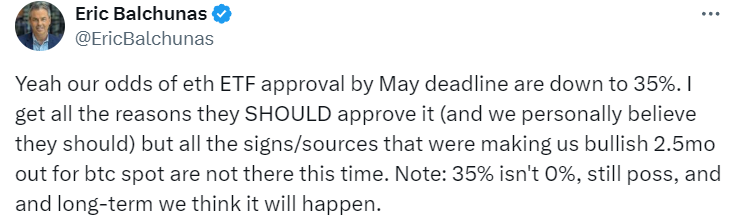

The Ethereum ETF Process

The lack of communication from the Securities and Exchange Commission regarding Ethereum exchange-traded funds could be a bad sign for those hoping for Ethereum ETF approvals by May. Bloomberg ETF analyst Eric Balchunas discussed several reasons why he reduced the chances of Ethereum ETF approval to only 35%.

Balchunas suggested that SEC Chairman Gary Gensler’s stance on Ethereum might play a role, arguing that Gensler still views Ethereum as a security and may not want to endure another round of political backlash after the approval of spot Bitcoin ETF funds and the SEC’s court loss to Grayscale in August 2023:

“I also think he feels like he’s thrown the industry a bone. He took a beating with the court loss and from his point of view it’s like: Well, you should be satisfied now. At the end of the day, Gensler thinks Ethereum is a security. He wouldn’t want to approve it if he didn’t think it was a commodity like Bitcoin. All these little things are coming together.”

Bitfarms Makes Notable Move

Bitcoin miner Bitfarms has purchased an additional 51,908 ASIC miners to increase its mining capacity ahead of the expected halving event next month. The purchase includes 28,000 Bitmain T21 ASIC miners, 19,280 Bitmain T21 miners, 3,888 Bitmain S21 miners, and 740 Bitmain S21 hydro miners.

Each Bitmain T21 ASIC miner costs about $3,000 on the retail market and has a hash rate of 190 TH/s. Geoff Morphy, CEO of Bitfarms, stated that the purchase was made ahead of expected hardware price increases as the industry transitions into Bitcoin’s four-year halving event.