Last week, Fetch.ai emerged as one of the best-performing assets with a price surge reaching an all-time high. However, with gains came profits, and some FET investor groups did not hesitate to sell their assets to lock in those profits. Will this step trigger a price drop?

What’s Happening on the FET Front?

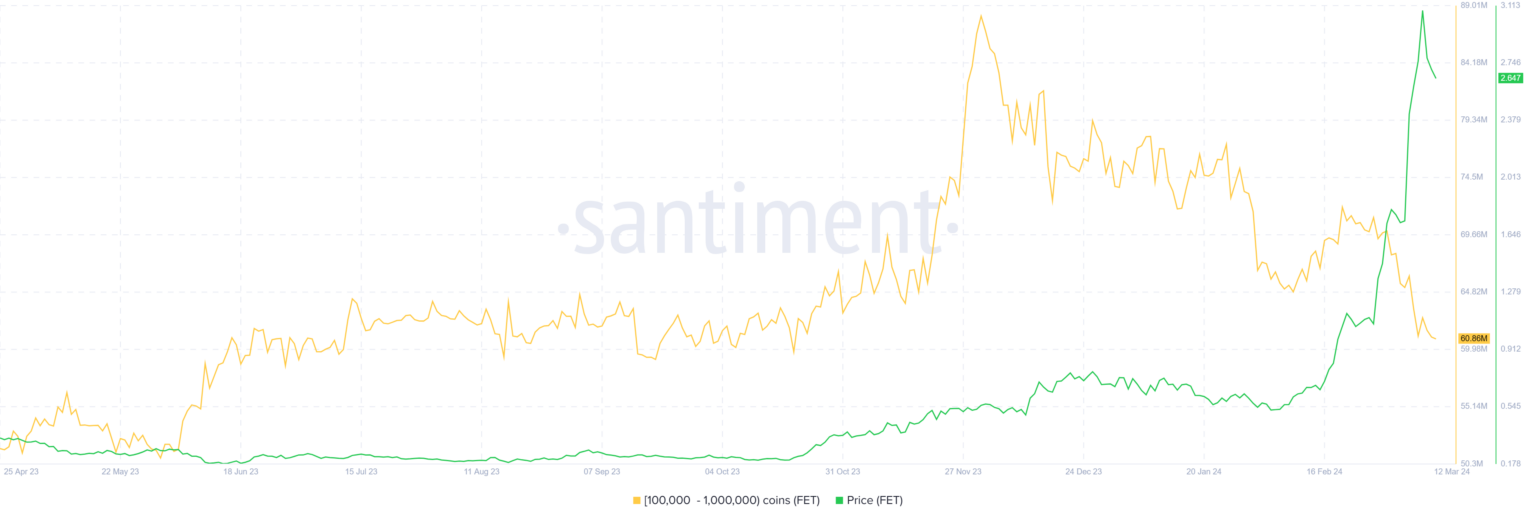

Within a week, FET investors, especially whale holders, preferred to offload their assets as prices rose. Addresses holding between 100,000 and 1 million FET tokens sold more than 9 million FET worth $24.3 million. When the Altcoin reached its all-time high of $3.07, sales became more pronounced, and the supply from large wallets dropped to 60.8 million FET. Naturally, this led to a disruption in the supply and demand balance, triggering a price drop.

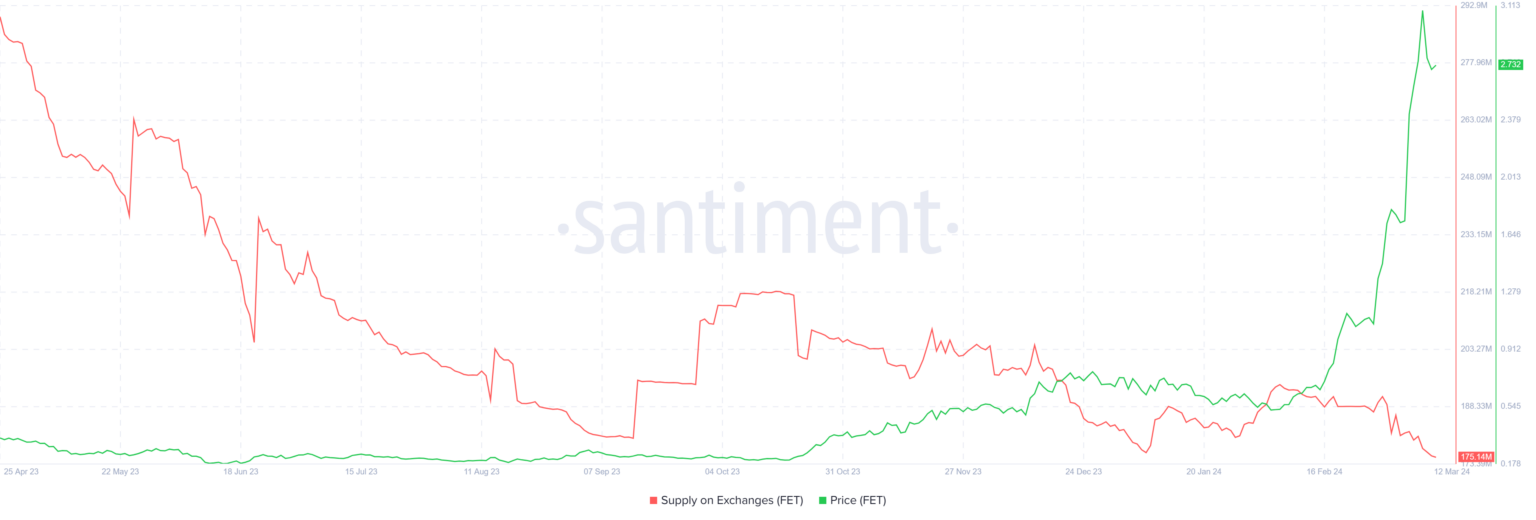

However, individual investors seem to be countering this despite having significantly less control over the circulating supply. A decrease in the total exchange supply indicates that investors are accumulating FET. Since the beginning of March, approximately 11 million FET worth $29.7 million has been withdrawn from these exchanges’ wallets. This suggests that optimism persists, but it is likely to diminish as profit-driven purchases intensify.

FET Chart Analysis

Considering the heavy whale selling and price action, further decline seems like a more probable outcome. At the time of writing, the Fetch.ai price was trading at $2.63, approaching the support line of $2.46. The Relative Strength Index (RSI) is currently in a bearish trend below the neutral 50.0 line.

The indicator’s presence in the bearish zone indicates a waning bullish trend, and staying in this area for an extended period would be negative for price movement. This could mean that the FET price might fall from the $2.46 support line, which intersects with the 100-day Exponential Moving Average, potentially dropping to $2.00.

However, if the altcoin finds some support from individual investors, it could rise from the $2.46 support level. This would allow the Fetch.ai price to consolidate above this mark until it regains upward momentum to attempt breaching the $3.07 resistance level again, invalidating the bearish thesis.

Türkçe

Türkçe Español

Español