Bitcoin price volatility has now initiated a selling trend, with significant sell-offs by profitable investors yet to start. The current environment could trigger major losses for altcoins, keeping cryptocurrency investors on high alert. So, what does the current outlook for Ethereum and Ethereum Classic tell us?

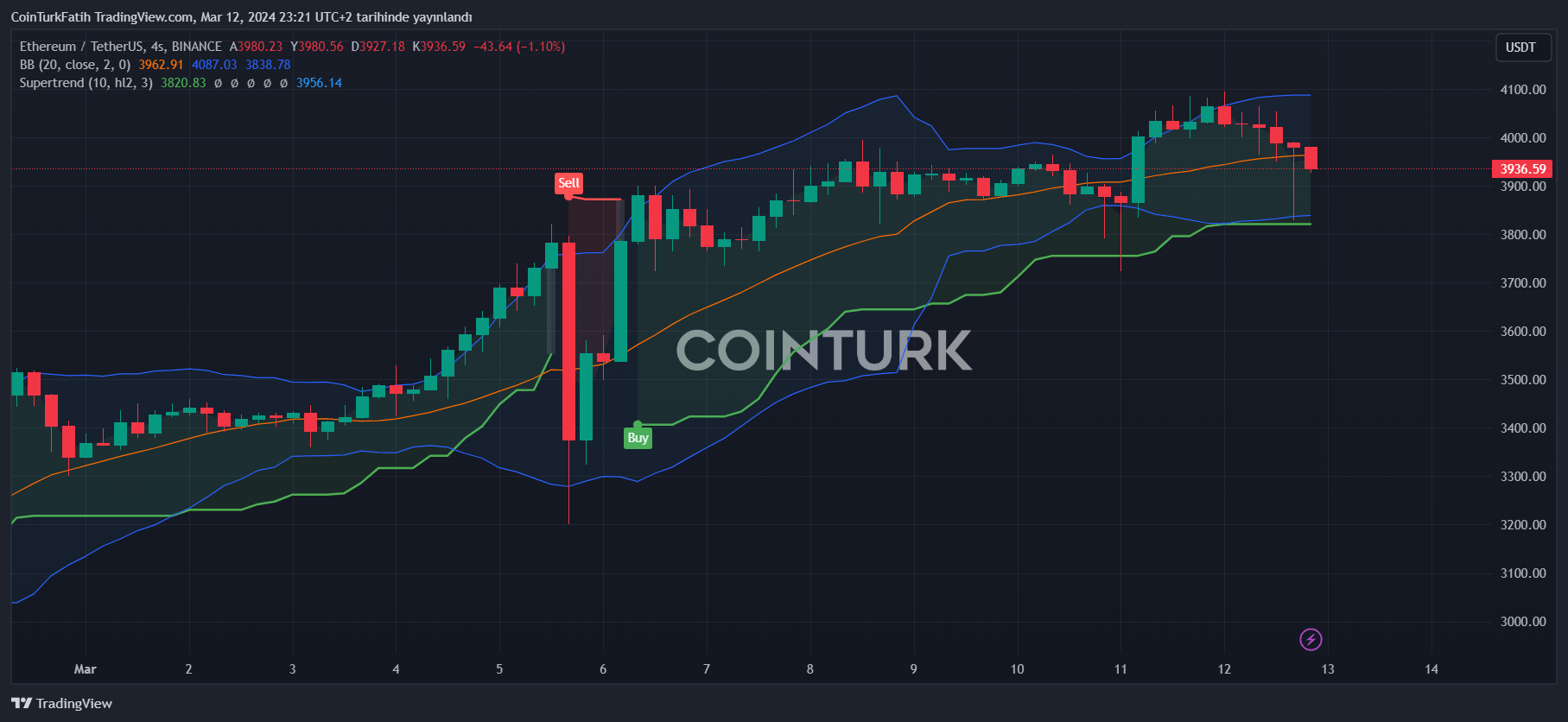

Ethereum (ETH)

In about 15 hours, Ethereum’s network will undergo one of its most significant updates. Although not as technically challenging as the PoS transition, this update is equally important in terms of its potential price impact. The Merge, which facilitated the transition to PoS, introduced negative inflation. The upcoming Dencun update has the potential to reduce transaction fees and significantly increase network activity.

Bitcoin‘s price has fallen below $70,000 and is hovering around $70,700 at the time of writing, which is not an ideal timing. If the BTC price were above $72,000 when the Dencun update occurs, we could see an increase in ETH price within a few days. This would also be supportive for the tokens of Ethereum layer2 solutions.

In the short term, the $3,830 region is being defended by ETH bulls. However, the loss of the $4,000 level could damage this motivation. If BTC continues to close above the $71,500 to $72,000 range, we could see a new test at $4,090. Closures above this level would indicate a confident stride towards an all-time high.

If the Ether price loses the $3,830 region, there is potential for a drop to $3,500.

Who Owns Ethereum

Ethereum is a decentralized network, and while development activities are open-source, they are supported by the Ethereum Foundation. Among its co-founders, the popular Vitalik Buterin is not the owner of Ethereum.

In summary, as Ethereum has passed significant milestones on the path to decentralization, it is a network without an owner. It has no central switch, and as long as you run your own stake nodes, the network will continue to operate.

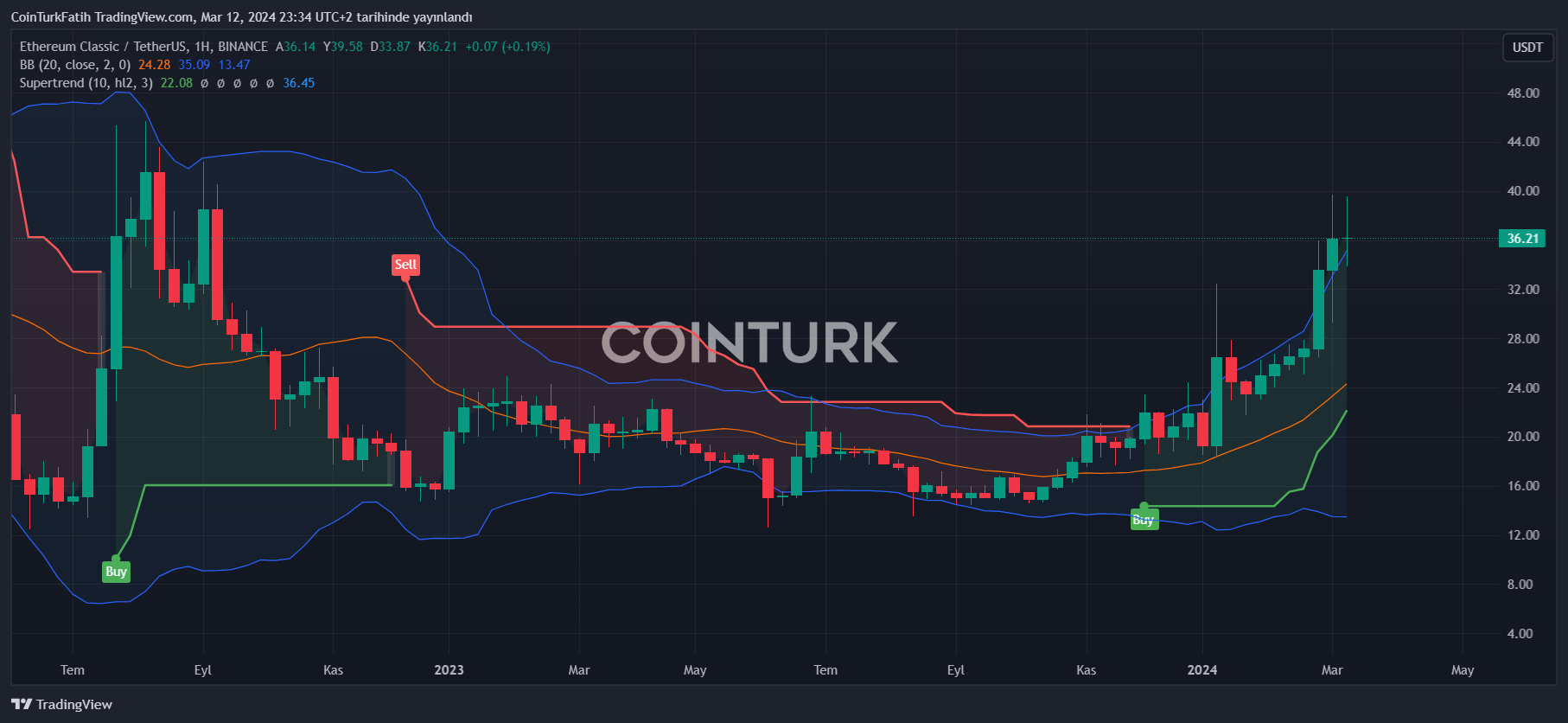

Ethereum Classic Commentary

At the time of writing, the ETC price is at $36.2. Long upper wicks indicate sell-offs triggered by BTC price movements. If BTC continues to fall, ETC could retreat to the $26 support area. In case of extreme sell-offs, the bottom support is at $18.5.

Türkçe

Türkçe Español

Español