Bitcoin prices fluctuate, but a few altcoins continue the day with double-digit gains. One of them is the Telegram-backed TON Coin, which has seen an increase of around 37% daily. Investors in altcoins are making profit sales in anticipation of a possible deep BTC price correction. So what are the latest developments and possible scenarios on the TON Coin front?

Why Is TON Coin Rising?

Telegram-backed TON Coin was finding buyers at $4 at the time of writing. In 2021, it surpassed the $5.8 price, approaching the all-time high (ATH) level again. It’s not just the price that’s increasing; the daily trading volume also hit an all-time high of $314 million. This surpasses last week’s record trading volume of $295 million.

Especially since there is a significant and consistent trend between TON price movements and trading volume, optimism about the future of the price is growing. There hasn’t been a major development in the altcoin that could trigger a price increase, just routine activities and announcements.

For example, the latest announcement talks about the possibility of distributing 50% of the revenue to Telegram channel owners.

“Telegram will distribute rewards using Toncoin on the TON Blockchain. Channel owners will start receiving 50% of all revenue generated from advertising on the company’s channels.”

However, days when liquidity moves around altcoins and some of them rapidly increase in value are standard in bull markets. This seems to resemble such a rise.

TON Coin Price Prediction

At the time of writing, 95% of TON Coin investors are in profit. If the price does not experience significant profit-taking in the short term, this indicates that these investors are targeting new peaks. We had seen the last example of this in FLOKI Token, which lingered at the 95% profitability level and then doubled its price.

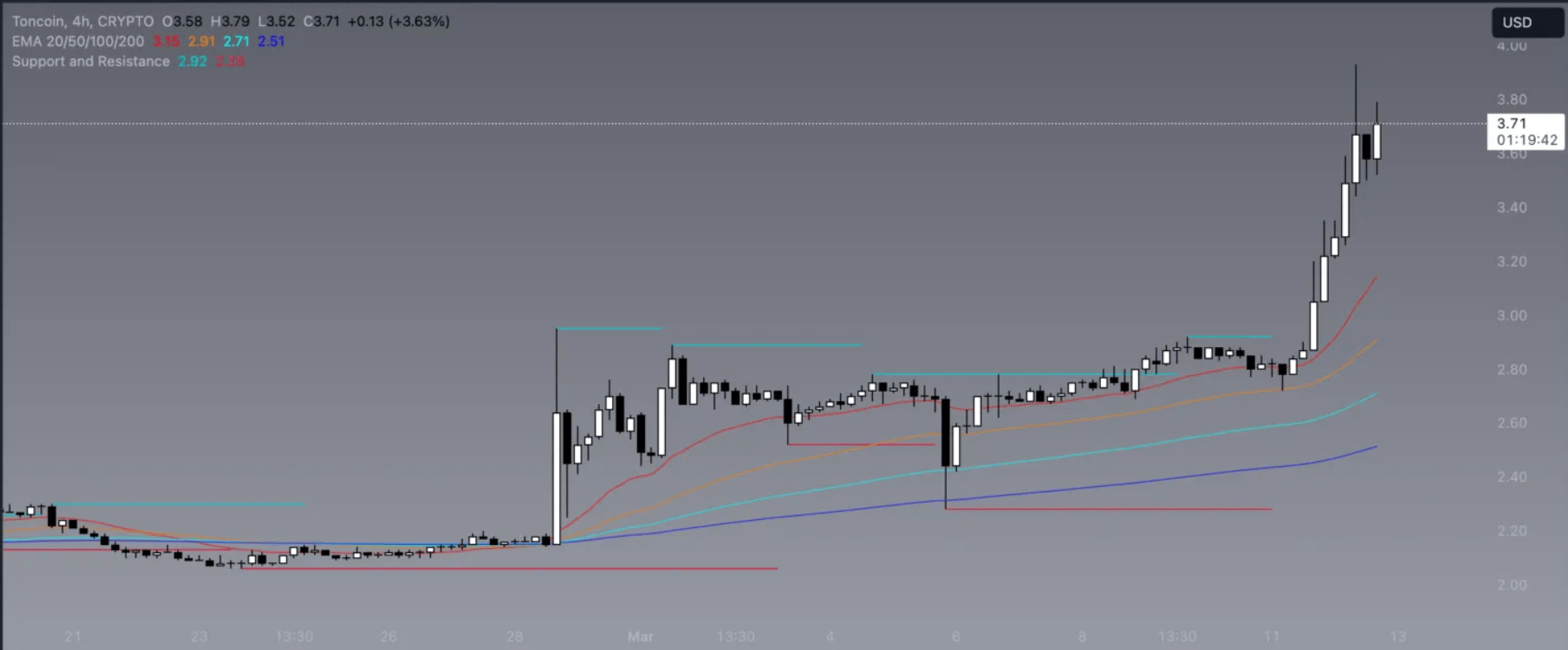

Nevertheless, acknowledging the potential for selling pressure would be prudent. A 37% price increase calls for caution. The four-hour chart indicates a short-term bullish trend in price movement.

TON Coin has historically found support in the $2.6 and $2.38 regions. A potential sell-off could see a dip to these levels. However, if the momentum continues, closures above $4 like now could initiate a new move towards $5.8.

Bitcoin‘s price is at $71,400 with 15 minutes to the daily close, and the market has the potential to make a significant move in either direction as Asian markets open in a few hours.

Türkçe

Türkçe Español

Español