Popular crypto currency analyst Ali Martinez believes that the price of Ethereum (ETH) could soon reach up to $5000. However, the altcoin must surpass the supply wall ranging from $4522 to $4646. Utilizing data from IntoTheBlock, Ali Martinez noted that 600,000 addresses have purchased 1.63 million ETH within the specified region.

Current Data on ETH

Therefore, some buyers may try to reach their breakeven point, which has now become a resistance for the cryptocurrency. Experts suggest that this could slow down Ethereum‘s upward momentum, although a rise to $5000 is anticipated. This could also result from an insufficient margin balance to cover the funding fee. According to HyblockCapital’s data, if ETH reaches $4205, significant liquidations could occur. However, a successful close above this price could lead to a further increase in value.

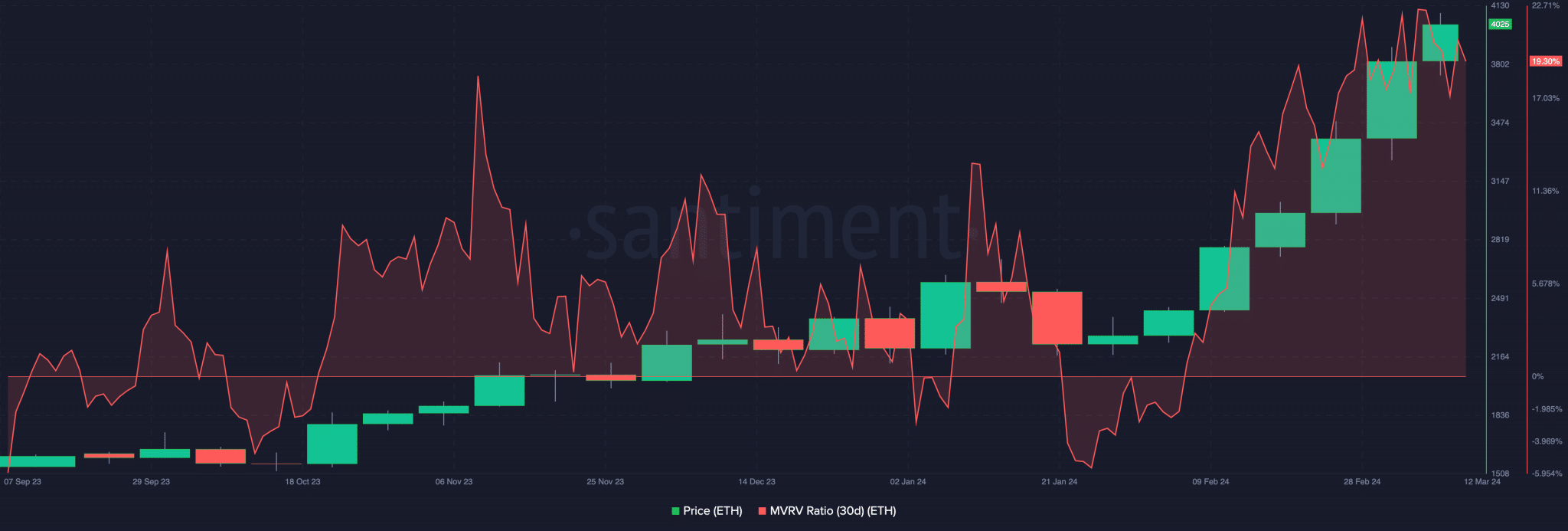

The chart shared by the expert indicates that the altcoin may not face significant resistance below $4310. Moreover, if ETH surpasses $4860, the rise to $5000 could be much easier. Another measure that could give experts a clue about the continuation of the altcoin’s rise is the funding rate. The funding rate is the difference between the price of a perpetual contract and the spot price of a cryptocurrency. According to Santiment’s data, Ethereum’s total funding rate was 0.068%. A positive funding rate implies that ETH is trading at a premium price above its index value.

Active Addresses on Ethereum

In addition to the rising ETH price, a high metric can indicate that short positions are aggressive. For this reason, the price movement of ETH could potentially signal an uptrend. At the time of writing, the number of active addresses on the Ethereum network was 537,000. This number was a significant increase from the count on March 10th. The increase in active addresses shows growing interest and confidence in ETH. While this could also mean that the network is becoming healthier, investors may see it as a bullish signal.

Türkçe

Türkçe Español

Español