Among altcoin projects that have achieved significant gains, Algorand has also made a good rise in the last few days. However, despite the notable increase, ALGO holders are still disappointed and this rise may face losses up to a certain point. Unlike Algorand, the trajectory follows one of two paths. The asset rises and falls, then there is a final increase, or the token first corrects but then finds a way to return to the peak.

What’s Happening on the Algorand Front?

ALGO reached its all-time high shortly after its initial launch in June 2019 and has been struggling to return to the peak since then. The altcoin, which is currently trading well below its ATH value of $3.27, is now at the $0.31 level.

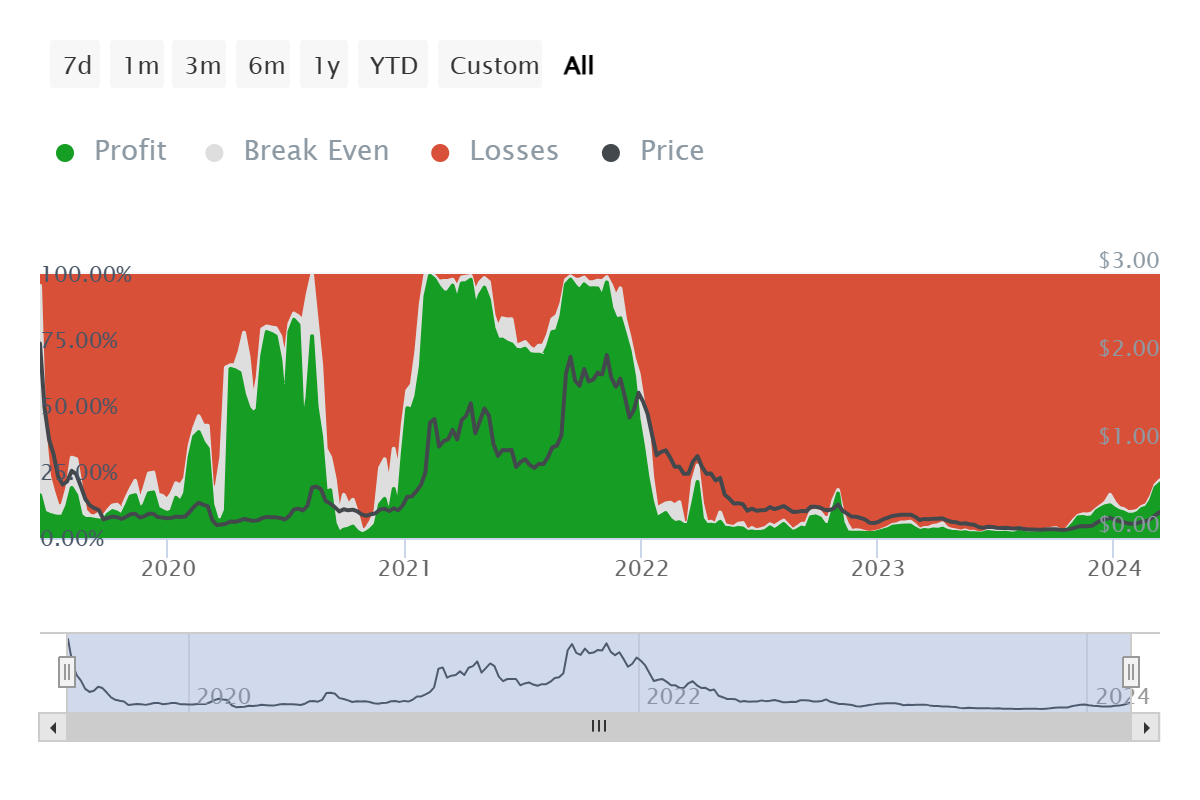

This means that the Algorand price needs to increase by at least 926% to reclaim its highest point and draw new peaks. The demand for the same is extremely high, but it does not seem likely that ALGO will achieve this in the near future. As a result, investors who bought their assets at around 20% of the ATH level will have to wait much longer to be able to separate their profits. These addresses are known as the all-time highs and currently make up 85% of all ALGO investors.

About 16.1 million out of 20 million ALGO holders are at a loss and are likely to continue this way. In fact, despite Algorand’s price being at a 16-month high, these statistics have not changed. At the time this article was written, the break-even metric showed very small changes over the past two weeks. This data calculates whether the addresses holding ALGO assets bought before or after the current price to determine their total profit and loss.

Currently, only 20.6% of all ALGO investors are in profit, and this rate has risen to 18.5% in 12 days. This difference represents a 2.1% increase in total profit, which is a very small rate considering a 71% rally. Therefore, unless the Algorand price manages to rise above $1 again, the chance for these investors to make a profit is almost non-existent.

ALGO Chart Analysis

Algorand’s price has risen, but as mentioned, most investors remain at a loss. However, this is not the worst thing for this altcoin. A lack of profits means a lack of sales, which often reduces the downward trend that would arise due to profit-taking. This allows ALGO to rise further and continue its rally. Algorand’s price is already at the cusp of surpassing the resistance level of $0.32, and doing so will push the altcoin to challenge and tag $0.35.

However, the possibility of sales that will have some impact on the cryptocurrency cannot be completely ignored. ALGO could potentially fail to breach and may fall to $0.30. Losing this support would invalidate the bullish thesis and send the altcoin down to $0.28.

Türkçe

Türkçe Español

Español