The long-awaited Dencun Ethereum update finally launched on March 13, bringing with it the promise of increased cost efficiency for the network. According to CoinMarketCap data, following the update, Ethereum‘s price experienced a significant drop from $4,082 to $3,932. Data from TradingView indicates that Ethereum continued to decline on March 14, falling by 3% in the last 24 hours and trading at $3,848 at the time of publication.

Dencun Update and ETH

Ethereum has undergone various updates aimed at enhancing the efficiency of the Layer-1 blockchain network by increasing transaction speed, reducing transaction fees, or changing the contract mechanism. This is expected to increase the network’s value in the long term. Richard Meissner, co-founder of Safe, commented on the issue:

“Dencun will change the way Ethereum developers create smart contracts, leading to more secure and user-friendly applications.”

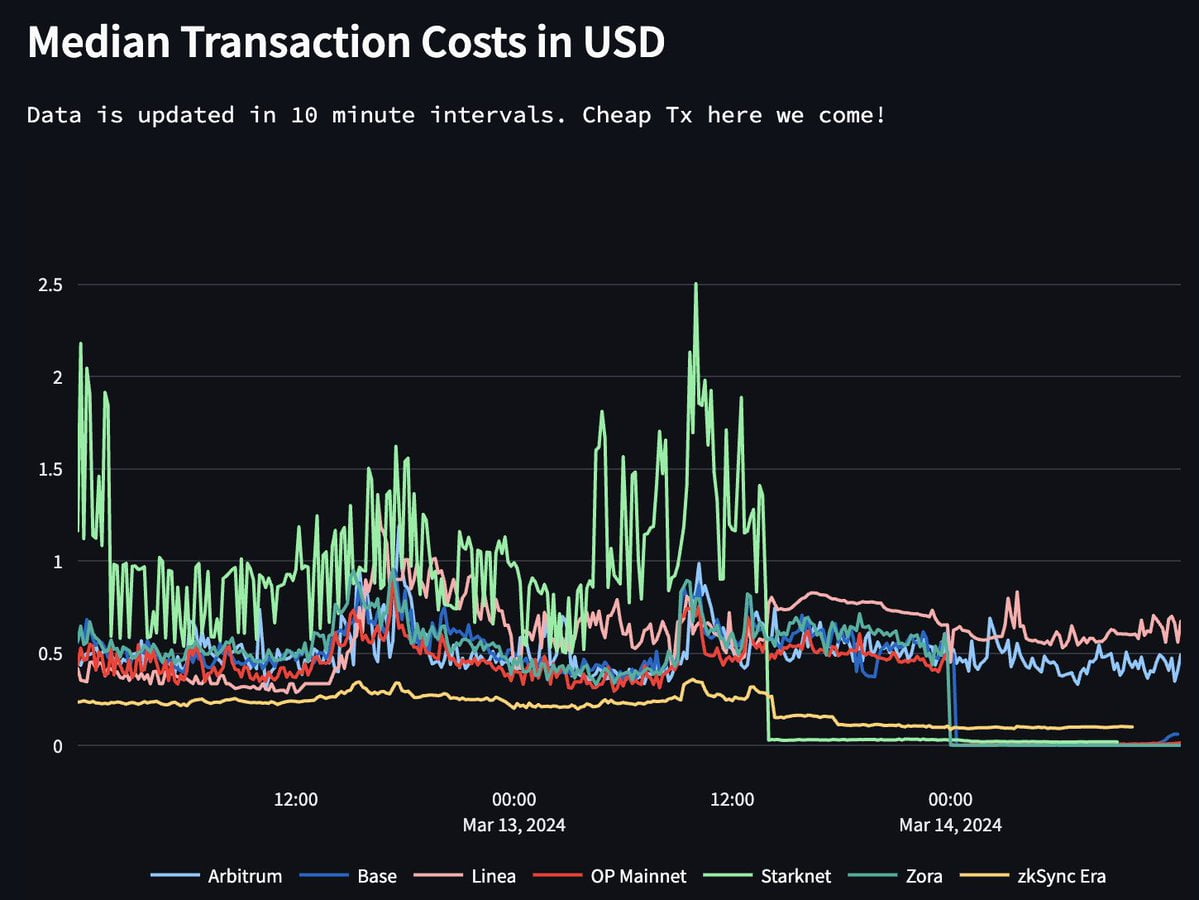

Independent investor VirtualBacon commented on the success of the Dencun update, stating that it aims for a 75% cut in transaction costs on Layer-2 networks, which will reshape the ecosystem’s capacity. Ethereum Layer-2 network Starknet acknowledged that they have achieved this goal in the Layer-2 scaling protocol:

“Starknet has the highest share of Layer-1 data availability costs among Validity Rollups, making it the biggest beneficiary of this update. As a result, we saw a significant drop in transaction fees by over 90%.”

The Impact of Update Processes on Price

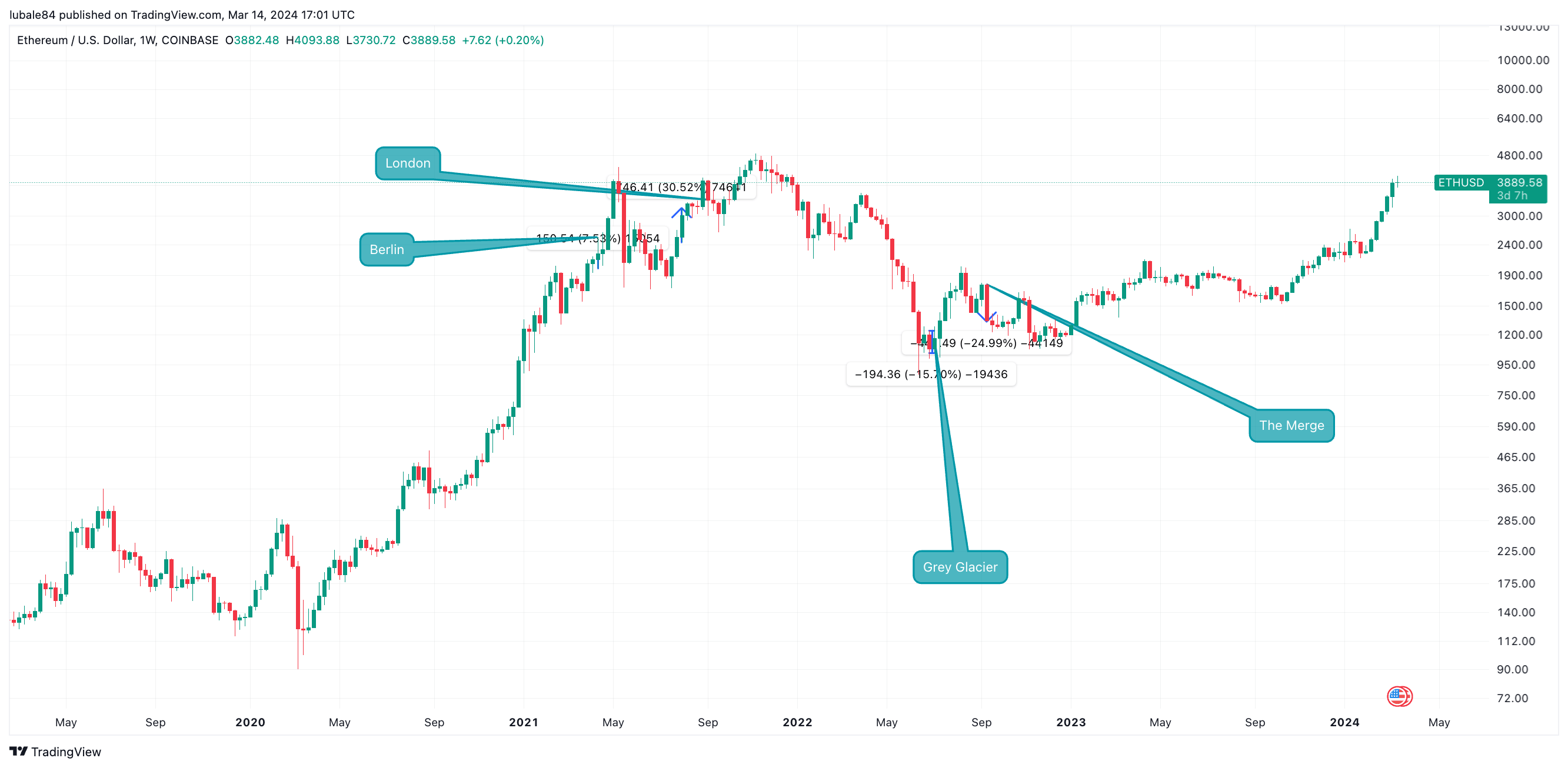

Historically, Ethereum updates have had minimal impact on price. The week before the April 2021 Berlin update, Ethereum rose by 7.5%. On April 14, 2021, Ethereum traded around $2,043, and the price increased by approximately 3.5% to $2,520 on the day of the update, April 15, 2021.

Before the London update in August 2021, Ethereum’s price was trading at $2,724 on August 4, and it rose by 3.4% to $2,821 when the update was released on August 5. Ethereum then saw a further 30% increase to $3,191 by the end of that week.

During the Grey Glacier update on June 30, 2022, the price fell by 3.8%, from $1,098 to $1,057. Throughout that week, Ethereum experienced a significant price drop from $1,275 to $1,043. The week before the Merge, a hard fork that transitioned Ethereum from a proof-of-work mechanism to a proof-of-stake algorithm, Ethereum rose by 20%. On the day of the Merge, September 15, 2022, Ethereum sharply declined from $1,635 to close at $1,472.

The price continued to fall steadily throughout the week, closing at $1,325, representing a weekly drop of 25%. This week, with the implementation of Dencun, Ethereum is trending downward, and if more selling pressure is added, such as waning hope for spot Ethereum ETF applications, the price could fall further.