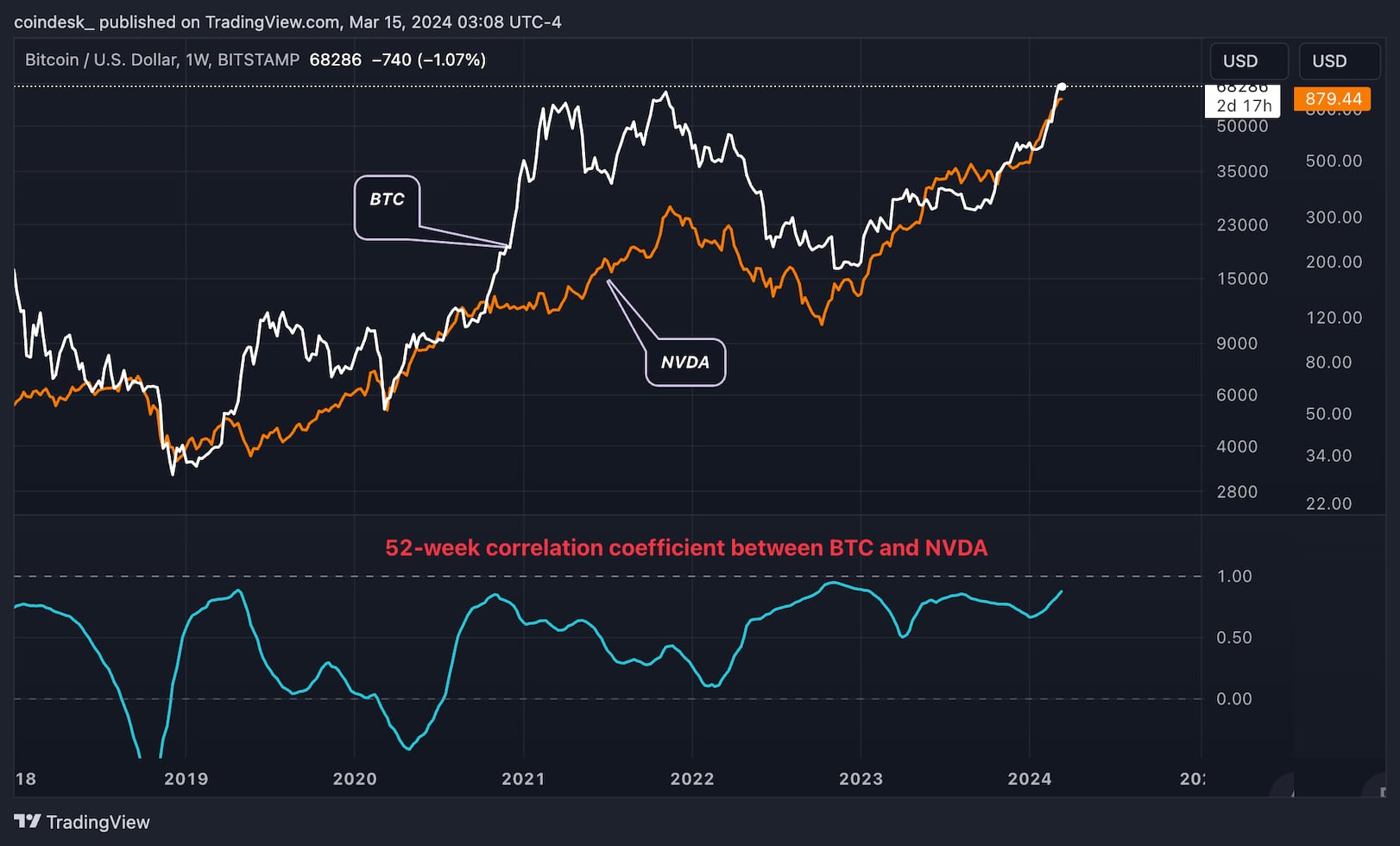

Bitcoin (BTC) and the Nasdaq-listed chip manufacturer Nvidia have shown a strong positive relationship, with both 90-day and 52-week correlation coefficients rising above 0.80. This correlation is particularly noteworthy as it coincides with the period when analysts expressed concerns about Nvidia’s value increase, which some believe represents a potential AI bubble.

Correlation Coefficient Above 0.80

Despite Bitcoin‘s pullback from its record high, current data shows that both assets have made significant gains since the beginning of the year; Bitcoin’s price increased by 60%, while Nvidia’s shares rose by 77.5%.

Over the last five years, both Bitcoin and Nvidia have experienced exponential growth in market value. Bitcoin’s market cap rose from $70 billion to $1.43 trillion, while Nvidia’s market cap soared from approximately $100 billion to over $2 trillion. Nvidia’s growth is partly due to increased demand for the company’s processors from AI projects like ChatGPT and other generative AI applications.

The correlation between Bitcoin and Nvidia has reached some of the highest levels in years, with a 90-day correlation coefficient of 0.86 and a 52-week correlation of 0.88. A coefficient above 0.80 indicates a strong positive correlation, suggesting that the two assets tend to move in the same direction.

Reminiscent of the Dot-com Bubble

However, some market observers, including investment management firm GMO, are raising concerns about an AI frenzy similar to the dot-com bubble that burst in 2000, cautioning investors. GMO’s Chief Investment Strategist Jeremy Grantham described the surge in AI-based stocks, fueled by excitement over technologies like ChatGPT, as a potential “bubble within a bubble” that could soon deflate.

Grantham pointed to historical precedents, noting that hype and stock market bubbles accompanied the early stages of previous technological breakthroughs like the internet and railroads. While these technologies ultimately proved transformative, they also went through periods of disappointment and market correction before realizing their full potential.

Despite bubble concerns, strategists at Citi, according to Investing.com, believe the AI bubble will continue to inflate until 2025. This forecast points to the uncertainty surrounding the future trajectory of AI-related assets like Nvidia and, indirectly, Bitcoin, as market participants grapple with the balance between hype and long-term value realization in the AI sector.