Last week, there was a significant price frenzy in cryptocurrencies, particularly in meme coins and artificial intelligence tokens. Developments focused around Nvidia provided support for the rise of many AI tokens. While all this was happening, attention turned to NEAR, the native token of the Near Blockchain. So, what is currently happening in the market with NEAR?

NEAR Protocol (NEAR) Insights

Santiment shared on X (formerly known as Twitter) that last month, the Near blockchain (NEAR) was at the forefront of daily development activities among crypto projects focusing on artificial intelligence and big data.

Development activities, a notable on-chain metric, track the number of unique development activity participants, the total number of events for a specific project, and the current count of unique GitHub activity participants.

Moreover, it provides data on a crypto project’s commitment to creating a working product and the likelihood of delivering new features. When a project records high development activity, it often reduces the probability of the project being an exit scam.

According to data provided by Santiment, NEAR’s development activity rose to 188 in the last 30 days. In comparison, Oasis Network (ROSE) and Golem (GLM) had only 162 and 90 development activity scores, respectively, placing NEAR ahead of them.

User Activity on Near Declines

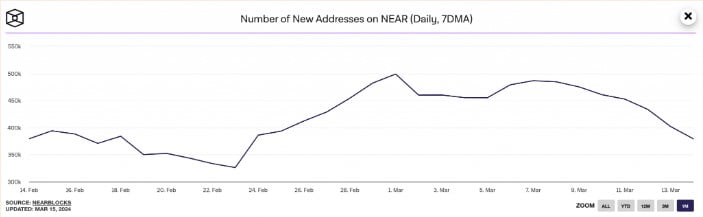

User activity on Near peaked at the beginning of March but has since been on a downward trend. An assessment of demand for the Proof of Stake (PoS) blockchain revealed a noticeable decline in the number of new addresses created on the network since March 1st.

According to data from The Block Data Dashboard, the daily count of unique addresses appearing in a transaction on Near reached up to 379,000 on March 14th. This figure represents a 24% decrease compared to the 498,000 new addresses using Near on March 1st.

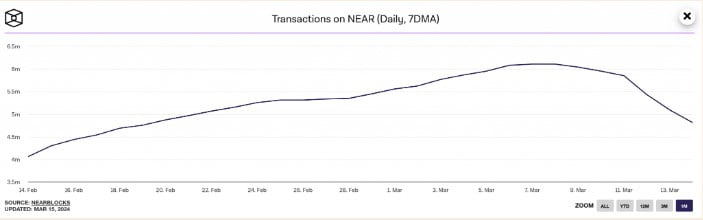

Additionally, an assessment based on the seven-day moving average of usage showed a decline in the daily number of transactions during the same period. There was a 17% decrease in the daily number of transactions completed on Near between March 6th and March 14th.

Due to the visible decrease in demand for the network, there was also a decline in transaction fees and related revenues. According to data provided by Artemis, daily transaction fees and protocol revenues fell by 41% and 40%, respectively, between March 4th and March 11th.

NEAR, serving as the protocol’s native coin, recorded a triple-digit rise over the past month, joining the bullish rally. As of the time of writing, NEAR is trading at $6.79, after an 8% decrease.