Last month, while the ADA price experienced intermittent corrections in its weekly chart with a modest downtrend, it exhibited notable resilience and growth. Currently, Cardano‘s price is at $0.6973, with a slight 2.56% decrease on the four-hour chart. However, investor sentiment continues, and optimism prevails for potential future gains.

Cardano’s Market Value And Expectations

Cardano‘s current market value is around $24.92 billion. This places it in a solid position among the top ten cryptocurrencies. In the last 24 hours, ADA‘s trading volume saw a 48% decrease, dropping to $842 million. However, this could be the result of a minor market correction.

Since the beginning of March, Cardano has shown nearly a 20% increase. However, efforts to surpass the critical resistance level of $0.76 seem to have failed. This development suggests that momentum could decrease.

Over the past week, ADA’s price has shown variability, oscillating between $0.60 and $0.80, following a horizontal trend.

Increase In Derivative Trading Volume

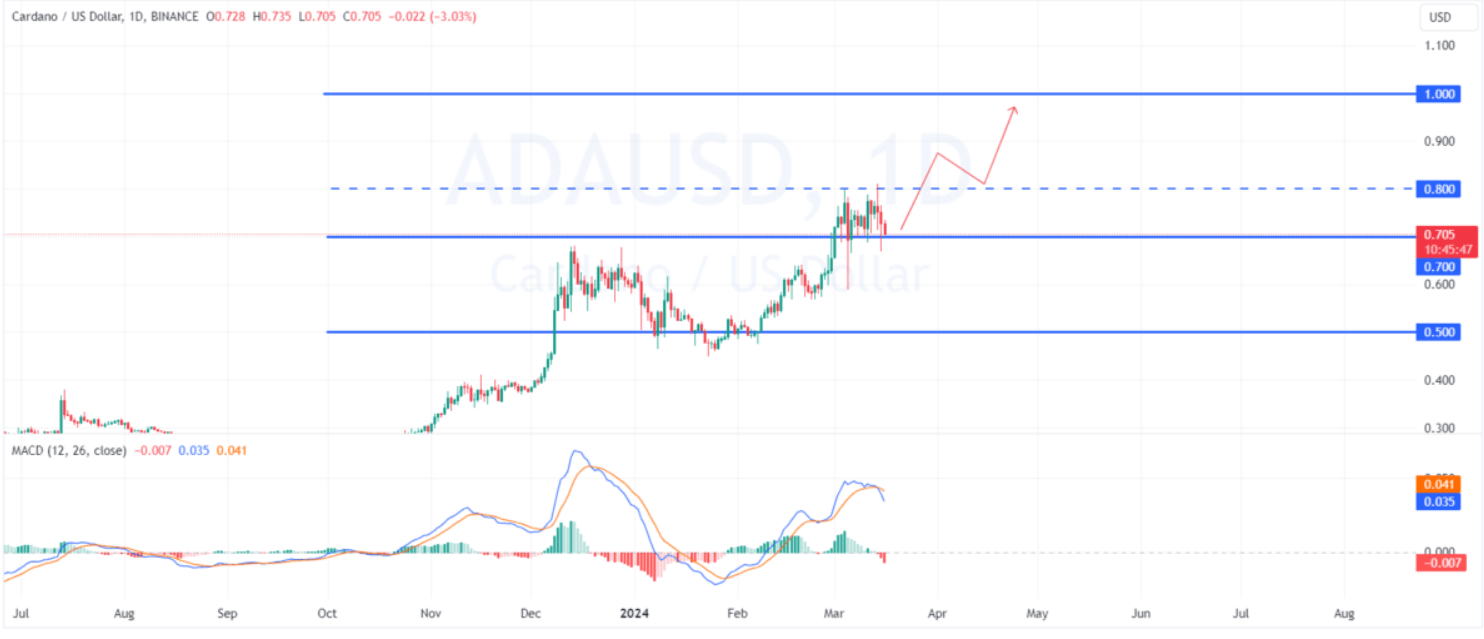

In the last 24 hours, a significant increase was observed in Cardano. Accordingly, the derivative trading volume surged by an impressive 78%. If the bulls manage to break above Cardano’s $0.70 resistance level, an upward momentum is expected. This momentum could lead the cryptocurrency to test the significant $1 resistance level.

However, after reaching $1, if market strength is insufficient, ADA’s value could decline and potentially fall to the support level around $0.8. Ongoing downward pressure could intensify the retreat, pulling the price towards a lower support level of $0.75 going forward.

What Do The Indicators Say?

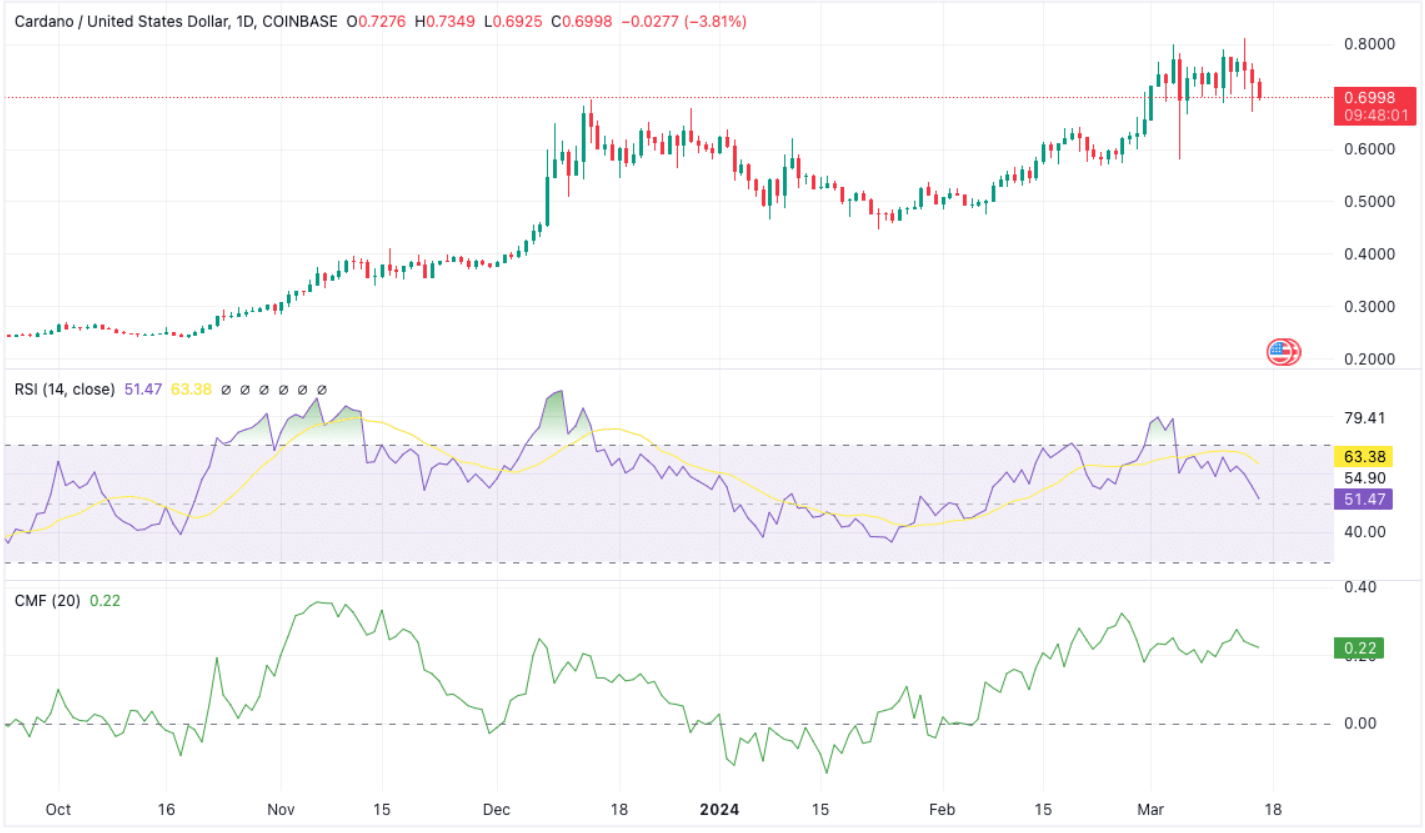

The Moving Average Convergence Divergence (MACD) metric indicates a positive trend. The MACD and signal lines are above the baseline, highlighting a strong bullish trend. The Chaikin Money Flow (CMF) indicator also reflects a positive trend at the 0.15 level, indicating an upward trend.

The Awesome Oscillator’s (AO) shift from green to red indicates a change from bullish to bearish momentum, while the Relative Strength Index (RSI) is at 51.47, showing that ADA is neither overbought nor oversold.

Türkçe

Türkçe Español

Español