Today, most cryptocurrencies are in the red, and the price of Bitcoin is currently disheartening. Following the recent drop, cautious selling in altcoins has accelerated, with most cryptocurrencies, including ETH, falling by about 5% in the past few hours. Volatility may increase in the coming hours.

March Federal Reserve Meeting

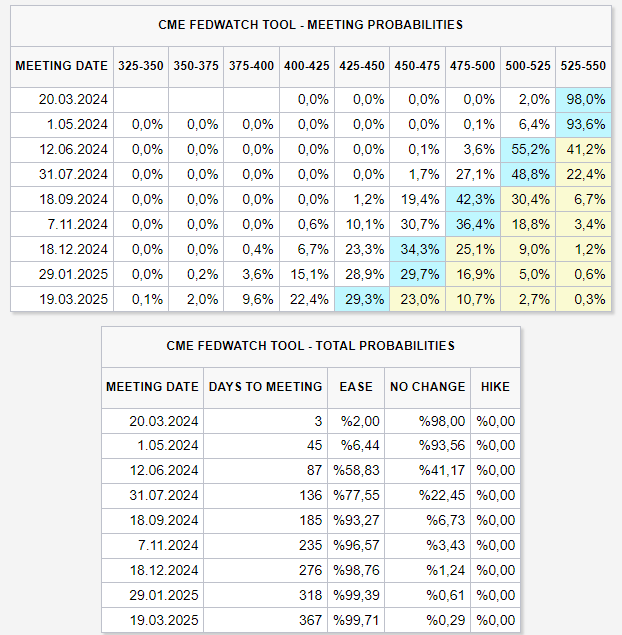

This week, after Bitcoin reached its new peak, we saw massive sell-offs due to record profitability over three years and several other reasons. Moreover, the Fed’s interest rate decision will be announced on Wednesday, and the current outlook may not yield encouraging results. Fed Chairman Jerome Powell’s speech on March 20th is now awaited with greater anxiety as inflation has exceeded expectations at 3.2%.

The rise in the producer price index is also among the reasons undermining optimism for interest rate cuts in 2024. Market participants who were expecting a 150bp cut this year are now seeing their expectations weaken, and we are not yet at the end of the journey to deflate the “excessive optimism” we have been loudly warning about since the beginning of January.

Cryptocurrencies May Decline Further

If the upcoming Monday does not see spot Bitcoin ETFs opening with volumes similar to their record days, and if BTC stays below $65,000, sales will likely accelerate due to investor pressure in the roughly 72 hours leading up to the interest rate decision day.

According to recent data, the Fed is not in a very strong position to combat inflation. Moreover, some indicators suggest that the institution’s chance of making a 75bp cut this year is becoming optimistic. This means increased pressure on risk markets and a shift in demand from cash markets to bonds.

The overall market outlook is not very positive until Wednesday. Open futures positions worth $35 billion are whetting the appetites of liquidity hunters, and the reasons why macroeconomic fronts are not performing well have been explained above. Accordingly, deeper plunges in BTC and altcoins wouldn’t be too surprising.

However, excessive demand through the ETF channel or some surprise good news that could fuel optimism may disperse this short-term negativity. Even though we see drops of up to 40% in bull markets, the trend is upward, so bears are often easily trapped.