Bitcoin price fell to a new daily low of $64,533 around 10:15 Turkish time. This drop, which triggered losses of up to 10% in altcoins, has now slowed down as the BTC price returned to $66,000. Altcoins also continue the day with losses of approximately 12-13%. So, what do the experts think?

Cryptocurrencies on the Decline

Bitcoin cut its recent upward movement short and after a weak rise, the price fell back to the $64,000 levels. Given that there is a Fed meeting before the weekly close, such movements can be considered normal.

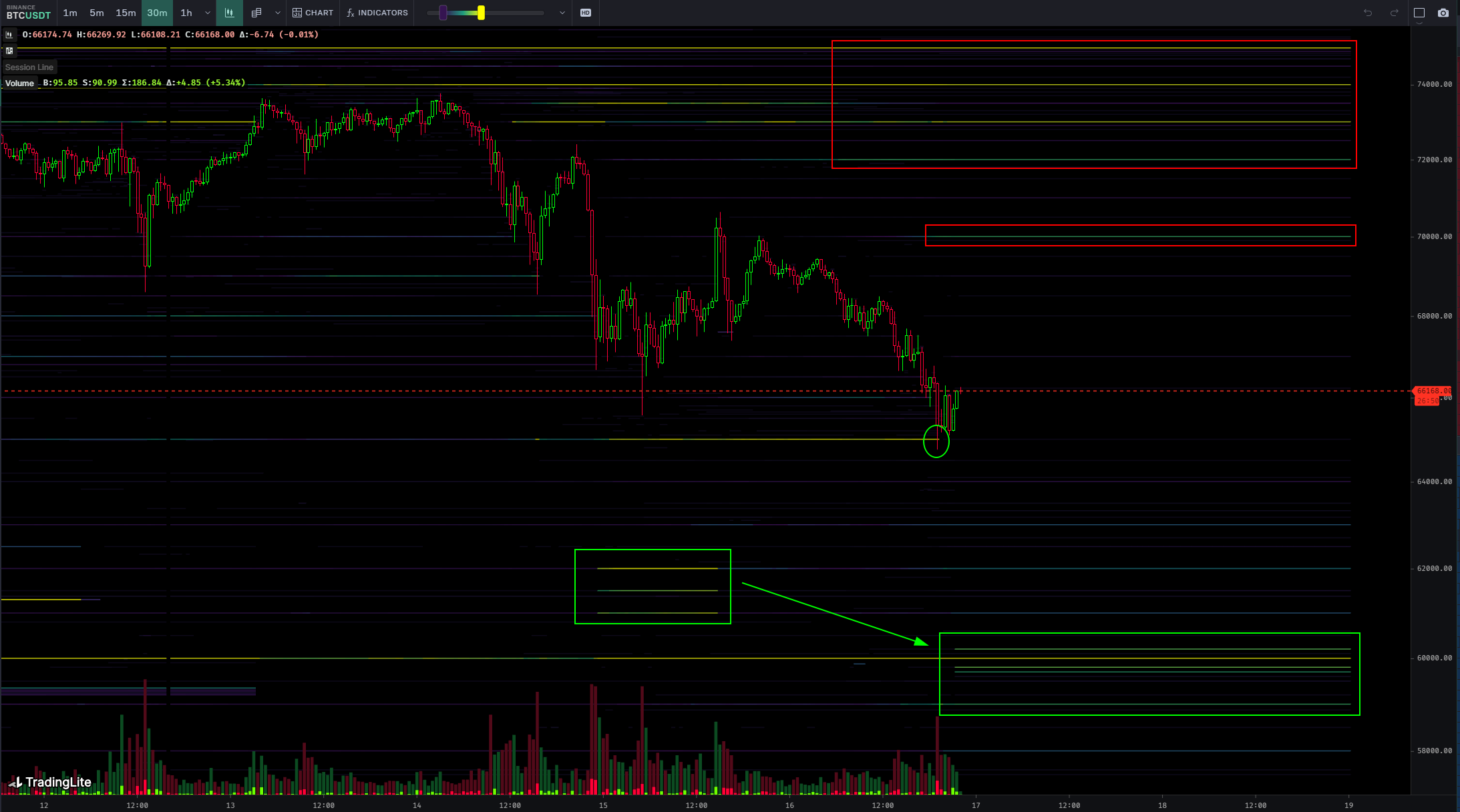

Popular cryptocurrency expert Skew noted that interest in major exchanges has shifted to the $60,000 to $64,000 region.

“Most of the sales were driven by buyers (market sales). Spot sales from exchanges like Coinbase and Binance were quite strong. The selling has continued since the $74,000 limit.”

Skew mentions that some institutions have started to take action for incremental purchases at dip levels, which could lead to price jumps. Institutions following a DCA strategy are evaluating the dip according to Skew. On the other hand, since the halving has not yet occurred, the strategy they apply may be correct as BTC has not reached its real ATH region according to historical data.

Will Cryptocurrencies Rise Again?

The truth is, we have seen major drops of around 30-40% in previous bull markets. Moreover, BTC losses have not even reached 20% yet. This suggests that investors who panic may be justified in the short term, but are mistaken in the long term.

Apollo’s CEO Thomas Fahrer commented on the current situation;

“Waves of liquidity will pour over Bitcoin ETFs. Real capital hasn’t even started allocating resources yet. If a $1 billion Hedge Fund position caused a 10% drop in BTC, can you imagine what $150 billion from advisors will do to the price?”

Considering that the BTC supply in exchanges is around $140 billion, such demand should drive the price to interesting levels. According to experts, the supply that can be sold (not asleep, not in Nakamoto wallets, etc.) is not much above $200 billion.

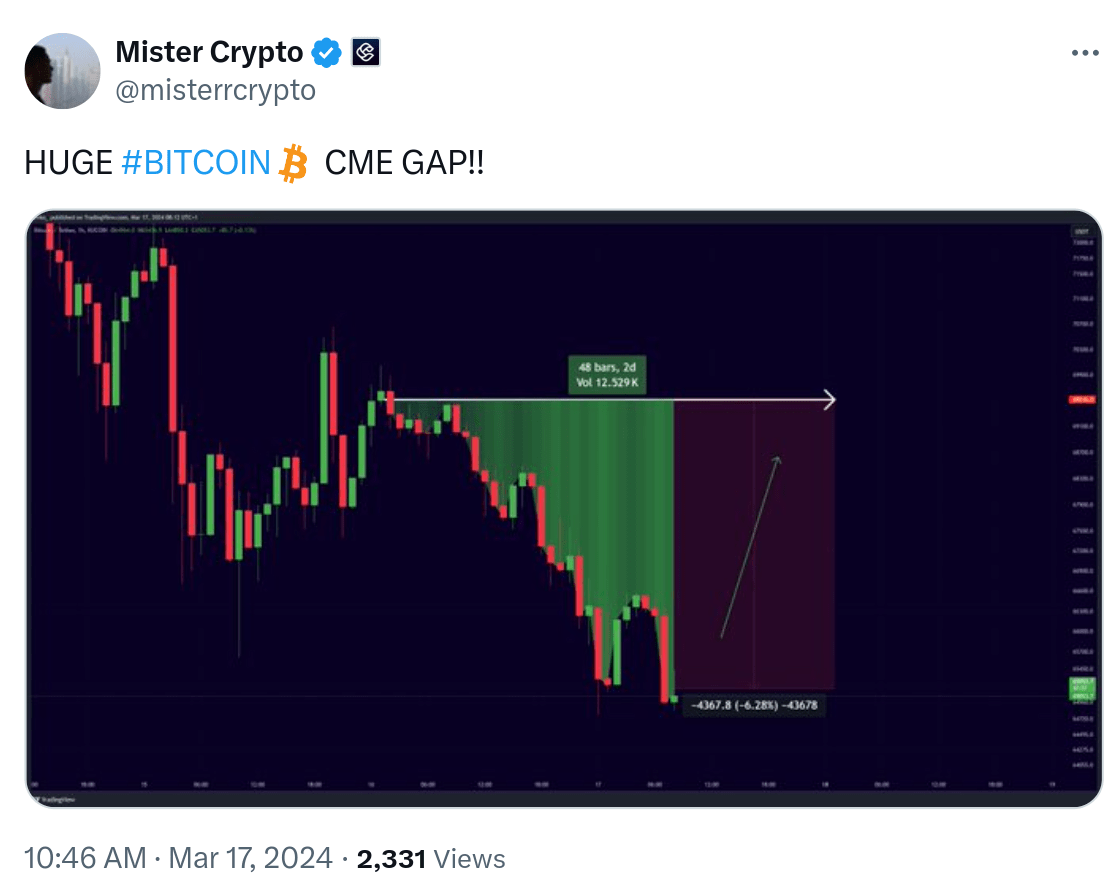

Fahrer expects a new wave of institutional influx into BTC in the coming months. Also, the CME Gap formed on March 15th is at $69,135, and the price tends to close these gaps.

Türkçe

Türkçe Español

Español