Layer (L2) token Arbitrum (ARB) fell by 14% shortly after the release of over a billion tokens into the market. According to the website 21milyon.com, ARB was trading at $1.9 on March 16. However, prices began to significantly drop following the planned end of the token supply release.

Token Unlocking Event in ARB

According to an analysis of token unlocking data, about 76% of ARB’s total circulating supply, which exceeds $2 billion, was distributed to the team, future team members, and investors. Most of these recipients moved quickly to profit from their tokens. According to Spot On Chain, six wallets transferred 8.95 million ARB to Binance just hours after the unlock, with over 32 million tokens still remaining in these wallets, which could potentially lead to more deposits in the coming days and possibly more downside.

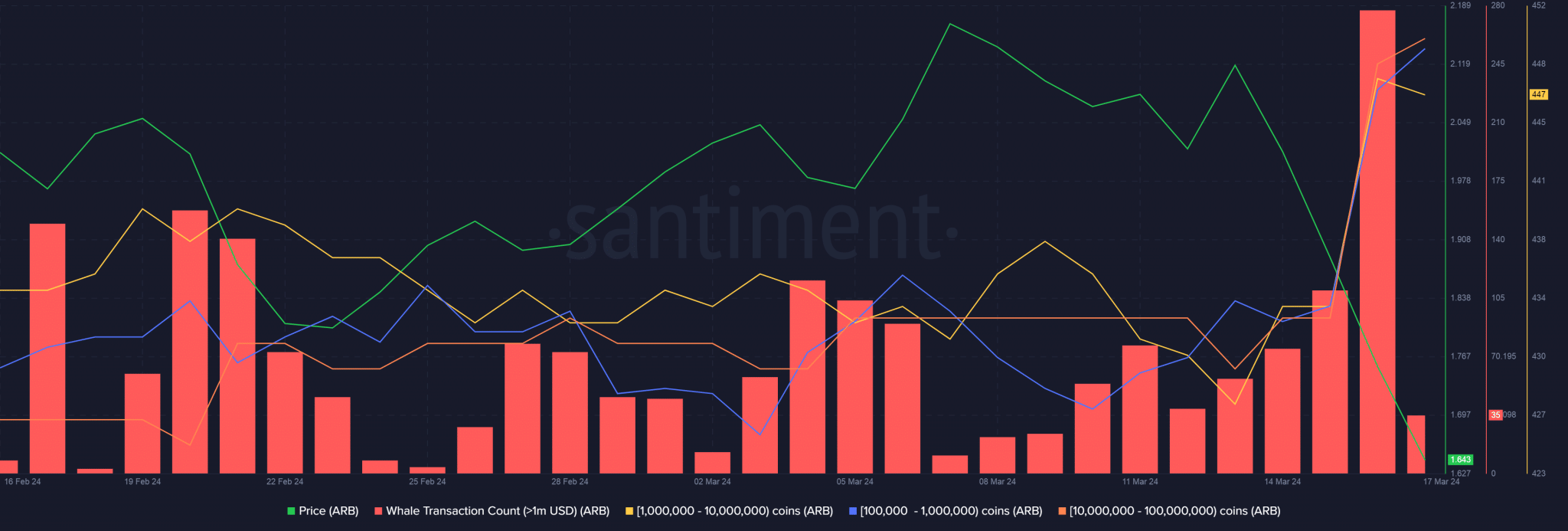

Cryptocurrency analytics firm Santiment investigated the behavior of ARB whales. Notably, transactions exceeding $1 million reached their highest value on March 16. However, it was observed that most large whales accumulated ARB instead of selling. Yet, wallets holding between 100,000 and 100 million tokens increased rapidly on the same day. These user groups began accumulating tokens during the days leading to the unlock, which could indicate optimism about ARB’s prospects. As prices have fallen, time will tell whether these whales will continue to accumulate or liquidate their holdings.

Increase in Active Addresses on ARB

Moreover, the on-chain activity of ARB significantly increased due to the unlocking event. On March 16, approximately 330,000 unique addresses were active, which could mean an increase of 13,000 compared to the previous day. Additionally, the number of new addresses on the network increased by 77%. This data indicates individual excitement and mainstream adoption of the token. Consequently, while Arbitrum experienced a 14% drop following the planned end of the token supply release, the quick market introduction of a large supply distributed to the team and investors, along with increased on-chain activity, significantly affected prices.

Türkçe

Türkçe Español

Español