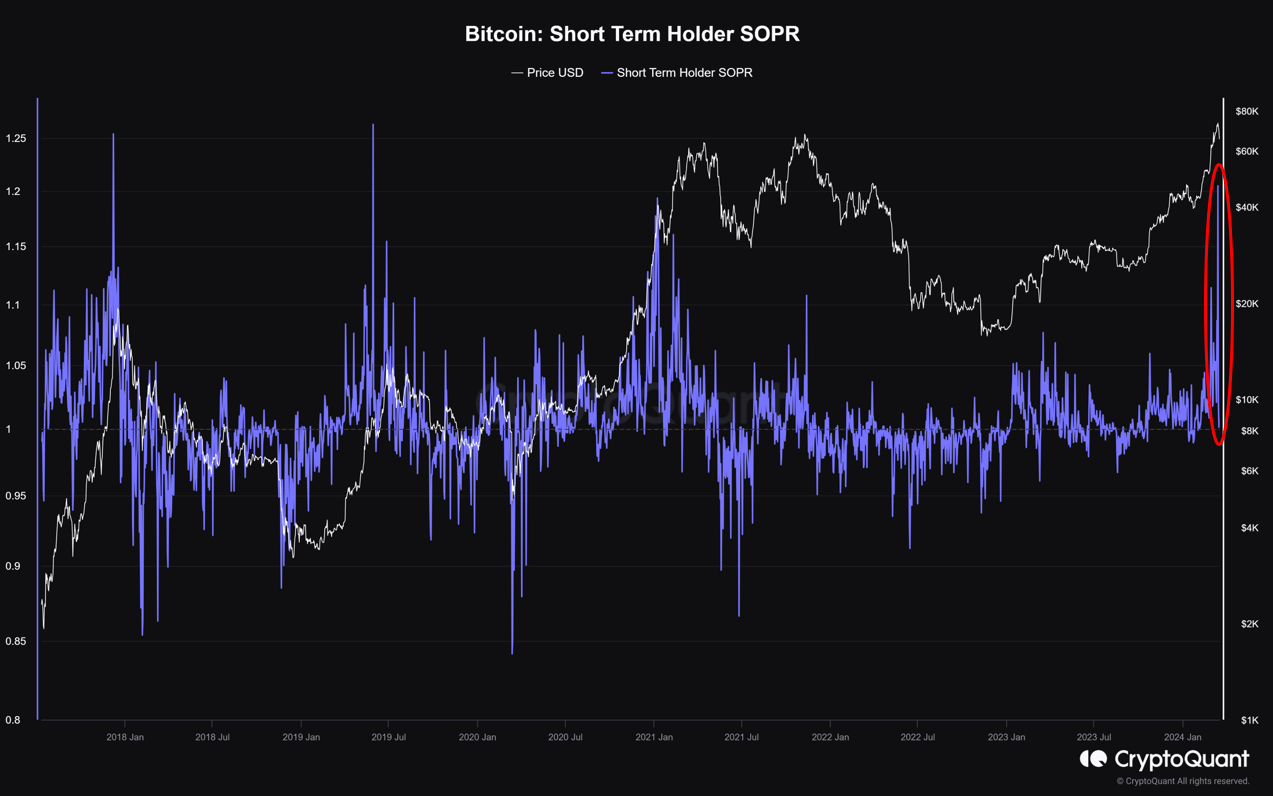

Bitcoin (BTC), despite currently trading above an important price level of $68,000, is seeing significant profit-taking among especially short-term investors. According to information obtained from CryptoQuant data, market analyses and on-chain data indicate a notable trend of profit-taking among investors who have held BTC for less than five months. The Spent Output Profit Ratio (SOPR) reflects this movement, mirroring past bull market peaks.

However, Seen Only Once Every Few Years

Analysis of the SOPR metric reveals that short-term Bitcoin investors are actively taking profits, sending alarm signals to investors by recalling a clear trend from past market peaks. Cryptocurrency expert Crypto Dan emphasizes the rarity and significance of this trend, noting that such events are infrequent and tend to repeat every few years.

Despite the potential negative consequences of this trend, the price of the largest cryptocurrency continues to move on complex grounds, fueled by the intense interest of institutional and individual investors and the launch of spot exchange-traded funds (ETFs) in the US. As analysts who foresee Bitcoin entering a rise again after a short correction period argue, this profit-taking trend complicates interpreting it as the definitive peak of the current bull market.

The Strongest Spot Demand-Driven Bull Market in History

Famous cryptocurrency analyst James Check, known as Checkmatey on social media, delves deeper into market behavior by analyzing metrics such as the Market Value to Realized Value (MVRV) ratio and Bitcoin’s Realized Price.

Check highlights psychological pricing models that influence investor decisions, stating that the current +1 standard deviation level of $70,800 is prompting many investors to convert their unrealized gains into realized profits. As a result of this trigger, approximately 735,000 BTC re-entered the market, with about 60% from the Grayscale Bitcoin Trust (GBTC) and the remainder from individual investors.

Despite this sell-oriented activity, the Bitcoin market corrected by about 10%. This is part of the strength and demand-driven nature of the current bull market, as Check points out. He further adds that the current situation is one of the strongest, spot demand-driven bull markets in history.

Türkçe

Türkçe Español

Español