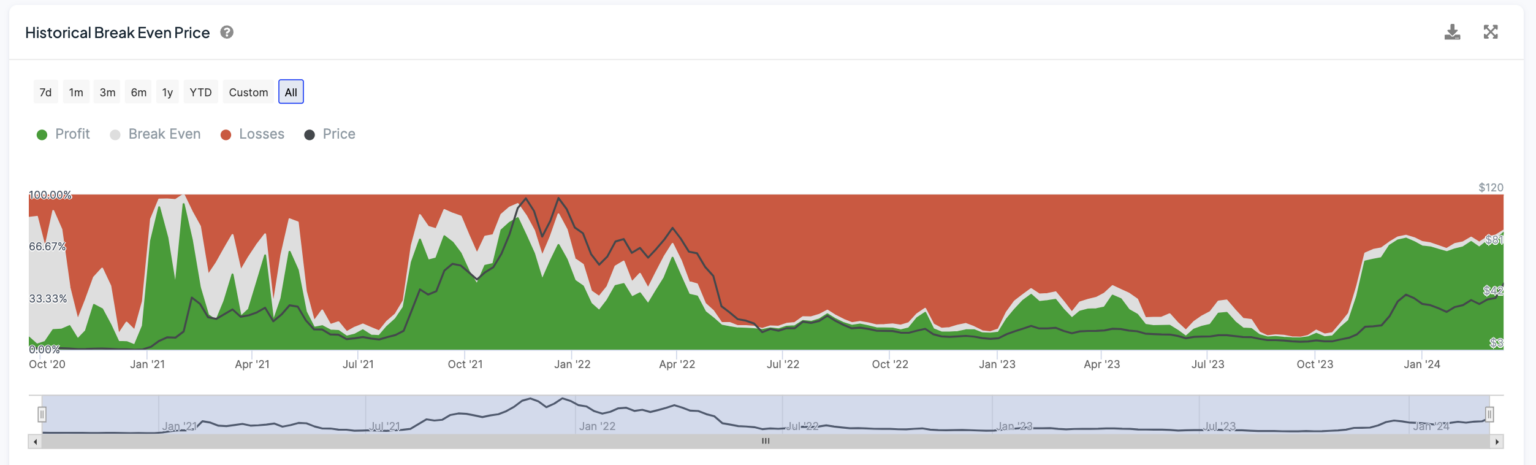

Last week, the price of Avalanche experienced a significant increase, recording a 21.93% growth. Despite the recent price surge, the Relative Strength Index (RSI) remains healthy, indicating that AVAX could rise further. Currently, 75% of AVAX holders are in a profitable position. Historical data indicates that this level has often served as a critical breakpoint for AVAX and could be a very important moment for the asset’s future performance.

What’s Happening with AVAX?

In the past few days, AVAX’s 7-day Relative Strength Index (RSI) has seen a noticeable drop from 75 to 69. Despite this decline, its price astonishingly rose from $40 to $61 within a week.

The observed decrease in RSI and the notable increase in price suggest that AVAX’s buying momentum has slightly decreased, yet the market price has managed to rise. This scenario could be attributed to strong investor confidence or the recognition of AVAX’s intrinsic value. While the RSI hovers around 69, it is on the verge of entering the overbought zone. Nevertheless, it continues to stay within a range that can still be considered relatively healthy, indicating neither overvaluation nor significant undervaluation.

If the RSI maintains its position below the overbought signal without a sharp decline, it could indicate sustained investor interest, potentially laying the groundwork for further upward price movement. This scenario suggests that investors are still willing to support AVAX, potentially leading to a continuous price increase.

Potential Scenarios for AVAX

Following the recent rise in market value, an impressive 75% of AVAX holders, corresponding to 5.6 million people, find themselves in a profitable position. This marks a significant change from the stability observed in the previous two months, where the percentage of profitable AVAX holders fluctuated between 50% and 60%.

A similar increase in the percentage of profitable holders to 75% was last witnessed in 2021. Following this increase, the AVAX price experienced a significant rise from $75 to $117 in just 20 days. This historical context carries great significance as data. In fact, this data measures the average price at which all holders neither make nor lose money, offering insight into the overall profitability of an investment in the cryptocurrency market over time.

23% of AVAX holders are still at a loss, which may indicate that these holders will continue to hold their AVAX and wait for further increases to become profitable. This is even more significant since AVAX is still 57.91% below its all-time high, reinforcing the possible scenario that holders may not start selling their AVAX anytime soon.

Türkçe

Türkçe Español

Español