Solana (SOL) has seen increased optimism among investors following a crypto analyst’s prediction that the SOL price could move above the $200 level for the first time since November 2021. The analyst highlighted that Solana recently challenged a significant sell signal, forecasting a potential 70% rally. Consequently, this pointed to a bullish outlook before the next sell signal.

Will Solana Rise?

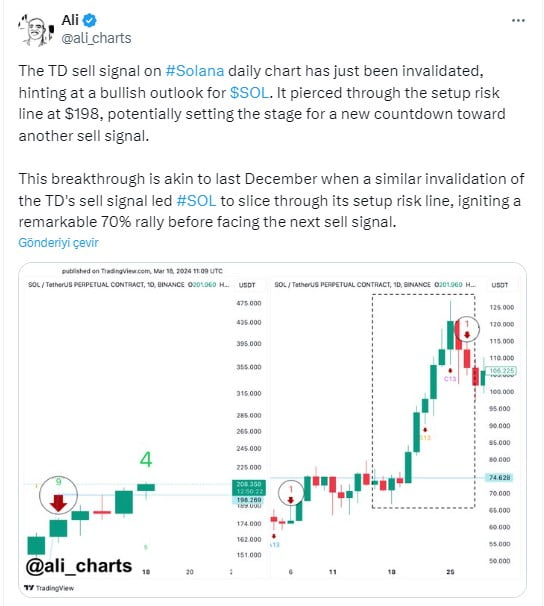

An analysis by Ali Martinez early today shed important insights on the Solana price. He emphasized that the TD sell signal seen on Solana’s daily chart had moved into an invalid position.

This outlook, which could signify a bullish trend for SOL, also generated excitement as it surpassed the critical resistance level at $198.

Moreover, Martinez recalled December of the previous year, when a similar breakout led to a notable 70% increase in Solana’s price, drawing attention to potential developments.

Currently, according to the analyst, SOL appears to be moving with the potential to start another upward trend. While the SOL price moves above the $200 level, Martinez’s analysis suggests that Solana could achieve even greater gains before another sell signal arrives.

On the other hand, over the weekend, Solana network activity surpassed Ethereum, becoming the focus of attention. The surge was said to be due to increasing demand for Solana-based memecoins.

According to data provided by DefiLlama, on March 16th, the volume of Solana transactions exceeded Ethereum‘s, reaching over $3.52 billion and creating a difference of $1.1 billion.

Especially during this period, a rush to a new memecoin called Book of Meme (BOME) on March 14th turned all attention to the SOL ecosystem.

During this time, BOME reached a market value of $1.45 billion in just 56 hours. Additionally, according to data from DefiLlama, Solana’s decentralized finance (DeFi) total value locked (TVL) saw an increase of over 80% last month.

The recent developments have lifted Solana’s DeFi TVL to the highest point in the last two years, and it continues to stand at $4.30 billion.

Solana Price Situation

The incredible volatility in Solana’s price continues unabated. The price surge reached a new level on Monday, March 18th. As of the time of writing, the SOL price had risen by 7.13% to $204, and its market cap had surpassed $91.56 billion. In contrast, SOL’s trading volume had decreased by 12.17% to $10.74 billion in the last 24 hours.

According to data from Coinglass, Solana saw a 9.05% increase in open interest, rising to $3.20 billion.

However, due to the recent price increase, there was an uptick in short position liquidations as traders sought to minimize their losses. In the last 24 hours, $17.67 million worth of positions were liquidated on the Solana side, with $11.77 million of these being short positions.