Following accusations, the CEO of Binance exchange, who had to resign and was later banned from leaving the USA, continues to face an ongoing legal process. Changpeng “CZ” Zhao is expected to appear before a judge on April 30 and has shared hints of a project, which he says is not a new token.

CZ’s Mysterious Share

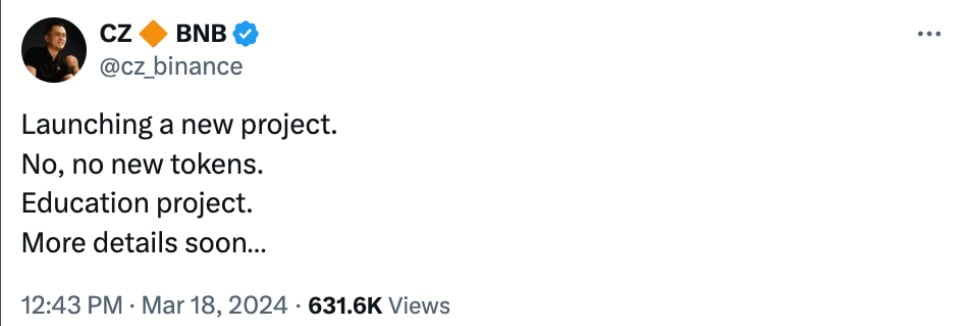

In a share made today, March 18, CZ provided information about a project that seems to be related to cryptocurrencies or blockchain technology and is focused on education.

The former Binance CEO, in his mysterious share, stated that the project would not include ‘new tokens’, revealed it to be an education project, and planned to release more details soon.

CZ resigned from his position as CEO of Binance, the world’s largest cryptocurrency exchange by volume, in November 2023 as part of an agreement with US authorities.

The agreement with the US Department of Justice, Treasury Department, and Commodity Futures Trading Commission required Binance to pay $4.3 billion as part of the settlement and for Zhao to admit to a charge related to the failure to maintain an effective Anti-Money Laundering program.

CZ’s Legal Process

During this time, Zhao continues to stay in the US on a $175 million bail.

Although CZ’s legal team has repeatedly petitioned the judge to allow him to visit his family in the United Arab Emirates, they have not received a favorable outcome.

There were rumors that CZ could be convicted as early as February, but the hearing was later postponed to April 30. Some legal experts believe the former CEO could face 12 to 18 months in prison.

Since his agreement with US institutions, CZ has limited his use of social media, mostly sharing neutral holiday messages. His post on March 18 led to much speculation among his followers about the project, but Zhao did not provide details in his statement.

Binance, Binance.US, and Zhao are still grappling with a lawsuit filed by the US Securities and Exchange Commission (SEC) in June 2023. The exchange’s US branch filed a court application on March 5, stating that the SEC’s enforcement action nearly ended the exchange.

Türkçe

Türkçe Español

Español