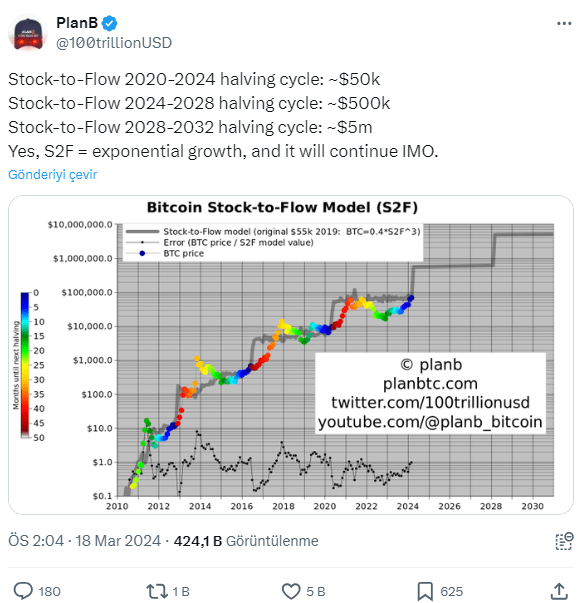

Bitcoin enthusiasts frequently fill with excitement and speculation about the future of the cryptocurrency. The Stock-to-Flow (S2F) model, which has gained popularity in recent years, adds a new dimension to the debate on where Bitcoin‘s price may head. PlanB, the pioneer of the model, has made headlines with new statements about Bitcoin’s potential price movements.

PlanB, the S2F Model, and Bitcoin

PlanB’s analysis based on the S2F model emerges as a significant tool for forecasting Bitcoin’s future journey. The model examines the correlation between existing reserves and annual production, forming the basis for bold predictions.

The $50,000 price forecast for the 2020-2024 halving cycle could be seen as a harbinger of a period when Bitcoin gains momentum. However, real excitement emerges with a $500,000 price forecast for the 2024-2028 cycle and an enormous $5 million price in subsequent cycles.

PlanB’s BTC Predictions

PlanB’s predictions have sparked widespread interest and debate within the crypto community. However, the difficulty and uncertainty of predicting future prices have led some investors to be cautious.

For instance, it should be considered that PlanB’s predictions have deviated in the past and that a margin of error must be taken into account. There are also intense debates on this subject. PlanB acknowledges that his predictions only provide a general direction and are largely subject to a margin of error.

Other participants in these discussions also suggest that PlanB’s projections could be overly optimistic, but patience is needed to articulate a clear view of the market’s future. They emphasize the importance of considering factors such as the impact of ETFs and adoption rates.

What Awaits Bitcoin’s Currency Price?

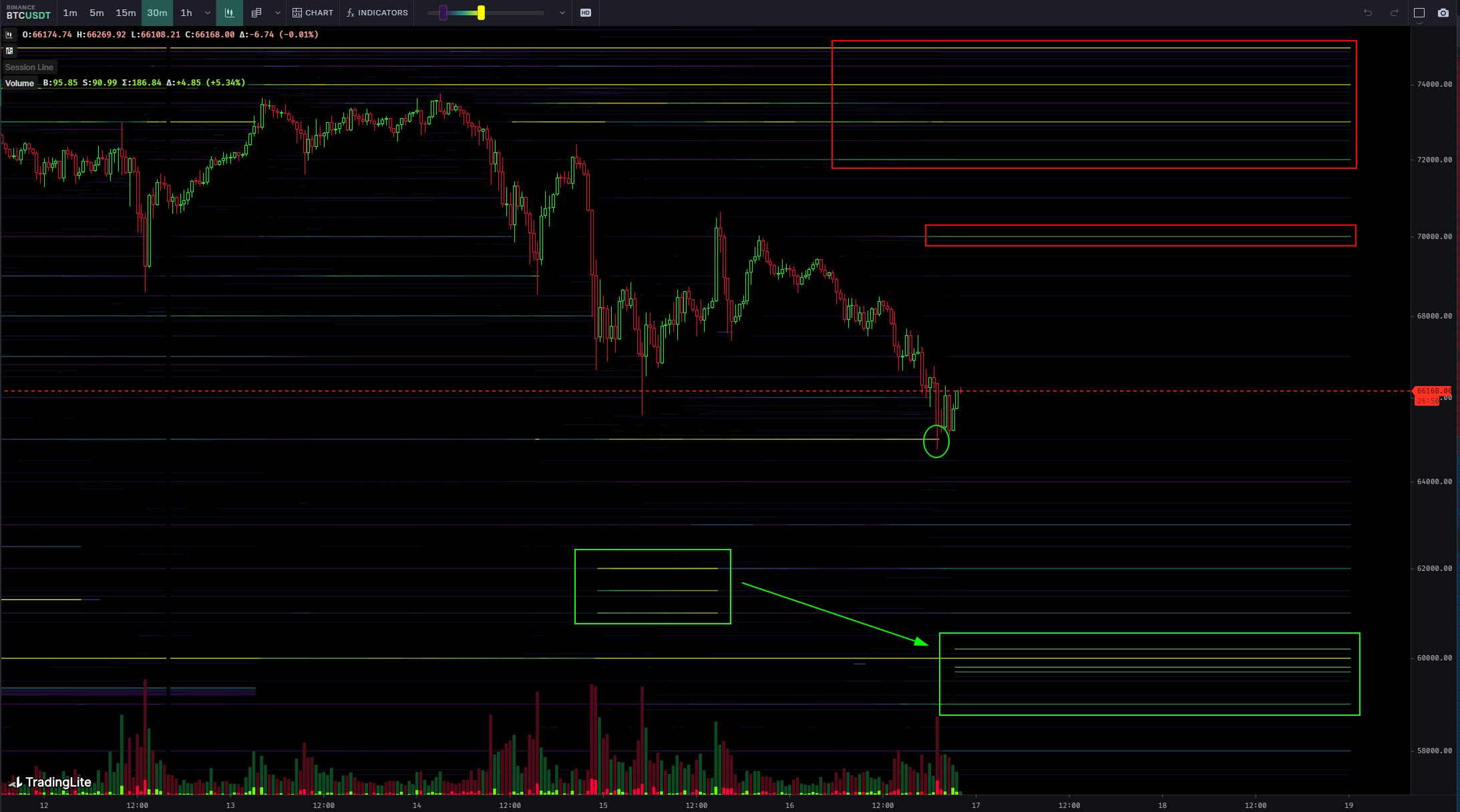

Last week, Bitcoin’s price experienced a significant 7.5% drop, putting its investors through a tough test. This downward trend continued over the last 24 hours, causing the cryptocurrency to retreat an additional 4.5%. Bitcoin’s trading price is currently hovering around $65,057.

Famous trader Skew’s technical analysis points to a critical support range between $60,000 and $67,000 for Bitcoin investors. This range coincides with significant selling activities on leading exchanges, potentially marking a turning point for the market’s direction.

Türkçe

Türkçe Español

Español