Blockchain developments continue to make headlines. Accordingly, Mehen Finance, the company behind Cardano’s newest stablecoin project USDM, aims to offer it to individual investors at the beginning of next month. USDM was officially launched on Cardano on March 17th, but currently, it is only available to institutional users.

Cardano’s New Stablecoin Project Details

Mehen Finance co-founder Matthew Plomin stated in a comment that the individual investor launch will likely happen in April. Plomin added that institutions in appropriate jurisdictions can now join the platform and participate in the stablecoin process.

Plomin explained that the USDM model resembles other fiat-backed stablecoin projects but includes a key feature that prevents excessive minting. The USDM reserve is reported to Charli3, a decentralized oracle designed for the Cardano network, and Charli3 oracle data is integrated into the token’s smart contract. Plomin said this allows for transparent real-time transfers:

“The independently reported oracle value determines the amount of USDM tokens that can be minted, so over-minting is not possible.”

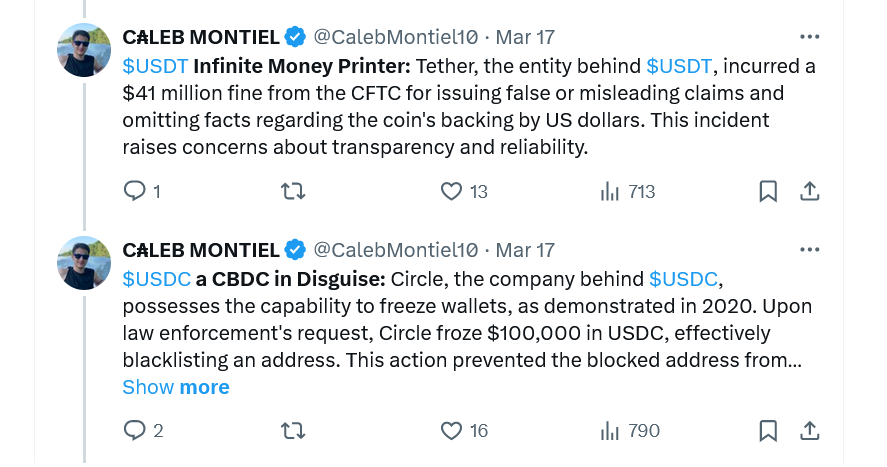

Last July, Mehen stated that unlike Circle’s USD Coin and Tether, USDM could not be frozen. Caleb Montiel, the founder of the Cardano content platform Cardano Curation, argues that this feature makes USDM a superior stablecoin.

However, according to crypto commentator Vanessa Harris, the inability to freeze USDM on-chain could backfire, and regulators could instead freeze USDM’s bank accounts, which could affect the value of USDM.

Noteworthy Details for USDM

Mehen, is based in New York, where the state’s financial services regulator has a history of investigating and taking action against some of the largest industry players. Plomin said that the USDM reserve is held only in government money market funds at Fidelity and Western Asset Management, emphasizing that these are not used as banks.

The first institutional users are currently sending US dollars via bank transfer and receiving USDM at a 1:1 ratio. Mehen has received license approvals from 17 US states and will seek money transmitter and crypto asset service provider licenses in Europe and the United Kingdom this year. Meanwhile, Plomin announced that Mehen will soon receive its first investment through a crowd-funded equity increase rather than a token sale.

“Securities offered under regulated crowd funding can be used by people all around the world, and our Series A shares will undergo a tokenization process on Cardano.”