Ethereum‘s Layer 2 scaling solution Arbitrum (ARB) has made headlines with significant market dynamics changes following its token unlock event on March 16. The price of Arbitrum’s native asset ARB fell by 25% after the latest token unlock, and it is currently trading at $1.51, sparking discussions about market performance and investor sentiment.

Price Drops But Market Value Increases After Token Unlock

During the “Cliff Unlock” event, Arbitrum distributed 1.1 billion ARB tokens to its investors, team members, and advisors by unlocking them all at once. Such events typically raise concerns about potential market sell-off pressure, causing unease across the market. Despite this trend, Arbitrum chose to release all tokens simultaneously, allocating 673.5 million tokens to advisors and the team, and the remaining 438.25 million tokens to investors.

Despite the price correction, Arbitrum’s market value has surged over 80% in the last 24 hours, exceeding $4 billion, indicating strong adoption within the crypto ecosystem. This increase in market value reflects strong demand and investor confidence in the altcoin, despite lower prices per token compared to previous highs.

Tokenomics, particularly the inflation rate, continues to play a very important role in Arbitrum’s market dynamics. Similar to other projects like Solana (SOL), Arbitrum relies on increasing its market value to balance inflationary pressures and reach all-time high (ATH) levels despite price fluctuations.

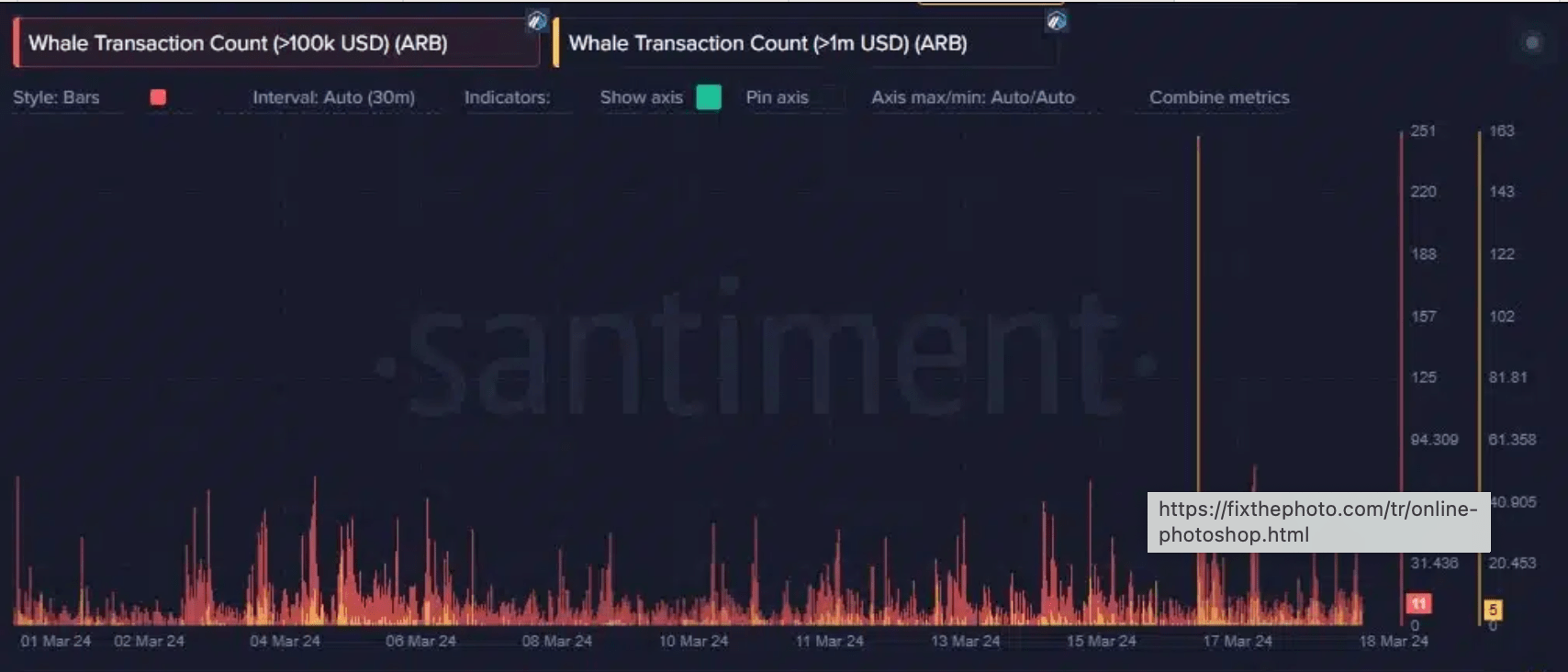

Whales Buying and Selling

Whales are also contributing to the price volatility with substantial ARB transactions. On-chain data provider Lookonchain reported on March 18 that approximately 58 million ARB tokens were transferred to cryptocurrency exchanges, with 11 whales behind these transactions.

While some investors are taking profits and selling their ARB, a significant portion of whales continue to hold their ARB without selling. This suggests that there are high long-term expectations for Arbitrum, indicating ongoing investor confidence.

Additionally, data from the crypto analytics platform Santiment shows that despite the selling pressure, there has been a significant increase in wallet addresses holding large amounts of ARB, revealing that whales are predominantly accumulating despite market concerns for the altcoin.

Türkçe

Türkçe Español

Español