With approximately one hour left to the daily close, the Bitcoin price continues to close below $63,000, and altcoins are on the decline. Altcoins like SOL and AVAX continue to fall to feared levels. The outlook for BTC is negative, and there is concern that this pressure will persist hours before the Fed meeting. The second-largest weekly outflow from GBTC was observed, with sales exceeding $400 million.

FTM Coin

As Grayscale outflows accelerate, the past day saw losses exceeding $400 million. This also indicates that panic selling continues through ETF channels, as entries into other ETFs have significantly weakened. Meanwhile, BTC is still targeting $59,000 with closures below $66,000.

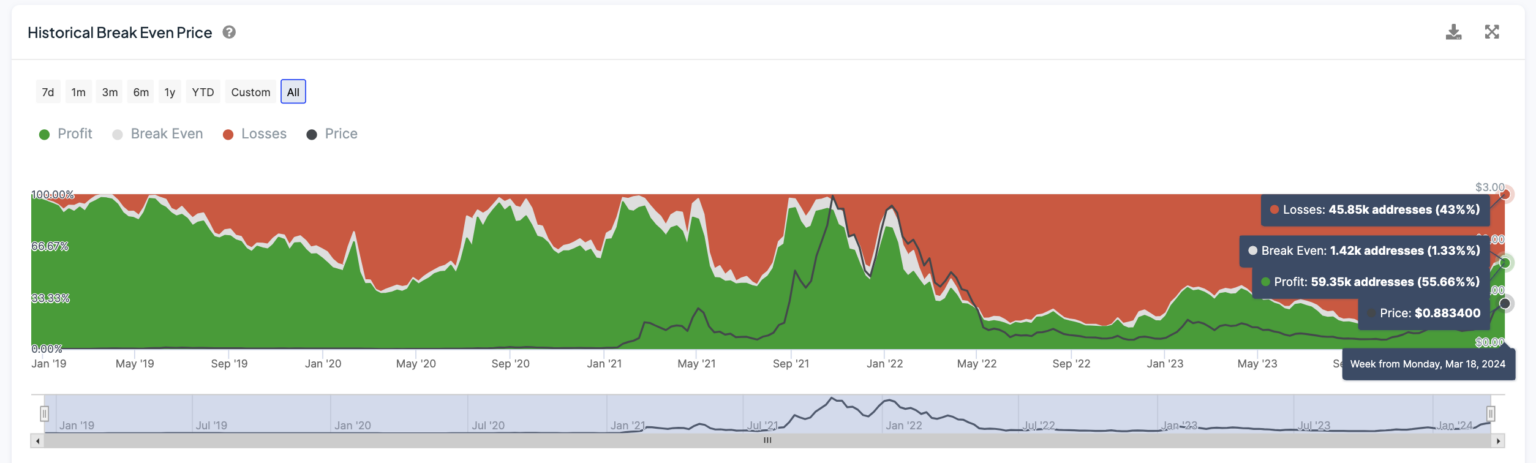

Of course, FTM Coin has also taken its share of the general market negativity. After a rapid increase in the price of Fantom (FTM) Coin, the $1 region was surpassed, resulting in investor profitability reaching 55%. This level had not been seen since August 2021. At that time, the price climbed from $0.31 to $2.97 in just three months, an increase of over 800%.

From March 7 to March 18, short-term investors increased by 116%. This change in the FTM supply distribution reflects the sales of medium and long-term investors.

FTM Coin Could Decline

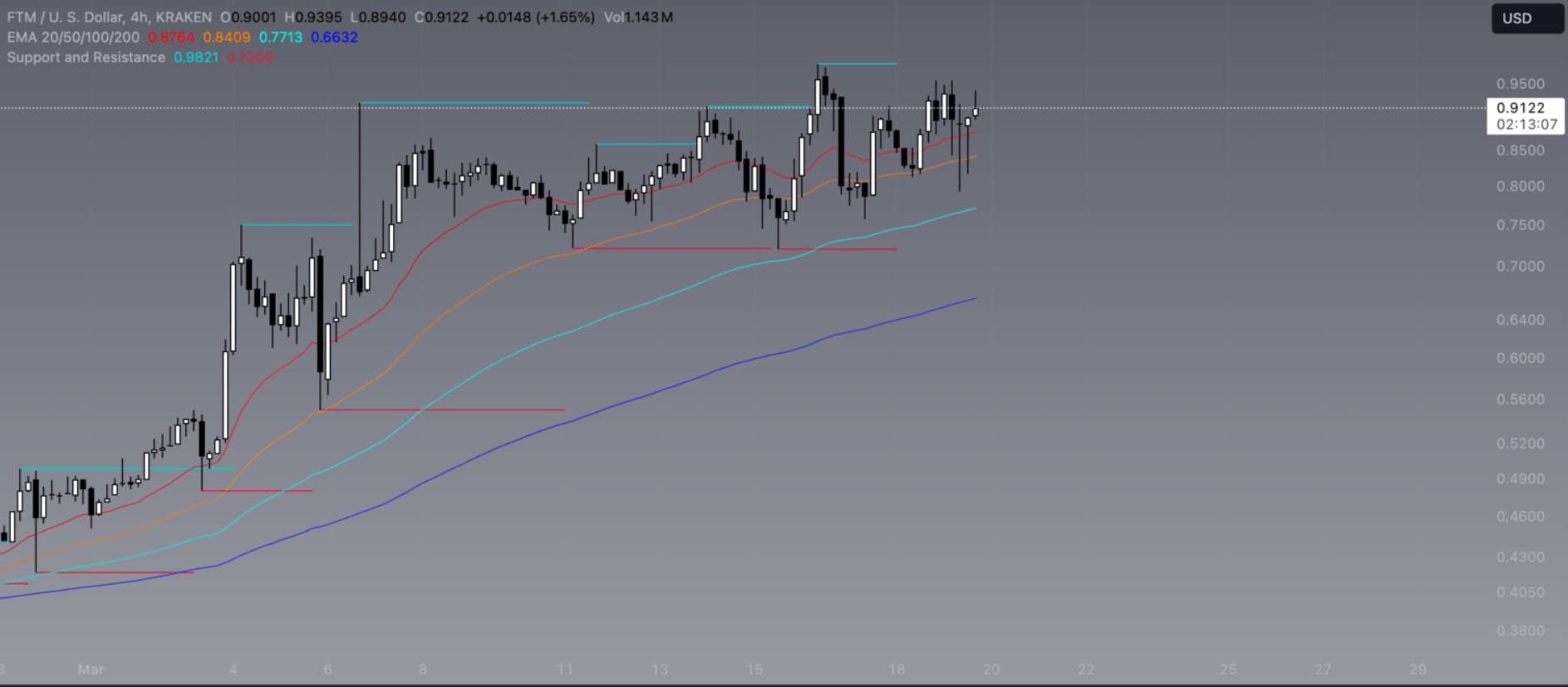

If the proportion of short-term investors increased before BTC fell, then the related altcoin is expected to suffer more losses compared to the general market. On the four-hour chart, the $0.98 key resistance area could be a bullish signal. Although this area was surpassed at the time of writing, high profitability and BTC’s situation could trigger rapid sales.

The crossing of short-term EMAs over long-term EMAs indicates a shift towards a short-term uptrend. Recent price movements are pushing the short-term average upwards.

With one hour left to the daily close, the price is at the $1 threshold, but if Bitcoin‘s targeted drop to $59,000 occurs, FTM Coin investors could see the price fall to $0.48 and $0.41. At this point, the key support is at $0.54.

Türkçe

Türkçe Español

Español