Cryptocurrency markets have seen significant activity lately, with the decline in Bitcoin prices drawing particular attention. BTC has fallen below the critical support of $62,000 and is currently trading around $62,480. What is causing this downward trend, and what should investors expect?

Bitcoin Price Continues Its Downward Trend

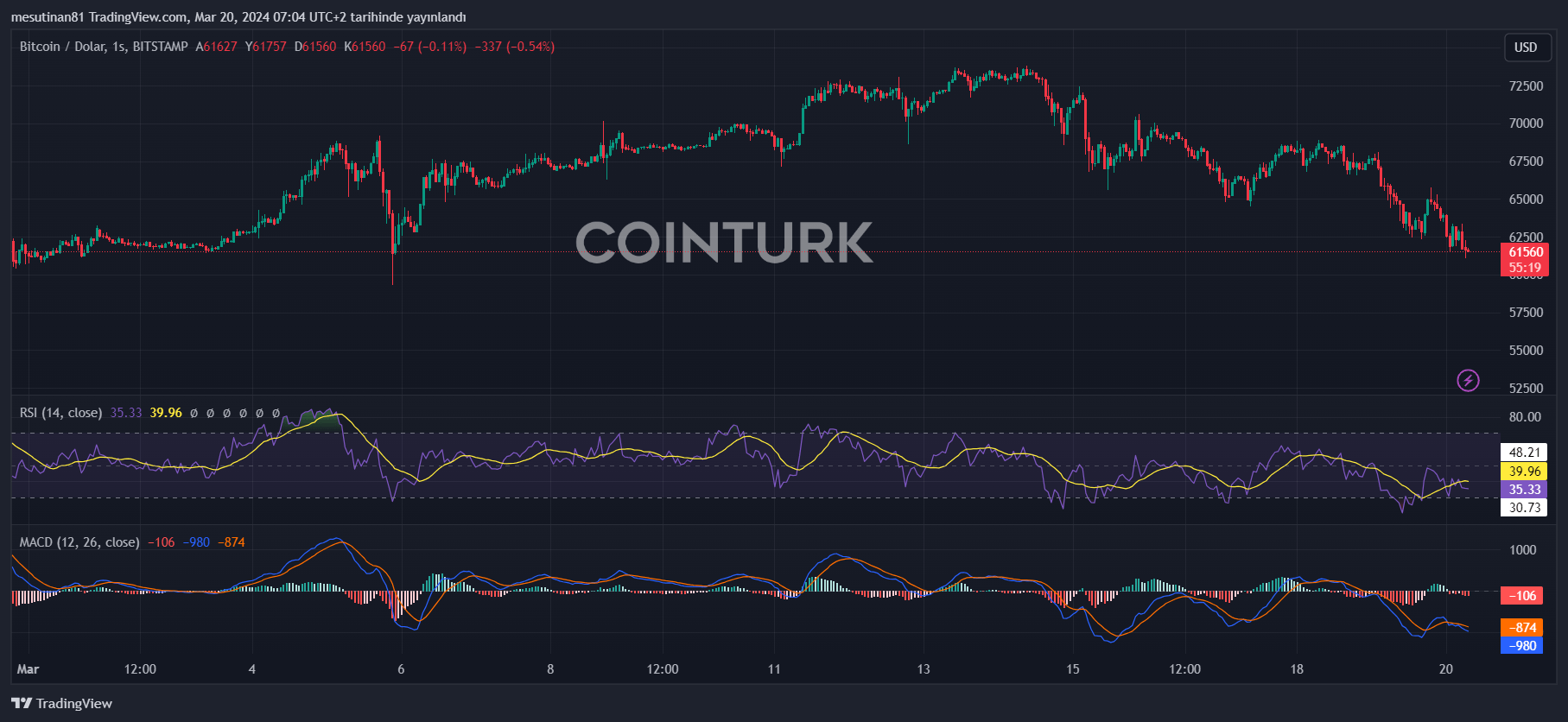

Looking at the hourly chart for the BTC/USD pair, a downward trend line at the $63,300 level indicates that the price is in a downward momentum. Bitcoin, trading below the 100-hour Simple Moving Average (SMA), is challenging these resistance levels.

Analysts suggest that if Bitcoin, the flagship cryptocurrency, can overcome the resistance area around $64,000, it could rise again. However, there is a support level at $61,000, and a close below this level could drive the price further down.

Is Further Decline Likely for Cryptocurrency Bitcoin?

If the cryptocurrency Bitcoin cannot break above the $63,300 resistance area, it may continue to move downward. The immediate support on the downside is near $61,200.

The first major support is at $61,000. The next support is at the $60,500 level. If there is a close below $60,500, the price could initiate a decline towards the $60,000 level. Further losses could send the price towards the support zone at $58,800 in the near term.

What Do Technical Indicators Suggest?

Technical indicators show that the hourly MACD is gaining momentum in the bearish zone. Similarly, the RSI for the BTC/USD pair is also trending below the 50 level. This indicates that the selling pressure is continuing.

Critical levels for Bitcoin investors are the $61,000 support and $63,300 resistance. However, the current market uncertainty and volatility require investors to remain vigilant.

While there is ongoing uncertainty about the short-term trajectory of cryptocurrency Bitcoin, experts are still optimistic about its long-term potential. However, due to the volatile nature of the crypto markets, volatility remains a constant risk factor. The recent decline in Bitcoin can particularly be attributed to the upcoming FED decision on interest rates, which is why the markets are behaving sensitively. Despite the downturn, there is a possibility that the BTC price may recover somewhat after the drop.

Türkçe

Türkçe Español

Español