Bitcoin has been following a quite volatile course recently, and some indicators that cause concern among investors are emerging. In particular, the rapid declines experienced lately and the changes in the NUPL metric are creating uncertainty about where the market is heading.

Bitcoin Loses 14% in Six Days

Bitcoin‘s 14% loss over the past six days has confused many investors. Is this downward trend a short-term correction or a sign of a larger adjustment? These questions are currently occupying minds.

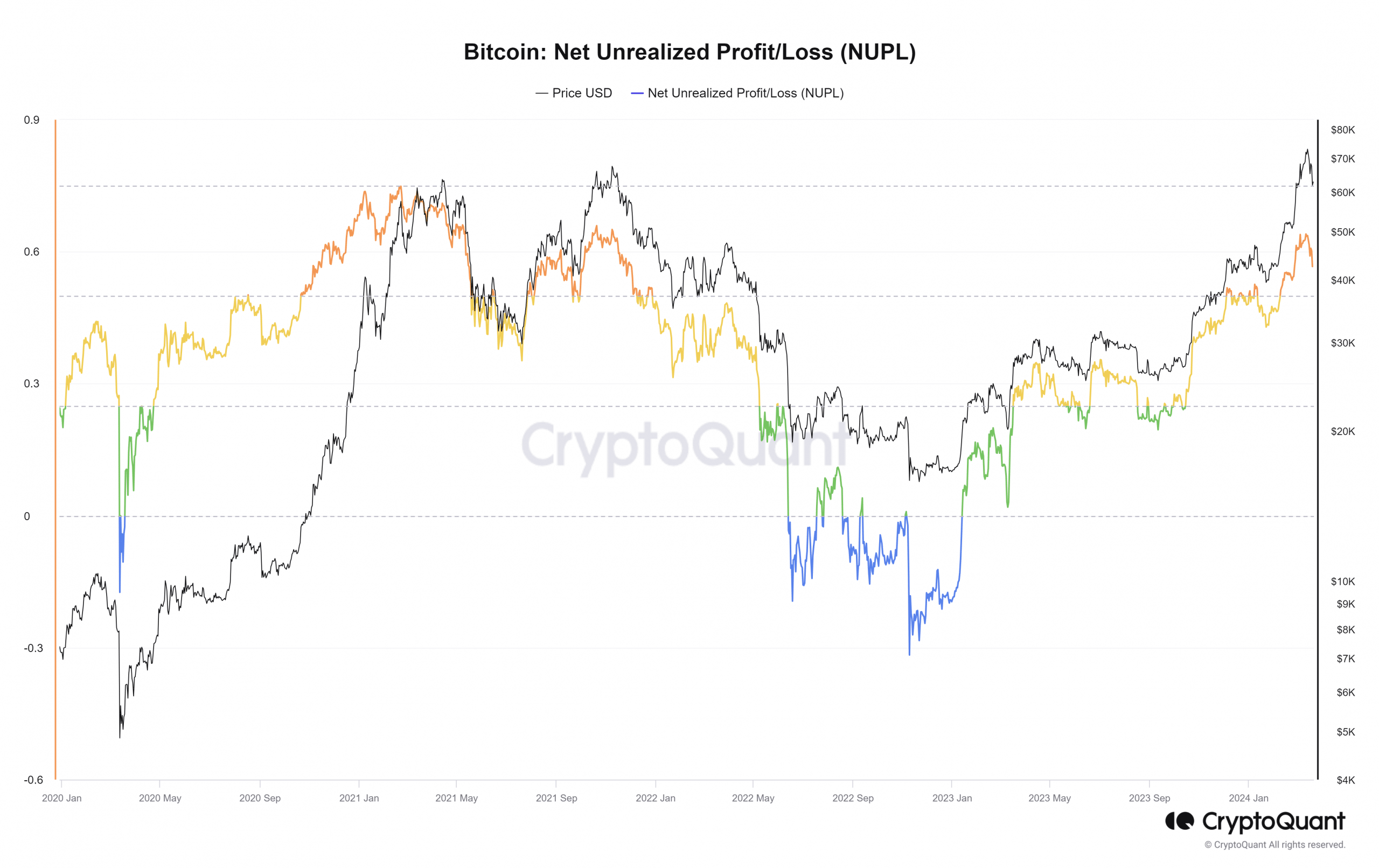

NUPL (Net Unrealized Profit/Loss) is an important metric used to understand the profitability of investors in the market. This metric often signals sharp price corrections when it rises above the +0.6 level, although this trend can change during bull runs.

From December 2020 to April 2021, as Bitcoin rose from 19 thousand dollars to 60 thousand dollars, the NUPL consistently stayed above +0.6. On February 28th, the NUPL once again rose above +0.6. Bitcoin surpassed 73 thousand dollars but could not maintain it. Since March 16th, the NUPL has fallen below +0.6, and the price at the time of writing is 61,678 dollars. However, the short-term outlook seems to support a deeper correction.

Tendency to Realize Profits

On the other hand, Bitcoin outflows from exchanges are interpreted by some as a sign of accumulation. The net flow chart of BTC shows that despite the price retracting from its peak of 73 thousand dollars, more BTC is leaving centralized exchanges than entering. This was an impressive aspect of not only the rise but also the pullback.

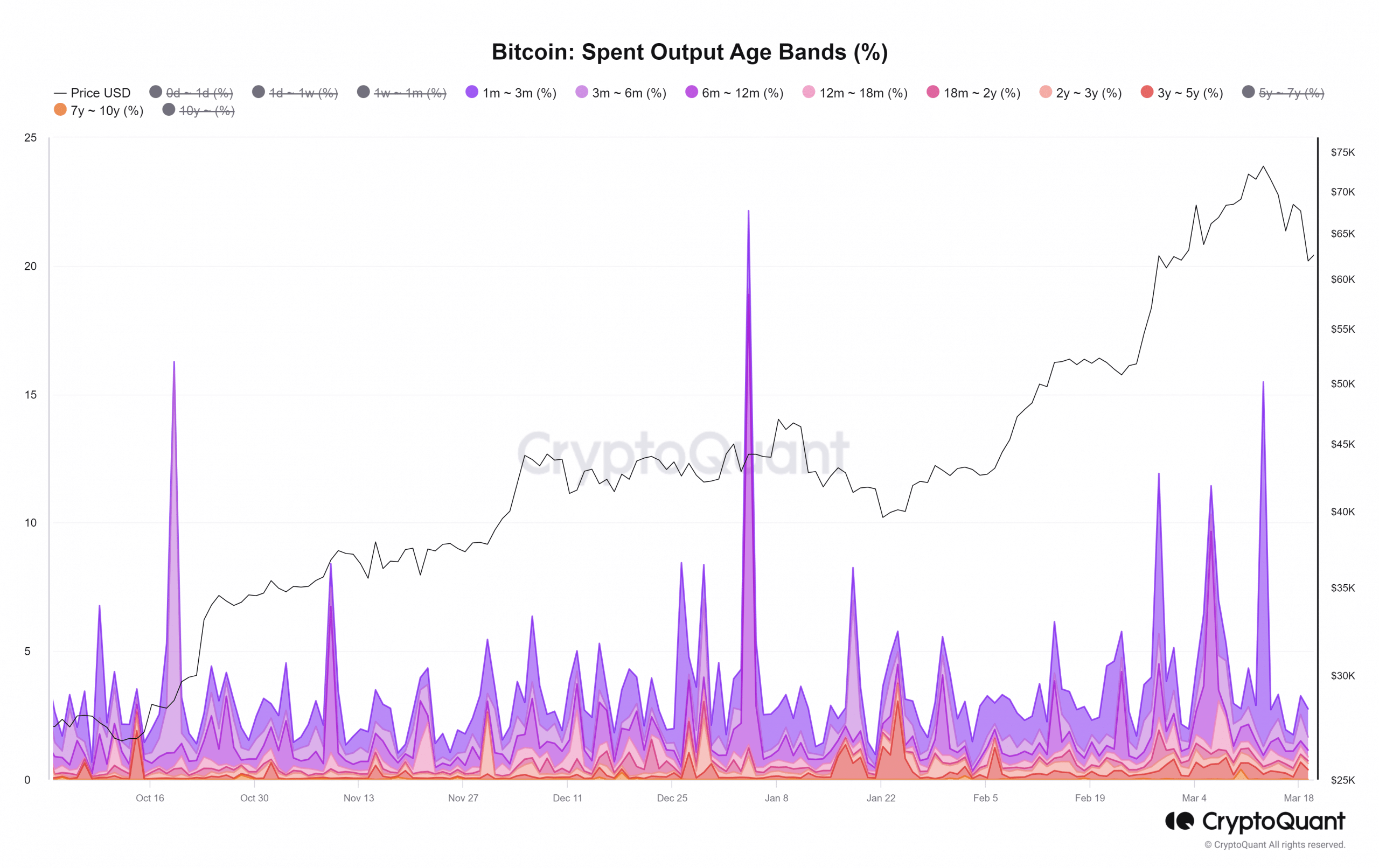

In particular, on March 13th, there was a significant increase in the amount of Bitcoin spent by holders who had only held it for 1-3 months. This indicated that short-term holders were realizing profits. In the past, similar increases were typically seen when sellers would sell as prices rose.

However, even during this downturn, most long-term holders who have been loyal to Bitcoin for a year or longer have kept their assets. This seems to reflect a strong belief in Bitcoin.

However, it should not be forgotten that the behaviors of long-term holders do not always definitively determine Bitcoin trends. In some cases, even long-term holders can succumb to panic selling when BTC experiences a long-term decline.