For a while, sellers were in a dominant position in the cryptocurrency markets, but as of today, things might change. With the Federal Reserve meeting behind us, the pressure of risk on investors has somewhat weakened. The fact that the price of BTC has reached $68,100 again is an indicator of this. So, what is the current situation with spot Bitcoin ETFs?

Current Status of Spot Bitcoin ETFs

Bitcoin‘s price decline brought the risk of falling to $60,000 this week, along with an acceleration of outflows in the spot Bitcoin ETF channel. However, after the Bitcoin price dropped to $62,022, it is now back over $67,700 and recently rose to $68,100. We are seeing the first reflections of this in the ETFs.

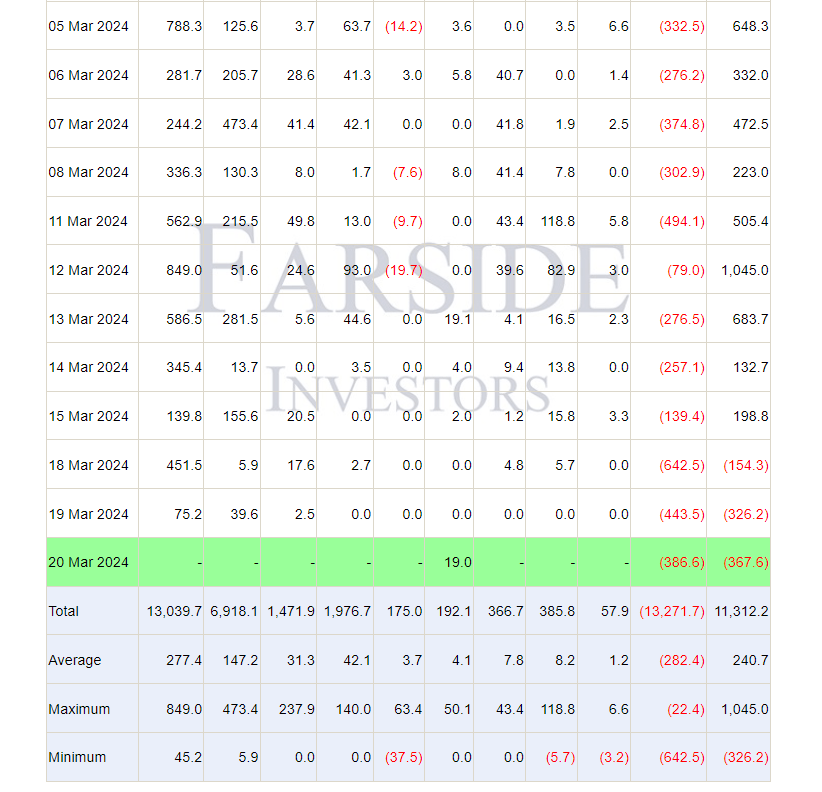

Outflows from GBTC were at a terrifying figure of $642 million on the first day of the week, but fell to $443 million on March 19. On Wednesday, March 20, these outflows were limited to $386.6 million.

Although there are no clear data for other ETFs yet, the slowdown in GBTC outflows is likely to mean an increase in entries to other ETFs. This suggests that the cumulative outflows could be below the $326 million seen on March 19.

Will Cryptocurrencies Rise?

Fed meeting attendees were worried about Chairman Powell indicating a new interest rate hike focusing on January and February inflation data. However, Powell mentioned that the first rate cut of the year could happen in the first half. He also emphasized that they could be bolder in this year’s cuts if there is a relaxation in inflation or an unexpected decline on the employment front.

Looking at the first data and the spot Bitcoin price, we come across two results.

- GBTC outflows have weakened.

- Since the Bitcoin price surpassed $68,000, investors may have made strong entries, seeing that the feared scenario after the Fed meeting did not materialize. This could reverse the net outflows that have been ongoing for days as of March 20.

In conclusion, depending on the data for other ETFs in the coming hours, if the appetite of investors in the ETF channel has increased as in the spot markets, this situation could pave the way for a new move towards $70,000. For now, the short-term fear is reversing with a falling DXY, rising BTC, and stock markets.

Türkçe

Türkçe Español

Español